Kodak 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

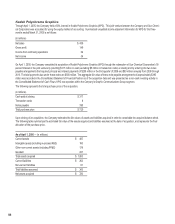

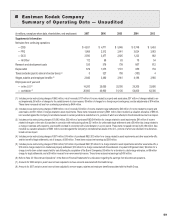

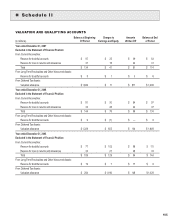

(5) Includes pre-tax restructuring charges of $216 million ($78 million included in cost of goods sold and $138 million included in restructuring costs and other), which

increased net loss by $187 million; and $4 million of asset impairment charges, which increased net loss by $3 million.

(6) Includes pre-tax restructuring charges of $224 million ($68 million included in cost of goods sold and $156 million included in restructuring costs and other), which

increased net loss by $197 million; $4 million (included in SG&A) related to charges for an unfavorable legal settlement, which increased net loss by $4 million; and $9

million of asset impairment charges, which increased net loss by $9 million.

(7) Includes pre-tax restructuring charges of $181 million ($73 million included in cost of goods sold and $108 million included in restructuring costs and other), which

increased net loss by $174 million; a gain of $43 million related to property and asset sales, which reduced net loss by $33 million; and a $2 million gain related to the

reversal of certain asset impairment charges previously recorded in the second quarter, which reduced net loss by $2 million.

(8) Includes pre-tax restructuring charges of $77 million ($63 million included in cost of goods sold and $14 million included in restructuring costs and other) of restructur-

ing charges, which decreased net earnings by $95 million; a $3 million gain on the sale of assets, which decreased net earnings by $1 million; and a $6 million gain

related to the reduction of legal reserves, which increased net earnings by $6 million. Also included is a valuation allowance of $89 million recorded against the

Company’s net deferred tax assets in certain jurisdictions outside the U.S., portions of which are reflected in the aforementioned restructuring amount.

(9) Refer to Note 23, “Discontinued Operations” for a discussion regarding earnings (loss) from discontinued operations.

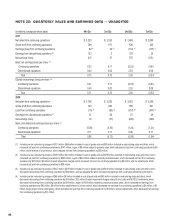

(10) Each quarter is calculated as a discrete period and the sum of the four quarters may not equal the full year amount. The Company’s diluted net earnings (loss) per

share in the above table includes the effect of contingent convertible debt instruments which occurred only for the fourth quarter of 2007.

Changes in Estimates Recorded During the Fourth Quarter December 31, 2007

During the fourth quarter ended December 31, 2007, the Company recorded a charge of approximately $24 million, net of tax, related to changes in

estimate with respect to certain of its employee benefit and compensation accruals. These changes in estimates negatively impacted the results for the

fourth quarter by $.08 per share.

Changes in Estimates Recorded During the Fourth Quarter December 31, 2006

During the fourth quarter ended December 31, 2006, the Company recorded a charge of approximately $17 million, net of tax, related to changes in

estimate with respect to certain of its employee benefit and compensation accruals. These changes in estimates negatively impacted the results for the

fourth quarter by $.06 per share.