Rogers 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Rogers Communications Inc. 2004 Annual Report

MEDIA SEASONALITY

Media is subject to seasonal fluctuations that materially impact quarter-to-quarter operating results. As a result, one quarter’s operat-

ing results are not necessarily indicative of what a subsequent quarter’s operating results will be. The seasonality at Media is a result of

fluctuations in advertising and related retail cycles as they relate to periods of increased consumer activity, with the fourth quarter

generally the strongest quarter.

RECENT MEDIA INDUSTRY TRENDS

Increased Radio/TV Ownership Fragmentation

In recent years, Canadian radio and television broadcasters have had to operate in increasingly fragmented markets. Canadian consumers

have a growing number of radio and television services available to them, providing them with an increasing number of different pro-

gramming formats. In the radio industry, since the introduction of its Commercial Radio Policy in 1998, the CRTC has licenced more than

65 new radio stations through competitive processes in markets across Canada. In that time, the CRTC has also licenced a large number

of additional new FM stations through AM to FM station conversions. In the television industry, the CRTC has licenced a number of new,

over-the-air television stations and a significant number of new digital Category 1 and Category 2 services. The new services and the

new formats combine to fragment the market for existing radio and television operators.

MEDIA REGULATORY DEVELOPMENTS

The CRTC has announced that a further review of the Commercial Radio Policy will not occur until decisions have been released later in

2005 regarding the licencing and policy framework for satellite and terrestrial subscription-based radio services.

The CRTC has released its digital television policy, covering issues such as priority carriage and simultaneous substitution.

Media believes that the CRTC policy provides an effective framework for continued growth and development of digital television

broadcasting in Canada.

CRTC consultation processes have also been initiated to develop policy frameworks for the licencing and distribution of high def-

inition pay and specialty services as well as the transition or migration of specialty services from analog to digital.

MEDIA COMPETITION

Broadcasting’s radio stations compete with the other stations in their respective market areas as well as with other media such as

newspapers, magazines, television, outdoor advertising, direct mail marketing and the Internet.

Competition within the radio broadcasting industry occurs primarily in individual market areas, amongst individual market stations.

On a national level, Media’s Broadcasting division competes generally with other larger radio operators such as Corus Entertainment

Inc., Standard Radio Inc. and CHUM Limited, each of which owns and operates radio station clusters in markets across Canada.

Additionally, over the past several years the CRTC has granted additional licences in various markets for the development of new radio

stations which in turn provide additional competition to the established stations in the respective markets. The CRTC is also considering

the licencing of one or more new satellite and terrestrial subscription-based radio services and a decision is expected in the latter half

of 2005.

OMNI.1 and OMNI.2 compete principally for viewers and advertisers with television stations that broadcast in Ontario, but pri-

marily in the Toronto and southern Ontario markets. These include Canadian television stations in the Greater Toronto Area as well as

U.S. border stations, and increasingly with other distant Canadian signals and U.S. border stations given the time-shifting capacity

available to digital subscribers.

Rogers Sportsnet competes for viewers and advertisers principally with The Sports Network (“TSN”), Headline Sports and sports

programs carried by other Canadian and U.S. television stations and networks.

On a product level, The Shopping Channel competes with various retail stores, catalog retailers, Internet retailers and direct mail

retailers. On a broadcasting level, The Shopping Channel competes with other television channels for viewer attention and loyalty, par-

ticularly infomercials selling products on television.

The Canadian magazine industry is highly-competitive, competing for both readers and advertisers. This competition comes

from other Canadian magazines and from foreign, mostly U.S., titles that sell in significant quantities in Canada. In the past, the compe-

tition from foreign titles has been restricted to competition for readers as there have been restrictions on foreigners operating in the

Canadian magazine advertising market. These restrictions were significantly reduced as a result of the enactment in 1999 of the Foreign

Publishers Advertising Services Act (Canada) and amendments to the Canadian Tax Act. Increasing competition from U.S. magazines for

advertising revenues is expected in the coming years.

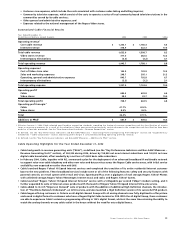

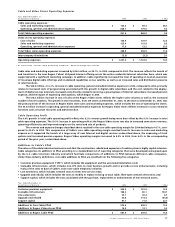

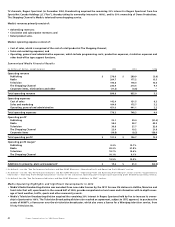

MEDIA OPERATING AND FINANCIAL RESULTS

Year Ended December 31, 2004 Compared to Year Ended December 31, 2003

For discussion purposes, Media’s financial results have been divided into “Publishing”, “Radio”, “Television”, “The Shopping Channel”,

and “Other”, which includes corporate expenses. Publishing includes Media’s consumer and business publications. Radio includes 43 AM

and FM radio stations, TV Listings and its 50% share in Canadian Broadcast Sales (“CBS”). Television includes the results of its two OMNI