Rogers 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Rogers Communications Inc. 2004 Annual Report

We May Engage in Unsuccessful Acquisitions and Divestitures

Acquisitions of complementary businesses and technologies, development of strategic alliances and divestitures of portions of our

business are an active part of our overall business strategy. Services, technologies, key personnel or businesses of acquired companies

may not be effectively assimilated into our business or service offerings and our alliances may not be successful. We may not be able to

successfully complete any divestitures on satisfactory terms, if at all. Divestitures may result in a reduction in our total revenues and

net income.

We Are and Will Continue to be Involved in Litigation

Cable requires access to support structures and municipal rights of way in order to deploy its cable television facilities. In a 2003 deci-

sion, the Supreme Court of Canada determined that the CRTC does not have the jurisdiction to establish the terms and conditions of

access to the poles of hydroelectric companies. As a result of this decision, the costs of obtaining access to the poles of hydroelectric

companies could be substantially increased on a prospective basis and, for certain arrangements, on a retroactive basis. Cable, together

with other Ontario cable companies, has applied to the Ontario Energy Board (“OEB”) to request that it assert jurisdiction over the fees

paid by such companies to hydroelectric distributors. The OEB accepted jurisdiction over this matter in November 2004. Cable expects a

decision from the OEB in 2005. The amount of this contingency is presently not determinable; however, management has recorded its

best estimate of this liability at December 31, 2004.

On August 9, 2004, a proceeding under the Class Actions Act (Saskatchewan) was brought against providers of wireless commu-

nications in Canada, including Wireless and Microcell. The proceeding involves allegations by wireless customers of breach of contract,

misrepresentation and false advertising arising out of the charging of system access fees. The plaintiffs seek unquantified damages

from the defendant wireless communications service providers. The proceeding has not been certified as a class action and it is too

early to determine whether the proceeding will qualify for certification as a class action. Similar proceedings have also been brought

against us and other providers of wireless communications in Canada in Alberta, British Columbia, Manitoba, Ontario and Québec. In

addition, on December 9, 2004, we were served with a court order compelling us to produce certain records and other information rele-

vant to an investigation initiated by the Commissioner of Competition under the misleading advertising provisions of the Competition

Act with respect to our system access fee.

On April 21, 2004, a proceeding was brought against Microcell and others alleging breach of contract, breach of confidence, mis-

use of confidential information, breach of a duty of loyalty, good faith and to avoid a conflict of duty and self interest, and conspiracy.

The proceeding involves Microcell’s Inukshuk fixed wireless venture. The plaintiff is seeking damages in the amount of $160 million.

The proceeding is at an early stage.

We are and may from time to time be named as a defendant in other legal actions arising in the ordinary course of our business,

including claims arising out of our dealer arrangements.

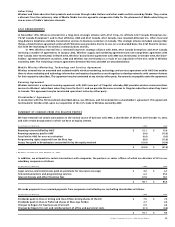

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

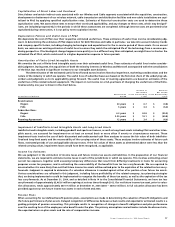

Contractual Obligations

Our material obligations under firm contractual arrangements are summarized below as at December 31, 2004. See also Notes 20 and 21

to the Consolidated Financial Statements.

Less Than After

1 Year 1-3 Years 4-5 Years 5 Years Total

Long-Term Debt 612,699 685,000 – 6,663,321 7,961,020

Convertible Preferred Securities – – 600,000 – 600,000

Derivative Instruments169,501 – – 544,688 614,189

Mortgages and Capital Leases 5,538 26,688 1,296 613 34,135

Operating Leases 155,531 244,226 170,231 107,130 677,118

Player Contracts 44,834 79,498 – – 124,332

Purchase Obligations2104,173 40,538 4,127 – 148,838

Other Commitments 10,518 19,729 18,015 – 48,262

Total 1,002,794 1,095,679 793,669 7,315,752 10,207,894

1 Amounts reflect net disbursements only.

2 Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally binding and that specify all significant terms

including fixed or minimum quantities to be purchased, price provisions and timing of the transaction. In addition, we incur expenditures for other items

that are volume-dependant. An estimate of what we will spend in 2005 on these items is as follows:

i. Wireless is required to pay annual spectrum licencing and CRTC contribution fees to Industry Canada. We estimate our total payment obligations to

Industry Canada will be approximately $99.0 million in 2005.

ii. Payments to acquire customers in the form of commissions and payments to retain customers in the form of residuals are made pursuant to contracts

with distributors and retailers at Wireless. We estimate that payments to these distributors and retailers will be approximately $517.0 million in 2005.

iii. We are required to make payments to other communications providers for interconnection, roaming and other services at Wireless. We estimate the

total payment obligation to be approximately $185.0 million in 2005.

iv. We estimate our total payments to a major network infrastructure supplier at Wireless to be approximately $185.0 million in 2005.

v. Based on Cable’s approximately 2.25 million basic cable subscribers as of December 31, 2004, the Company estimates that its total payment obligation to

programming suppliers and MDU building owners in 2005 will be approximately $473.2 million, including amounts payable to the copyright collectives,

the Canadian programming production funds and expenditures related to its Internet service for Internet interconnectivity and usage charges. In addi-

tion, the Company estimates that Rogers Video will spend approximately $63.6 million in 2005 on the acquisition of DVDs, videocassettes and video

games (as well as non-rental merchandise) for rental or sale in Rogers Video stores. In addition, the Company expects to pay an additional amount of

approximately $24.5 million in 2005 to movie studios as part of its revenue-sharing arrangements with those studios.