Rogers 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Rogers Communications Inc. 2004 Annual Report

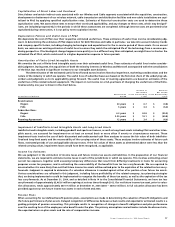

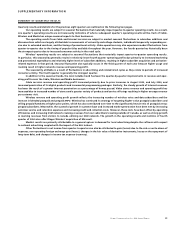

Loss on repayment of long-term debt

On March 26, 2004, we repaid long-term debt resulting in a loss on early repayment of long-term debt of $2.3 million. This loss included,

among other items, a $40.2 million gain on the realization of the deferred transitional gain related to cross-currency interest rate

exchange agreements, which were unwound in connection with the repayment of long-term debt. Under U.S. GAAP, we record cross-

currency interest rate exchange agreements at fair value. Therefore, under U.S. GAAP, the deferred transition gain realized under

Canadian GAAP would be reduced by $28.8 million, representing the $40.2 million gain net of realization of a gain of $11.4 million,

related to the deferred transition adjustment that arose on the adoption of Statement of Financial Accounting Standard No. 133,

“Accounting for Derivative Instruments and Hedging Activities”.

Acquisition of Wireless

At December 31, 2004, we exchanged the outstanding stock options of Wireless for stock options in the Company. U.S. GAAP requires

that the intrinsic value of the unvested options issued be determined as of the consummation date of the transaction and be recorded

as deferred compensation. Canadian GAAP requires that the fair value of unvested options be recorded as deferred compensation.

Under U.S. GAAP, this results in an increase in goodwill in the consolidated accounts of the Company of $2.9 million, with a correspond-

ing adjustment to contributed surplus.

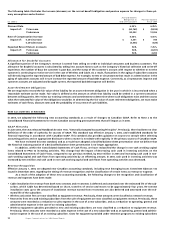

Blue Jays

Under U.S. GAAP, Financial Accounting Standards Board Interpretation No. 46, “Consolidation of Variable Interest Entities”, requires us to

consolidate the results of the Blue Jays effective January 1, 2004. Under Canadian GAAP, we consolidated the Blue Jays effective July 31,

2004. Therefore, the U.S. GAAP consolidated balance sheet as at December 31, 2004, and our net income for the year then ended would

be unchanged from that of Canadian GAAP as we recorded 100% of the losses of the Blue Jays. Under U.S. GAAP, consolidation from

January 1, 2004, to July 31, 2004, would result in an increase in revenues of $75.0 million, cost of sales would increase by $70.1 million,

sales and marketing costs would increase by $3.8 million, operating general and administrative expenses would increase by $17.8 mil-

lion, depreciation and amortization would increase by $5.8 million, operating income would be reduced by $22.6 million and losses from

equity method investments would decrease by $22.7 million.

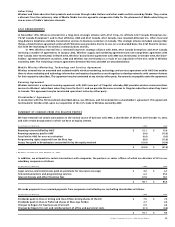

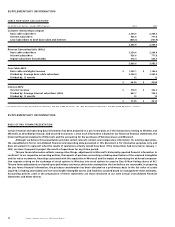

INTERCOMPANY AND RELATED PARTY TRANSACTIONS

RCI Arrangements with Our Subsidiaries

We have entered into a number of agreements with our subsidiaries, including Wireless, Cable, Media and Blue Jays. These agreements

govern the management, commercial and cost-sharing arrangements that we have with our subsidiaries. We monitor intercompany

and related party agreements to ensure they remain beneficial to us. We continually evaluate the expansion of existing arrangements

and the entry into new agreements.

Our agreements with our subsidiaries have historically focused on areas of operation in which joint or combined services pro-

vide efficiencies of scale or other synergies. For example, in late 2001, we began managing the call centre operations of Wireless and

Cable, with a goal of improving productivity, increasing service levels and reducing costs.

More recently, our arrangements are increasingly focusing on sales and marketing activities. In February 2004, the Boards of

Cable and Wireless approved two additional arrangements.

•Distribution: Wireless provides management services to Cable in connection with the distribution of Cable products and services

through retail outlets and dealer channels and also manages Cable’s e-commerce relationships. Wireless may manage other distribu-

tion relationships for Cable if mutually agreed by both partners.

•Rogers Business Services: Wireless established a division, Rogers Business Solutions, that will provide a single point of contact to

offer the full range of Wireless’ products and services and Cable’s products and services to small and medium-sized businesses and, in

the case of telecommunication virtual private network services, to corporate, business accounts and employees.

In addition, we continue to look for other operations and activities that can be shared or jointly operated with other companies within

the Rogers group. Specifically, the expansion of inter-company arrangements relating to sales and marketing activities as well as other

arrangements that may result in greater integration with other companies with the Rogers group are being considered. In the future,

market conditions may require us to further strengthen our arrangements to better coordinate and integrate our sales and marketing

and operational activities with our affiliated companies. Any new arrangements will be entered into only if we believe such arrange-

ments are in each company’s best interest. The definitive terms and conditions of the agreements relating to these arrangements are

subject to the approval of the Audit Committee of the Board of Directors of each company.

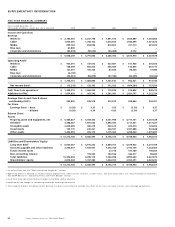

Management Services Agreement

Each of Wireless, Cable, Media, and Blue Jays has entered into a management services agreement with us under which we agree to pro-

vide executive, administrative, financial, strategic planning, information technology and various other services to each subsidiary.

Those services relate to, among other things, assistance with tax advice, Canadian regulatory matters, financial advice (including the

preparation of business plans and financial projections and the evaluation of PP&E expenditure proposals), treasury services, service on

the subsidiary’s Boards of Directors and on committees of the Boards of Directors, advice and assistance in relationships with employee

groups, internal audits, investor relations, purchasing and legal services. In return for these services, each of the subsidiaries has

agreed to pay us fees, which, in the case of Cable and Media, is an amount equal to 2% of their respective consolidated revenue for

each fiscal quarter, subject to certain exceptions, and, in the case of Wireless, is an amount equal to the greater of $8 million per year

(adjusted for changes in the Canadian Consumer Price Index from January 1, 1991) and an amount determined by both our and the

directors serving on the Audit Committee of Wireless. As a result of our acquisition of the minority interest in Wireless, we are review-

ing the Wireless management services agreement to determine if any changes may be appropriate.