Rogers 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 Rogers Communications Inc. 2004 Annual Report

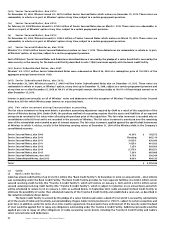

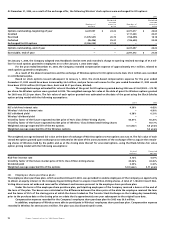

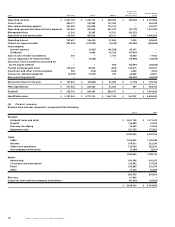

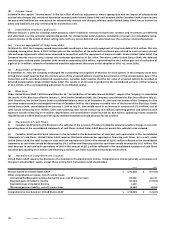

Net plan expense is outlined below:

2004 2003

Plan cost:

Service cost $ 11,746 $ 11,314

Interest cost 24,003 23,826

Actual return on plan assets (43,053) (36,332)

Actuarial loss on benefit obligation 54,526 2,744

Costs 47,222 1,552

Differences between costs arising in the period and costs recognized in the period in respect of:

Return on plan assets 17,900 14,225

Actuarial (gain) loss (49,537) 4,708

Plan amendments/prior service cost 829 829

Transitional asset (9,875) (9,875)

Net pension expense $ 6,539 $ 11,439

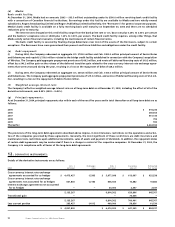

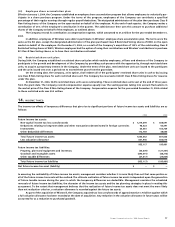

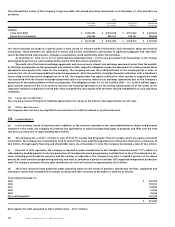

(a) Actuarial assumptions:

2004 2003

Weighted average discount rate for accrued benefit obligations 6.25% 6.25%

Weighted average rate of compensation increase 4.00% 4.00%

Weighted average expected long-term rate of return on plan assets 7.25% 7.25%

Expected return on assets represents management’s best estimate of the long-term rate of return on plan assets applied to the fair

value of the plan assets. The Company establishes its estimate of the expected rate of return on plans assets based on the fund’s target

asset allocation and estimated rate of return for each asset class. Estimated rates of return are based on expected returns from fixed

income securities which take into account bond yields. An equity risk premium is then applied to estimate equity returns. Differences

between expected and actual return are included in actuarial gains and losses.

The estimated average remaining service periods for the plans range from 9 to 13 years. The Company does not have any curtail-

ment gains or losses.

(b) Allocation of plan assets:

Percentage of Percentage of

plan assets, plan assets, Target asset

December 31, December 31, allocation

Asset category 2004 2003 percentage

Equity securities 58.9% 59.8% 50.0% to 65.0%

Debt securities 40.2% 38.8% 35.0% to 50.0%

Other (cash) 0.9% 1.4% 0.0 % to 1.0%

100.0% 100.0%

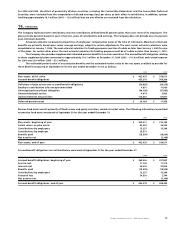

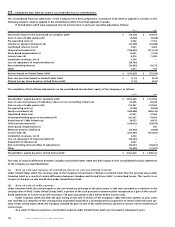

Plan assets are comprised primarily of pooled funds that invest in common stocks and bonds. The pooled Canadian equity fund has

investments in the Company’s equity securities comprising approximately 1% of the pooled fund. This results in approximately $0.7 mil-

lion of the plans’ assets being indirectly invested in the Company’s equity securities.

The Company makes contributions to the plans to secure the benefits of plan members and invests in permitted investments

using the target ranges established by the Pension Committee of the Company. The Pension Committee reviews actuarial assumptions

on an annual basis.

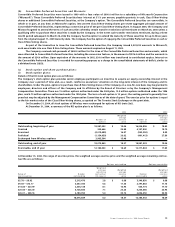

(c) Contributions:

Employer Employee Total

Actual contributions during 2003 $ 11,000 $ 13,248 $ 24,248

Actual contributions during 2004 19,153 13,237 32,390

Expected contributions by the Company in 2005 are estimated to be $23.0 million.

Employee contributions for 2005 are assumed to be at levels similar to 2003 and 2004 on the assumption staffing levels in the

Company will remain the same on a year-over-year basis.