Rogers 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Rogers Communications Inc. 2004 Annual Report

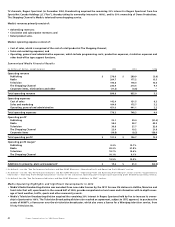

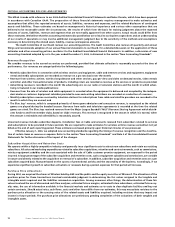

OUTSTANDING SHARE DATA

Set out below is our outstanding share data as at December 31, 2004. For additional detail, refer to Note 13 to the Consolidated

Financial Statements.

Common Shares

Class A Voting 56,235,394

Class B Non-Voting 218,979,074

Options to Purchase Class B Non-Voting Shares

Outstanding Options 18,075,849

Portion of Outstanding Options Exercisable 12,184,543

Securities Convertible into Class B Non-Voting Shares

Number of

Class B Non-Voting

Amount Shares Issuable on

Class Outstanding Conversion

Convertible Preferred Securities $ 600,000,000 17,142,857

Convertible Senior Debentures $ 270,581,000 7,726,270

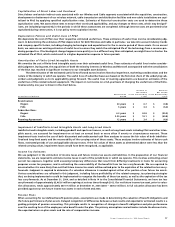

DIVIDENDS AND OTHER PAYMENTS ON RCI EQUITY SECURITIES

In May 2003, our Board of Directors (the “Board”) adopted a dividend policy that provides for dividends aggregating, annually, $0.10 per

share to be paid on each outstanding Class A Voting share and Class B Non-Voting share. Pursuant to this policy, the dividends are paid

twice yearly in the amount of $0.05 per share to holders of record of such shares on the record date established by the Board for each

dividend at the time such dividend is declared. These dividends are currently scheduled to be made on the first trading day following

January 1 and July 1 each year. The first such semi-annual dividend pursuant to the policy was paid July 2, 2003.

The dividend policy is reviewed periodically by the Board. The declaration and payment of dividends are at the sole discretion of

the Board and depend on, among other things, our financial condition, general business conditions, legal restrictions regarding the

payment of dividends by us, some of which are referred to below, and other factors which the Board may, from time to time, consider

to be relevant. As a holding company with no direct operations, we rely on cash dividends and other payments from our subsidiaries

and our own cash balances to pay dividends to our shareholders. The ability of our subsidiaries to pay such amounts to us is limited and

is subject to the various risks as outlined in this discussion, including, without limitation, legal and contractual restrictions contained in

instruments governing subsidiary debt.

During 2004, the Board declared dividends in aggregate of $0.10 per share on each of its outstanding Class B Non-Voting shares,

and Class A Voting shares, $0.05 of which were paid on July 2, 2004, to shareholders of record on June 14, 2004, and $0.05 of which were

paid on January 4, 2005, to shareholders of record on December 13, 2004.

During 2003, the Board declared dividends in aggregate of $0.10 per share on each of its outstanding Class B Non-Voting shares,

Class A Voting shares and Series E Preferred shares, $0.05 of which were paid on July 2, 2003, to shareholders of record on June 16, 2003,

and $0.05 of which were paid on January 2, 2004, to shareholders of record on December 12, 2003.

During the year ended December 31, 2002, no dividends were declared on Class A Voting shares, Class B Non-Voting shares,

Series B Preferred shares and Series E Preferred shares held by members of our Management Share Purchase Plan. During the year

ended December 31, 2001, $14,000 of dividends declared in 2001 were paid on Series B Preferred shares and Series E Preferred shares

held by members of our Management Share Purchase Plan. In fiscal 2000, dividends aggregating $10.2 million were paid on the Class A

Voting shares, the Class B Non-Voting shares, the Series B Preferred shares and the Series E Preferred shares. Dividends may not be paid

in respect of the Class A Voting shares or Class B Non-Voting shares unless all accrued and unpaid dividends in respect of its Preferred

shares have been paid or provided for. We have paid all dividends required to be paid pursuant to the terms of our Preferred shares.

We have also paid distributions on our Convertible Preferred Securities of approximately $18.6 million, $18.6 million, $20.3 million,

$29.8 million and $33.0 million for the years December 31, 2000, 2001, 2002, 2003 and 2004, respectively, in each case net of income taxes

and exclusive of dividends paid to subsidiary companies. In 2002, we accreted interest, excluding acquisition costs of approximately

$15.4 million on Preferred Securities, net of income tax recovery of $9.7 million and $16.5 million on our then outstanding Collateralized

Equity Securities.

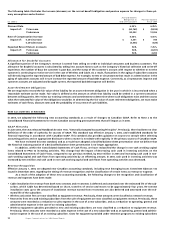

GOVERNMENT REGULATION

Substantially all of our business activities, except for Cable’s Video Stores and the non-broadcasting operations of Media, are regulated

by one or more of: the Canadian federal Department of Industry, on behalf of the Minister of Industry (Canada) (collectively “Industry

Canada”), and the Canadian Radio-television and Telecommunications Commission (“CRTC”) under the Telecommunications Act

(Canada) (the “Telecommunications Act”) and the CRTC under the Broadcasting Act (Canada) (the “Broadcasting Act”), and, accordingly,

our results of operations are affected by changes in regulations and by the decisions of these regulators.