Kodak 2007 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 41

position to the Company relative to other senior management positions or changes in the competitive marketplace. Any change in base

salary will affect an executive’s target opportunity under our annual variable pay plan, which is based on a percentage of base salary.

Committee Decision and Analysis

After reviewing the market analysis prepared by the Committee’s independent compensation consultant and the position of each Named

Executive Officer’s base salary relative to the market, the Committee held base salaries of our Named Executive Officers constant in 2007,

except where warranted by promotion. The Committee’s decision was primarily driven by the market analysis that indicated that most of

our Named Executive Officers’ base salaries are approximately at the median, with the exception of Mr. Langley, who is slightly above the

market median primarily as a result of the base salary level required to recruit him to the Company.

As a result of its analysis, the Committee did not increase base salaries for Messrs. Perez, Sklarsky and Langley and Ms. Hellyar. Mr.

Faraci’s base salary was increased from $520,000 to $600,000 upon his promotion in March 2007 to co-lead the Chief Operating Office

with Mr. Langley. Upon promotion to President and Chief Operating Officer in September 2007, Mr. Faraci received an increase in base

salary to $700,000, reflecting his new role and level of responsibilities as he became responsible for leading both the Graphic

Communications Group (GCG) and the Consumer Digital Imaging Group (CDG). In determining the level of Mr. Faraci’s base salary, the

Committee considered market data, the relative responsibilities of his role as compared to other Section 16 Executive Officers within the

Company and his consistent positive performance in prior positions

For 2008, the Committee determined not to increase base salaries for any Named Executive Officer as part of their annual base salary

review. The Committee reached this conclusion after reviewing total direct compensation as well as base salary and total target cash

against the market data prepared by the Committee’s independent compensation consultant. The Committee found the base salary levels

to be appropriate and competitive. The market analysis indicated that the total direct compensation of each of our Named Executive

Officers was approximately at or slightly above median and their base salaries were competitively positioned to median.

Annual Variable Pay

EXCEL Plan

The Company provides an annual variable cash incentive opportunity to our executives, including our Named Executive Officers, through

the EXCEL plan. Executives participating in the plan are assigned a target opportunity expressed as a percentage of base salary. The

EXCEL plan was last approved by our shareholders in 2005 and is intended to comply with the “performance-based” compensation

requirements of Section 162(m) of the Internal Revenue Code (the Code) so that any bonuses payable under the plan will be fully

deductible by the Company.

Annual cash bonuses may be awarded under the plan based on achievement of key financial performance goals established by the

Committee at the beginning of the year. These objective measures are designed to drive Company performance. Typically, the Committee

establishes threshold, target and stretch performance goals. If the threshold performance level is not achieved, no amounts will be paid

under the plan to our Named Executive Officers. If performance targets are exceeded, payouts may exceed an executive’s target

opportunity. After the end of the performance year, the Committee determines the extent to which the performance goals were achieved,

and subsequently will approve and certify the amount of any award to be received by our Named Executive Officers.

The Committee has the discretion to increase or decrease the amount of the corporate funding pool for any year. Positive discretion may

not, however, increase the size of a Named Executive Officer’s award above the maximum award level established under the plan. The

maximum award under the plan for any Named Executive Officer is the lesser of 10% of the corporate award pool determined based on

achievement of the performance metrics or 500% of his or her prior year-end base salary, not to exceed $5 million. The Committee

considers a number of baseline metrics described below when exercising its discretion to increase or decrease the corporate funding pool.

In addition, the Committee may choose to exercise discretion to recognize such things as unanticipated economic or market changes,

extreme currency exchange effects and management of significant workforce issues.

EXCEL Target Opportunity

As noted above, our Named Executive Officers are assigned target opportunities based on a percentage of base salary. Since a Named

Executive Officer’s EXCEL opportunity is a component of total direct compensation, the Committee annually reviews survey data to

determine the position of each Named Executive Officer’s target opportunity relative to the market.

Committee Decision and Analysis

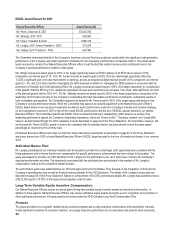

For 2007, the year-end target EXCEL opportunities for our Named Executive Officers were: Mr. Perez, 155%; Mr. Faraci, 85%; Mr.

Sklarsky, 75%; and Mr. Langley and Ms. Hellyar each had a target opportunity of 62%. With the exception of Mr. Faraci, the Committee did

not increase the target EXCEL opportunity for any of our Named Executive Officers in 2007 because the target variable cash bonus, when

combined with base salary for the Named Executive Officers, approximated the market median for total cash compensation. Mr. Faraci’s

target opportunity was initially increased to 75% from 62% of base salary as a result of his promotion in March 2007 to co-lead the Chief