Rogers 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Rogers Communications Inc. 2004 Annual Report

Covenant Compliance

All of the Rogers companies are currently in compliance with all of the covenants under their respective debt instruments, and we

expect to remain in compliance with all of these covenants. Based on our most restrictive covenants at December 31, 2004, we could

have borrowed approximately $2.25 billion of additional secured long-term debt under existing credit facilities, including $400.0 million

available for the repayment of debt maturing at Cable in 2005. In addition, at December 31, 2004, there was $244.0 million of available

cash on hand.

2005 Cash Requirements

We expect that Wireless may generate a net cash shortfall in 2005 and that Wireless has sufficient capital resources to satisfy its cash

funding requirements in 2005, taking into account cash from operations and the amount available under its $700.0 million bank credit

facility.

We expect that Cable will generate a net cash shortfall in 2005 and that Cable will have sufficient capital resources to satisfy its

cash funding requirements in 2005, taking into account cash from operations, the amount available under its $1,075.0 million bank

credit facility and intercompany advances from RCI.

We expect that Media will generate a net cash shortfall in 2005 and that Media has sufficient capital resources to satisfy its cash

funding requirements in 2005, taking into account cash from operations and the amount available under it $500.0 million bank credit facility.

We believe that, on an unconsolidated basis, we will have, taking into account interest income and repayments of intercompany

advances, together with the receipt of management fees paid by the operating subsidiaries and, the regular $6 million monthly distrib-

utions from Cable and investments from cash on hand, sufficient capital resources to satisfy our cash funding requirements in 2005.

In the event that we or any of our operating subsidiaries do require additional funding, we believe that any such funding

requirements would be satisfied by issuing additional debt financing, which may include the restructuring of existing bank credit facil-

ities or issuing public or private debt at any of the operating subsidiaries or at RCI or issuing equity of RCI, all depending on market

conditions. In addition, we or one of our subsidiaries may refinance a portion of existing debt subject to market conditions and other

factors. There is no assurance that this will or can be done.

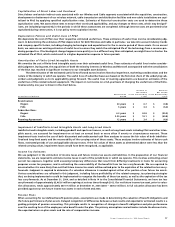

Required Principal Repayments

At December 31, 2004, our required principal repayments on all long-term debt in the next five years totalled approximately $1,331.2 mil-

lion excluding an aggregate $58.9 million in net cash scheduled settlements of cross-currency interest rate exchange agreements, of

which $69.5 million is scheduled to be paid in 2005; $4.2 million and $6.4 million to be received in 2007 and 2008, respectively. In 2005,

required debt repayments total $618.2 million including Cable’s US$291.5 million (equivalent $350.9 million) 10% Senior (Secured) Second

Priority Notes due 2005 and RCI’s US$217.5 million (equivalent $261.8 million) 5.75% convertible debentures due 2005. Total required

repayments in 2006 of $260.6 million include Wireless’ $160.0 million 10.50% Senior Secured Notes due 2006, RCI’s $75.0 million 10.50%

Senior Notes due 2006 and Wireless’ $22.2 million mortgage which matures in 2006. Required repayments in 2007 total $451.1 million,

which is almost entirely comprised of Cable’s $450.0 million 7.60% Senior (Secured) Second Priority Notes due 2007. Repayments in each

of 2008 and 2009 are minimal.

Credit Ratings

After putting the debt ratings of all Rogers rated debt under review for possible downgrade in September 2004, Moody’s Investors

Service lowered the debt ratings of RCI and Cable and confirmed the existing debt ratings for RWI in November 2004 upon the conclusion

of their review of the Rogers group, which was triggered by RCI’s acquisition of the 34% of Wireless previously owned by AWE and the

acquisition of Microcell. The debt ratings on RWI’s senior secured debt and new senior subordinated debt are Ba3 and B2, respectively,

with a stable outlook. RCI’s rating for senior unsecured debt was lowered to B3 from B2 and the ratings for Cable’s senior secured debt

and senior subordinated debt were lowered to Ba3 and B2, respectively, from Ba2 and Ba3, respectively. All of the new ratings have a

stable outlook.

In April 2004, Standard & Poor’s Ratings Service placed the debt ratings for all Rogers rated debt on credit watch with negative

implications following RCI’s announcement that it had received notice from AWE of its intent to explore the monetization of its 34%

stake in Wireless. On November 8, 2004, Standard & Poor’s lowered its credit ratings on all Rogers rated debt. RWI’s senior secured debt

was lowered to BB and S&P subsequently assigned a rating of B+ on RWI’s senior subordinated debt. The previous debt ratings for RWI’s

senior secured debt and (since redeemed) senior subordinated debt were BB+ and BB-, respectively. Credit ratings on Cable’s senior

secured debt and senior subordinated debt were lowered to BB+ and B+, respectively, from BBB- and BB-, respectively. The credit rating

on RCI’s senior unsecured debt was lowered to B+ from BB-. All ratings have a stable outlook.

In September 2004, Fitch Ratings placed its BBB- rating for RWI’s senior secured debt on “rating watch negative” following RCI’s

announcement of its agreement to purchase AWE’s 34% stake in Wireless. On November 12, 2004, Fitch downgraded the senior secured

debt of RWI to BB+ and assigned a rating of BB- on RWI’s new senior subordinated debt. Both ratings have a stable outlook. The previ-

ous debt rating on RWI’s (now redeemed) senior subordinated debt was BB.

INTEREST RATE AND FOREIGN EXCHANGE MANAGEMENT

Consolidated Economic Hedge Analysis

For the purposes of our discussion on the hedged portion of long-term debt, we have used non-GAAP measures. We include all cross-

currency interest rate exchange agreements (whether or not they qualify as hedges for accounting purposes) since all such agreements

are used for risk-management purposes only and are designated as a hedge of specific debt instruments for economic purposes. As a

result, the Canadian dollar equivalent of U.S. dollar-denominated long-term debt reflects the contracted foreign exchange rate for all

our cross-currency interest rate exchange agreements regardless of qualification for accounting purposes analysis.