Rogers 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Rogers Communications Inc. 2004 Annual Report

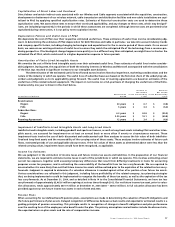

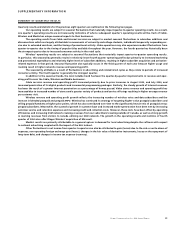

Gain on sale of cable systems

Under Canadian GAAP, the cash proceeds on the non-monetary exchange of the cable assets in 2000 were recorded as a reduction in the

carrying value of PP&E. Under U.S. GAAP, a portion of the cash proceeds received must be recognized as a gain in the consolidated

statements of income on an after-tax basis. The gain amounted to $40.3 million before income taxes.

Under Canadian GAAP, the after-tax gain arising on the sale of certain of our cable television systems in prior years was recorded

as a reduction of the carrying value of goodwill acquired in a contemporaneous acquisition of certain cable television systems. Under

U.S. GAAP, we included the gain on sale of the cable television systems in income, net of related future income taxes.

As a result of these transactions, amortization expense under U.S. GAAP was increased in subsequent years.

Pre-operating costs

Under Canadian GAAP, we defer the incremental costs relating to the development and pre-operating phases of new businesses and

amortize these costs on a straight-line basis over periods up to five years. Under U.S. GAAP, these costs are expensed as incurred.

Equity instruments

Under Canadian GAAP, the Convertible Preferred Securities are classified as shareholders’ equity and the related interest expense is

recorded as a distribution from retained earnings. Under U.S. GAAP, these securities are classified as long-term debt and the related

interest expense is recorded in the consolidated statements of income.

Capitalized interest

U.S. GAAP requires capitalization of interest costs as part of the historical cost of acquiring certain qualifying assets that require a

period of time to prepare for their intended use. This is not required under Canadian GAAP.

Unrealized holding gains and losses on investments

U.S. GAAP requires that certain investments in equity securities that have readily determinable fair values be stated in the consolidated

balance sheets at their fair values. The unrealized holding gains and losses from these investments, which are considered to be

“available-for-sale securities” under U.S. GAAP, are included as a separate component of shareholders’ equity and comprehensive

income, net of related future income taxes.

Acquisition of Cable Atlantic

U.S. GAAP requires that shares issued in connection with a purchase business combination be valued based on the market price at the

announcement date of the acquisition, whereas Canadian GAAP had required such shares be valued based on the market price at the

consummation date of the acquisition. Accordingly, the Class B Non-Voting shares issued in respect of the acquisition of Cable Atlantic

in 2001 were recorded at $35.4 million more under U.S. GAAP than under Canadian GAAP. This resulted in an increase to goodwill in this

amount, with a corresponding increase to contributed surplus in the amount of $35.4 million.

Financial instruments

Under Canadian GAAP, we account for certain of our cross-currency interest rate exchange agreements and interest exchange agreements

as hedges of specific debt instruments. Under U.S. GAAP, these instruments are not accounted for as hedges. Under U.S. GAAP, these deriv-

ative instruments are accounted for on a mark-to-market basis, with resulting gains or losses recorded in or charged against income.

Stock-based compensation

Under Canadian GAAP, effective January 1, 2004, we adopted the fair value method of recognizing stock-based compensation expense.

For U.S. GAAP purposes, the intrinsic value method is used to account for stock-based compensation of employees. Compensation

expense of $15.1 million recognized under Canadian GAAP would not be recognized under U.S. GAAP for the year ended December 31,

2004. The exercise price of stock options is equal to the market value of the underlying shares at the date of grant, therefore, there is no

expense under the intrinsic value method for U.S. GAAP purposes for the year ended December 31, 2004 and 2003.

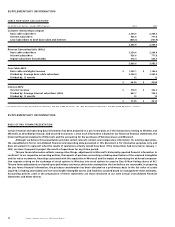

Effective January 1, 2004, the Blue Jays were determined to be a variable interest entity for U.S. GAAP purposes and, as a result,

their results were consolidated from that date. As such, the employees of the Blue Jays were considered employees of the Company

effective January 1, 2004 for U.S. GAAP purposes. The intrinsic value of the options of Blue Jays’ employees was calculated as at January 1,

2004 as nil. Prior to 2004, the Blue Jays’ employees were not considered employees of the Company. Therefore, compensation expense

of $1.2 million for the year ended December 31, 2003 under U.S. GAAP was determined using the fair value method.

Minimum pension liability

Under U.S. GAAP, we are required to record an additional minimum pension liability for one of our plans to reflect the excess of the accu-

mulated benefit obligation over the fair value of the plan assets. Other comprehensive income has been charged with $8.5 million (2003 –

$5.0 million), which is net of income taxes of $4.6 million (2003 – $2.9 million). No such adjustments are required under Canadian GAAP.

Income taxes

Under Canadian GAAP, future income tax assets and liabilities are remeasured for substantively enacted rate changes, whereas under

U.S. GAAP, future income tax assets and liabilities are only remeasured for enacted tax rates.

Installation revenues and costs

Effective January 1, 2004, for Canadian GAAP purposes, cable installation revenues for both new connects and re-connects are deferred

and amortized over the customer relationship period. For U.S. GAAP purposes, installation revenues are immediately recognized in

income to the extent of direct selling costs, with any excess deferred and amortized over the customer relationship period.