Rogers 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Rogers Communications Inc. 2004 Annual Report

SIGNIFICANT FOURTH QUARTER 2004 EVENTS

Purchase of Rogers Wireless Shares

On September 13, 2004, we announced an agreement with JVII General Partnership (“JVII”), a general partnership wholly-owned by

AWE, whereby we agreed to purchase all of JVII’s 27,647,888 Class A Multiple Voting shares (“Class A shares”) and 20,946,284 Class B

Restricted Voting shares (“Class B shares”) of Wireless for a cash purchase price of $36.37 per share totalling $1,767.4 million. We closed

this transaction on October 13, 2004. As a result of the transaction, the shareholders’ agreement among RCI, Wireless and JVII dated

August 16, 1999, as amended, was terminated; the registration rights agreement between Wireless and JVII, also dated August 16, 1999,

was terminated; and JVII’s four nominees to Wireless’ Board of Directors resigned.

Upon closing of this transaction on October 13, 2004, our ownership of Wireless increased from 55.3% at September 30, 2004 to

approximately 89.3%.

The sale by AWE of its shares of Wireless did not impact or change the extensive North American wireless voice and data roam-

ing capabilities between Wireless and AWE (now part of Cingular Wireless LLC). Customers of Wireless and Cingular continue to enjoy

the benefits of seamless wireless roaming between Canada and the U.S. on North America’s largest combined GSM/GPRS/EDGE network.

On November 11, 2004, we announced an exchange offer to purchase all of the publicly-owned Class B Restricted Voting shares

of Wireless, with the consideration being 1.75 RCI Class B Non-Voting shares for each Wireless Class B share held. The acquisition was

successfully completed effective December 31, 2004, and Wireless became a wholly-owned subsidiary. We issued a total of 28,072,856

RCI Class B Non-Voting shares as consideration in this transaction.

Refer to “Critical Accounting Policies and Estimates – Purchase Price Allocations” and Note 3 to the Consolidated Financial

Statements for more details regarding these transactions.

Acquisition of Microcell Telecommunications Inc.

On September 20, 2004, together with Wireless, we announced an all cash offer of $35.00 per share to acquire all of the issued and out-

standing equity securities of Microcell, Canada’s fourth largest wireless communications provider. Microcell’s Board of Directors

recommended that its shareholders tender to Wireless’ offer, we obtained certain necessary regulatory approvals and the acquisition

was successfully completed effective November 9, 2004. The acquisition of Microcell has made Wireless the largest wireless operator in

Canada with over 5.5 million wireless voice and data customers across the country at December 31, 2004, and the only Canadian wireless

provider operating on the world standard GSM/GPRS/EDGE wireless technology platform. We believe that the integration of Microcell,

amongst other things, will lead to significant operating and capital spending efficiencies. Refer to “Critical Accounting Policies and

Estimates – Purchase Price Allocations” and Note 3 to the Consolidated Financial Statements for more details regarding this transaction.

In the “Supplementary Information” section of this MD&A, certain financial and operating information has been prepared on a

pro forma basis as if the three transactions relating to Wireless, as described above, and related financings had occurred on January 1,

2003. Such information is based on our historical financial statements, the historical financial statements of Microcell and the account-

ing for the purchase of Wireless shares.

Financings

During the fourth quarter of 2004, long-term financings totalling approximately $3.3 billion were put in place. Approximately $2.8 billion

was issued by Wireless to finance our purchase of the 34% interest in Wireless from AWE and the acquisition of Microcell. Approximately

$509 million was issued by Cable to refinance borrowings under bank facilities. Refer to the section “Consolidated Liquidity and Capital

Resources” and Note 11 to the Consolidated Financial Statements for more information regarding long-term debt.

SEASONALITY

Our operating results are subject to seasonal fluctuations that materially impact quarter-to-quarter operating results, and thus one

quarter’s operating results are not necessarily indicative of what a subsequent quarter’s operating results will be. Each of Wireless,

Cable, Media and the Blue Jays has unique seasonal aspects to its business. For discussions of the seasonal trends affecting the

Wireless, Cable, Media and Blue Jays segments, please refer to the respective segment discussions below.

COMPETITION

We currently face effective competition in each of our primary businesses from entities providing substantially similar services, some of

which have significantly greater resources than we do. Each of our businesses also faces competition from entities utilizing alternative

communications and transmission technologies and may face competition from other technologies being developed or to be developed

in the future. For detailed discussions of the specific competition facing each of Wireless, Cable, and Media, please refer to the respec-

tive segment discussions below.

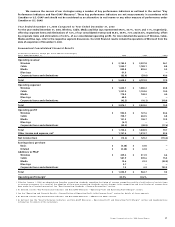

OPERATING AND FINANCIAL RESULTS

See sections in this MD&A entitled “Critical Accounting Policies and Estimates” and “New Accounting Standards” and also the Notes to

the Consolidated Financial Statements for a discussion of critical and new accounting policies and estimates as they relate to the dis-

cussion of our operating and financial results below.