Rogers 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

Rogers Communications Inc. 2004 Annual Report

(ii) Revenue recognition and classification:

Effective January 1, 2004, the Company adopted new Canadian accounting standards including CICA Section 1100, “Generally Accepted

Accounting Principles”, CICA Emerging Issues Committee (“EIC”) Abstract 142, “Revenue Arrangements with Multiple Deliverables” and

EIC 141, “Revenue Recognition”, regarding the determination of separate units of accounting in multiple element revenue arrange-

ments, the timing of revenue recognition and the classification of certain items as revenue or expense.

The Company has determined that the sale of wireless services with an accompanying handset constitutes a revenue arrangement with

multiple deliverables. Upon adoption of EIC 142, the Company divides these arrangements into separate units of accounting, including

the wireless service and handset. Consideration received for the handset is recognized as equipment sales when the handset is deliv-

ered. Consideration received for the wireless service is recognized as service revenue when earned. Since the non-refundable, up-front

activation fee charged to the subscriber does not meet the criteria as a separate unit of accounting, the Company allocates the addi-

tional consideration received from the activation fee to the handset (the delivered item) to the extent that the aggregate handset and

activation fee proceeds do not exceed the fair value of the handset. Any activation fees not allocated to the handset would be deferred

upon activation and recognized as service revenue over the expected customer relationship period.

The Company has also determined that the sale of cable and Internet services constitutes a revenue arrangement with multiple

deliverables. Upon adoption of EIC 142, the Company divides these arrangements into separate units of accounting, including the cable

or Internet service and the customer-premises equipment, comprised of either a set-top box or a modem, as applicable. Consideration

received for the customer-premises equipment is recognized upon delivery and acceptance by the customer. Consideration received for

the cable or Internet service is recognized when earned. Since installation fees charged to customers do not meet the criteria as a sepa-

rate unit of accounting, these fees are deferred and amortized over the related service period, determined to be approximately four

years, based on churn, transfers of service and moves. Installation fees and the related cable or Internet service revenue are considered

one unit of accounting. Incremental direct installation costs related to re-connects are deferred to the extent of deferred installation fees

and amortized over the same period as these related installation fees. New connect installation costs continue to be capitalized to PP&E

and amortized over the useful life of the related assets. Previously, installation revenue in connection with cable and Internet services

were recorded as revenue to the extent that direct selling costs were incurred.

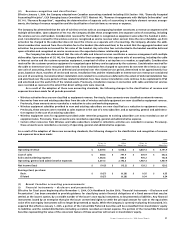

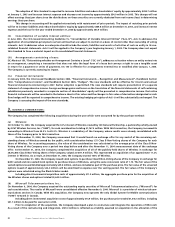

As a result of the adoption of these new accounting standards, the following changes to the classification of revenue and

expenses have been made for all periods presented:

• Wireless activation fees are now classified as equipment revenue. Previously, these amounts were classified as network revenue.

• Recoveries from new and existing subscribers from the sale of wireless and cable equipment are now classified as equipment revenue.

Previously, these amounts were recorded as a reduction to sales and marketing expense.

• Wireless equipment subsidies provided to new and existing subscribers are now classified as a reduction to equipment revenue.

Previously, these amounts were recorded as sales expense in the case of a new subscriber, and as operating, general and administra-

tive expense in the case of an existing subscriber.

• Wireless equipment costs for equipment provided under retention programs to existing subscribers are now recorded as cost of

equipment sales. Previously, these amounts were recorded as operating, general and administrative expense.

• Certain other recoveries from Wireless and Cable subscribers related to collections activities are recorded in revenue. Previously,

these amounts were recorded as a recovery of operating, general and administrative expenses.

As a result of the adoption of these new accounting standards, the following changes to the classification and recognition of revenue

and expenses have been made:

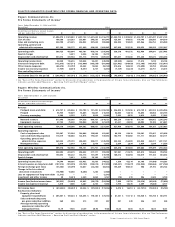

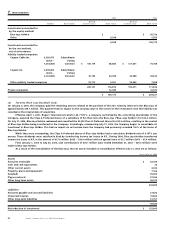

2004 2003

Prior to After Prior to After

Adoption Adoption Adoption Adoption

Operating revenue $ 5,639.5 $ 5,608.2 $ 4,847.4 $ 4,791.9

Cost of sales $ 568.6 $ 797.9 $ 505.9 $ 642.2

Sales and marketing expense 1,082.6 883.6 905.2 742.8

Operating, general and administrative expenses 2,251.3 2,192.6 1,987.3 1,957.9

Net income (loss) $ (10.5) $ (13.2) $ 129.2 $ 129.2

Earnings (loss) per share:

Basic $ (0.27) $ (0.28) $ 0.35 $ 0.35

Diluted (0.27) (0.28) 0.34 0.34

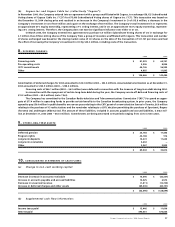

(t) Recent Canadian accounting pronouncements:

(i) Financial instruments – disclosure and presentation:

Effective for fiscal years beginning after November 1, 2004, CICA Handbook Section 3860, “Financial Instruments – Disclosure and

Presentation”, has been amended to provide guidance for classifying certain financial obligations of a fixed amount that may be

settled, at the issuer’s option, by a variable number of the issuer’s own equity instruments, to be presented as liabilities. Any financial

instruments issued by an enterprise that give the issuer unrestricted rights to settle the principal amount for cash or the equivalent

value of its own equity instruments will no longer be presented as equity. While the Company is currently evaluating this standard, it is

expected that effective January 1, 2005, a portion of the Convertible Preferred Securities will be reclassified from shareholders’ equity

to liabilities and the related distributions (including accretion) recorded as interest expense. The portion of the Convertible Preferred

Securities representing the value of the conversion feature of these securities will remain in shareholders’ equity.