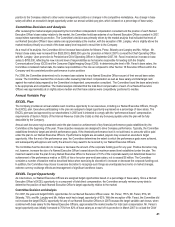

Kodak 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 39

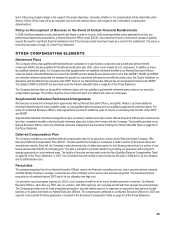

When determining base salary, annual variable pay target opportunities and long-term variable equity incentive awards, the Committee

seeks to provide an appropriate mix of compensation that is performance-based to drive company performance and properly align our

executives’ interests with the long-term interests of our shareholders. The Committee is guided by the principle that a significant amount of

total direct compensation for our Named Executive Officers should be “at risk,” with a positive correlation between the degree of risk and

the level of the executive’s responsibility. In other words, the senior-most executives have the greatest amount of compensation at risk,

which ensures that executives most responsible to shareholders are held most accountable to changes in shareholder value and

achievement of critical performance goals.

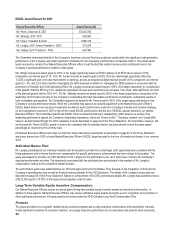

Over the last several years, the Committee has implemented a policy to place greater emphasis on the long-term variable equity incentive

component of total direct compensation. The portion of target total direct compensation awarded to our Section 16 Executive Officers in the

form of long-term variable equity incentive compensation has increased in the aggregate from 39% in 2004 to 57% in 2007. This is

supportive of our principle to align the interests of executives with the interest of the Company’s shareholders and results in a total

compensation package that is better aligned with the technology-based companies we compete with for executive talent.

Factors Considered by the Committee to Determine Levels of Total Direct Compensation

The Committee considers a broad range of facts and circumstances when determining levels of executive compensation. Among the

factors that the Committee considers are: 1) market competitiveness; 2) experience relative to typical market peers; 3) the importance of

the position to the Company relative to other senior management positions; 4) sustained individual performance; 5) readiness for

promotion to a higher level and/or role in the Company’s senior management succession plans; and 6) retention of critical talent. The

significance of any individual factor will vary from year to year and may vary among Named Executive Officers.

In general, the Committee does not consider awards granted or earned under plans in past or current years or the effect of changes in the

Company’s stock price when setting annual target total direct compensation levels of our Named Executive Officers, except to the extent

that such information is relevant to determining whether retention risk is high. Each Named Executive Officer’s level of annual target total

direct compensation is established by the Committee after reviewing market data and factors listed in the prior paragraph.

Competitive Compensation Analysis

The Committee generally targets total direct compensation for each Named Executive Officer at approximately the median of total direct

compensation paid to executives in similar positions with similar responsibilities in companies with similar revenues as Kodak as identified

by market data derived from national surveys. The Committee does not have a pre-defined target for each element of total direct

compensation, but rather reviews the market data as a reference to assess how each component compares to market practices and to

confirm that the overall compensation mix is reasonably aligned with market practices.

To assist the Committee in its annual market review, the Committee’s independent compensation consultant prepares an analysis of the

market competitiveness of the aggregate value of total direct compensation as well as the market competitiveness of each element of total

direct compensation (base salary, total target cash and total long-term incentive) for each Named Executive Officer. The market data

prepared by the Committee’s independent compensation consultant is derived from the average of data from national surveys in which the

Company participates.

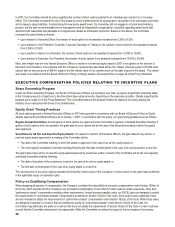

In 2007, market data was compiled from the Towers Perrin Executive Compensation Survey, the Hewitt Executive Compensation Survey

and the Radford Survey. All three surveys are national non-industry specific compensation surveys. The Radford Survey, which was first

added in 2007, has a higher concentration of participants in the technology industry. The Committee felt it was appropriate to include the

Radford Survey as a survey source in 2007 due to the Company’s multi-year restructuring activities and transformation to a digital

technology company. The use of the Radford Survey data, on average, had little impact on the competitive data.

The Committee does not review the individual companies who participate in these surveys. The Committee believes based on the

recommendation of its independent compensation consultant that the surveys represent the market from which the Company competes for

executive talent. In recent years, the Committee has used the national survey data in lieu of a smaller group of specific companies to

benchmark total direct compensation because there were few companies with a similar product portfolio during the Company’s digital

transformation. As the Company continues its migration to a digital technology company, the Committee intends to periodically review the

process of using survey versus specific peer frame data and may, if and when appropriate, adopt a specific peer frame for benchmarking

purposes.

Actual realized compensation of our Named Executive Officers may be more or less than the aggregate target opportunity provided to

them depending upon Company, unit and individual performance under the EXCEL plan and our long-term variable equity incentive plans.

The most current market data provided by the Committee’s independent compensation consultant was utilized as a reference when the

Committee considered base salary, long-term variable equity incentive awards and the target EXCEL opportunity for Named Executive

Officers.