Rogers 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

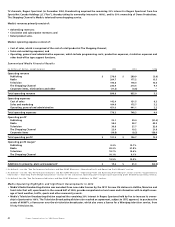

52 Rogers Communications Inc. 2004 Annual Report

carrying the right to vote in all circumstances. Accordingly, Edward S. Rogers is able to elect all of our Board of Directors and to control

the vote on matters submitted to a vote of our shareholders. The interests of Edward S. Rogers may not correspond with those of other

shareholders. For purposes of the foregoing, a reference to “Edward S. Rogers” includes Edward S. Rogers, O.C., the President and Chief

Executive Officer and a director of the Company, and certain other corporations, owned or controlled directly or indirectly by him and

trusts for the benefit of himself and his family.

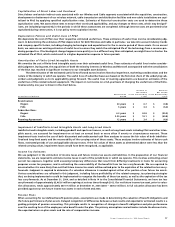

The Operation of Our Business Requires Substantial Capital, and There is No Guarantee That Financing will be

Available to Meet Those Requirements

The operation of our networks, the marketing and distribution of our products and services and future technology upgrades of the

networks will require substantial capital resources. We had approximately $8.0 billion of long-term debt outstanding at December 31,

2004. Our PP&E spending on a consolidated basis in 2004 was over $1.0 billion. Other significant additions to PP&E are also expected to

be incurred during 2005 and in the future.

The actual amount of PP&E expenditures required to finance our operations and network development may vary materially from

our estimates. We may incur significant additional capital expenditures in the future as a result of unforeseen delays in the development

of our networks, cost overruns, customer demand, unanticipated expenses, regulatory changes or other events that affect our busi-

nesses, and may need to obtain additional funds as a result of these unforeseen events. We anticipate that additional debt financing

may be needed to fund cash requirements in the future. We cannot predict whether such financing will be available, what the terms of

such additional financing would be or whether existing debt agreements would allow additional financing at that time. If we cannot

obtain additional financing when needed, we will have to delay, modify or abandon some of our plans. This could slow our growth and

negatively impact our ability to compete.

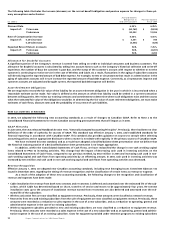

Our Substantial Leverage May Have Adverse Consequences

Our substantial debt may have important consequences. For instance, it could:

• Make it more difficult for us to satisfy our financial obligations;

• Require us to dedicate a substantial portion of any cash flow from operations to the payment of interest and principal due under our

debt, which will reduce funds available for other business purposes;

• Increase our vulnerability to general adverse economic and industry conditions;

• Limit our flexibility in planning for, or reacting to, changes in our businesses and the industries in which they operate;

• Place us at a competitive disadvantage compared to some of our competitors that have less financial leverage; and

• Limit our ability to obtain additional financing required to fund working capital and capital expenditures and for other general

corporate purposes.

Our ability to satisfy our obligations and to reduce our total debt depends on our future operating performance and on economic,

financial, competitive and other factors, many of which are beyond our control. Our business may not generate sufficient cash flow and

future financings may not be available to provide sufficient net proceeds to meet these obligations or to successfully execute our busi-

ness strategies.

We May Experience Adverse Effects Due to Exchange Rate and Interest Rate Fluctuations

Nearly all of our business is transacted in Canadian dollars. Accordingly, we are exposed to foreign exchange rate risk on our U.S. dollar

denominated debt. The exchange rate between Canadian dollars and U.S. dollars, although historically less volatile than those of cer-

tain other foreign currencies, has varied significantly over the last three years. Foreign exchange and interest rate fluctuations may

materially adversely affect our financial performance or results of operations. For a more complete discussion on the impact of

exchange rate and interest rate fluctuations, see the section entitled “Interest Rate and Foreign Exchange Management”.

Regulatory Changes Could Adversely Affect Our Results of Operations

Substantially all of our business activities are regulated by Industry Canada and the CRTC, and/or accordingly our results of operations

on a consolidated basis are affected by changes in regulations and by the decisions of these regulators. This regulation relates to,

among other things, licencing, competition, the cable television programming services that we must distribute, the rates we may

charge to provide access to our network by third parties, resale of our networks and roaming on to our networks, our operation and

ownership of communications systems and our ability to acquire an interest in other communications systems. In addition, our cable,

wireless and broadcasting licences may not generally be transferred without regulatory approval. Changes in the regulation of our

business activities, including decisions by regulators (such as the granting or renewal of licences or decisions regarding services we

must offer to our customers), or changes in the interpretations of existing regulations by courts or regulators, could adversely affect

our consolidated results of operations.

Restrictions on Non-Canadian Ownership and Control May Adversely Affect Our Cost of Capital

Our regulated subsidiaries must be Canadian-owned and controlled under requirements enacted or adopted under the Broadcasting

Act (Canada), the Telecommunications Act (Canada) and the Radiocommunication Act (Canada). The requirements generally provide

that Canadians must own at least 80% of the voting shares of the regulated entities, that at least 80% of the members of the Board of

Directors must be Canadian, and that the entities must not be controlled in fact by non-Canadians. In addition, no more than 331/3% of

the voting shares of a parent company, such as RCI, may be held by non-Canadians and the parent company must not be controlled in

fact by non-Canadians. These restrictions on non-Canadian ownership and control may have an adverse effect on us, including on our

cost of capital. Our Articles and the Articles of Wireless contain provisions which constrain the issue and transfer of certain classes of

shares, including our Non-Voting shares, for the purpose of ensuring that we and our subsidiaries remain eligible to hold licences or to

carry on businesses which are subject to non-Canadian ownership and control restrictions.