Kodak 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

As of December 31, 2007, there were no borrowings outstanding for these Secured Credit Facilities. Debt issue costs incurred of approximately $57

million associated with the Secured Credit Facilities were recorded as an asset and are being amortized over the life of the borrowings. As a result of the

payment of secured debt in connection with the sale of the Health Group, approximately $19 million of unamortized costs were written off in the second

quarter of 2007 to the gain on sale within discontinued operations.

Pursuant to the Secured Credit Agreement and associated Security Agreement, each subsidiary organized in the U.S. jointly and severally guarantees the

obligations under the Secured Credit Agreement and all other obligations of the Company and its subsidiaries to the Lenders. The guaranty is supported

by the pledge of certain U.S. assets of the U.S. Borrower and the Company’s U.S. subsidiaries including, but not limited to, receivables, inventory, equip-

ment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital stock of “Material Subsidiaries.”

Excluded from pledged assets are real property, “Principal Properties” and equity interests in “Restricted Subsidiaries,” as defined in the Company’s 1988

Indenture.

“Material Subsidiaries” are defined as those subsidiaries with revenues or assets constituting 5 percent or more of the consolidated revenues or assets of

the corresponding borrower. Material Subsidiaries will be determined on an annual basis under the Secured Credit Agreement.

Pursuant to the Secured Credit Agreement and associated Canadian Security Agreement, Eastman Kodak Company and Kodak Graphic Communications

Company (KGCC, formerly Creo Americas, Inc.), jointly and severally guarantee the obligations of the Canadian Borrower, to the Lenders. Subsequently,

KGCC has been merged into Eastman Kodak Company. Certain assets of the Canadian Borrower in Canada were also pledged, including, but not limited

to, receivables, inventory, equipment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital

stock of the Canadian Borrower’s Material Subsidiaries.

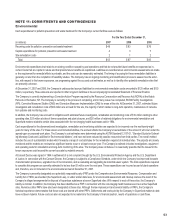

Interest rates for borrowings under the Secured Credit Agreement are dependent on the Company’s Long Term Senior Secured Credit Rating. The Se-

cured Credit Agreement contains various affirmative and negative covenants customary in a facility of this type, including two quarterly financial covenants:

(1) a consolidated debt for borrowed money to consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) (subject to adjust-

ments to exclude any extraordinary income or losses, as defined by the Secured Credit Agreement, interest income and certain non-cash items of income

and expense) ratio, on a rolling four quarter basis, of not greater than: 3.50 to 1 as of December 31, 2006 and thereafter, and (2) a consolidated EBITDA

to consolidated interest expense (subject to adjustments to exclude interest expense not related to borrowed money) ratio, on a rolling four-quarter basis,

of no less than 3.00 to 1. As of December 31, 2007, the Company was in compliance with all covenants under the Secured Credit Agreement.

In addition, subject to various conditions and exceptions in the Secured Credit Agreement, in the event the Company sells assets for net proceeds totaling

$75 million or more in any year, except for proceeds used within 12 months for reinvestments in the business of up to $300 million, proceeds from sales of

assets used in the Company’s non-digital products and services businesses to prepay or repay debt or pay cash restructuring charges within 12 months

from the date of sale of the assets, or proceeds from the sale of inventory in the ordinary course of business, the amount in excess of $75 million must be

applied to prepay loans under the Secured Credit Agreement.

The Company pays a commitment fee at an annual rate of 37.5 basis points on the undrawn balance of the 5-Year Revolving Credit Facility at the

Company’s current Senior Secured credit rating of Ba1 and BB from Moody’s Investor Services, Inc. (Moody’s) and Standard & Poor’s Rating Services

(S&P), respectively. This fee amounts to $3.75 million annually, and is reported as interest expense in the Consolidated Statement of Operations.

In addition to the 5-Year Revolving Credit Facility, the Company has other committed and uncommitted lines of credit as of December 31, 2007 total-

ing $62 million and $499 million, respectively. These lines primarily support borrowing needs of the Company’s subsidiaries, which include term loans,

overdraft coverage, letters of credit and revolving credit lines. Interest rates and other terms of borrowing under these lines of credit vary from country to

country, depending on local market conditions. Total outstanding borrowings against these other committed and uncommitted lines of credit at December

31, 2007 were $4 million and $1 million, respectively. These outstanding borrowings are reflected in the short-term borrowings in the accompanying

Consolidated Statement of Financial Position at December 31, 2007.

As of December 31, 2007, the Company had outstanding letters of credit totaling $143 million and surety bonds in the amount of $79 million primarily to

ensure the payment of possible casualty and workers’ compensation claims, environmental liabilities, and to support various customs and trade activities.

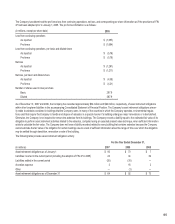

Debt Shelf Registration and Convertible Securities

On September 5, 2003, the Company filed a shelf registration statement on Form S-3 (the primary debt shelf registration) for the issuance of up to $2.0

billion of new debt securities. Pursuant to Rule 429 under the Securities Act of 1933, $650 million of remaining unsold debt securities under a prior shelf

registration statement were included in the primary debt shelf registration, thus giving the Company the ability to issue up to $2.65 billion in public debt.

After issuance of $500 million in notes in October 2003, the remaining availability under the primary debt shelf registration was $2.15 billion.