Kodak 2007 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Committee Reports

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Company’s Board is composed solely of independent directors and operates under a written charter adopted

by the Board, most recently amended on February 17, 2004. A copy of the Audit Committee’s charter is attached as Exhibit V to this Proxy

Statement and can be found on our website at www.kodak.com/go/governance.

Management is responsible for the Company’s internal control over financial reporting, the Company’s disclosure controls and procedures,

and preparing the Company’s consolidated financial statements. The Company’s independent registered public accounting firm

(independent accountants), PricewaterhouseCoopers LLP (PwC), is responsible for performing an independent audit of the consolidated

financial statements and of its internal control over financial reporting in accordance with standards of the Public Company Accounting

Oversight Board (United States) and for issuing a report of the results. As outlined in its charter, the Audit Committee is responsible for

overseeing these processes.

During 2007, the Audit Committee met and held discussions with management and the independent accountants on a regular basis.

Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with

accounting principles generally accepted in the United States (U.S. GAAP), and the Audit Committee reviewed and discussed the audited

consolidated financial statements with management and the independent accountants.

The Audit Committee met and discussed with the Corporate Controller and Assistant Controllers the Company’s significant accounting

matters, key fluctuations in the Company’s financial statements and the quality of the Company’s earning reports.

The Audit Committee discussed with the independent accountants the matters specified by Statement on Auditing Standards No. 61,

“Communications with Audit Committee,” as adopted by the PCAOB in Rule 3200T. The independent accountants provided to the Audit

Committee the written disclosures required by the Independence Standards Board Standard No. 1, “Independence Discussion With Audit

Committees,” as adopted by the PCAOB in Rule 3600T. The Audit Committee discussed with the independent accountants their

independence.

The Audit Committee discussed with the Company’s internal auditors and independent accountants the plans for their audits. The Audit

Committee met with the internal auditors and independent accountants, with and without management present. The internal auditors and

independent accountants discussed with or provided to the Audit Committee the results of their examinations, their evaluations of the

Company’s internal control over financial reporting, the Company’s disclosure controls and procedures, and the quality of the Company’s

financial reporting.

With reliance on these reviews, discussions and reports, the Audit Committee recommended that the Board approve the audited financial

statements for inclusion in the Company’s Annual Report on Form 10-K for the year ended December 31, 2007, and the Board accepted

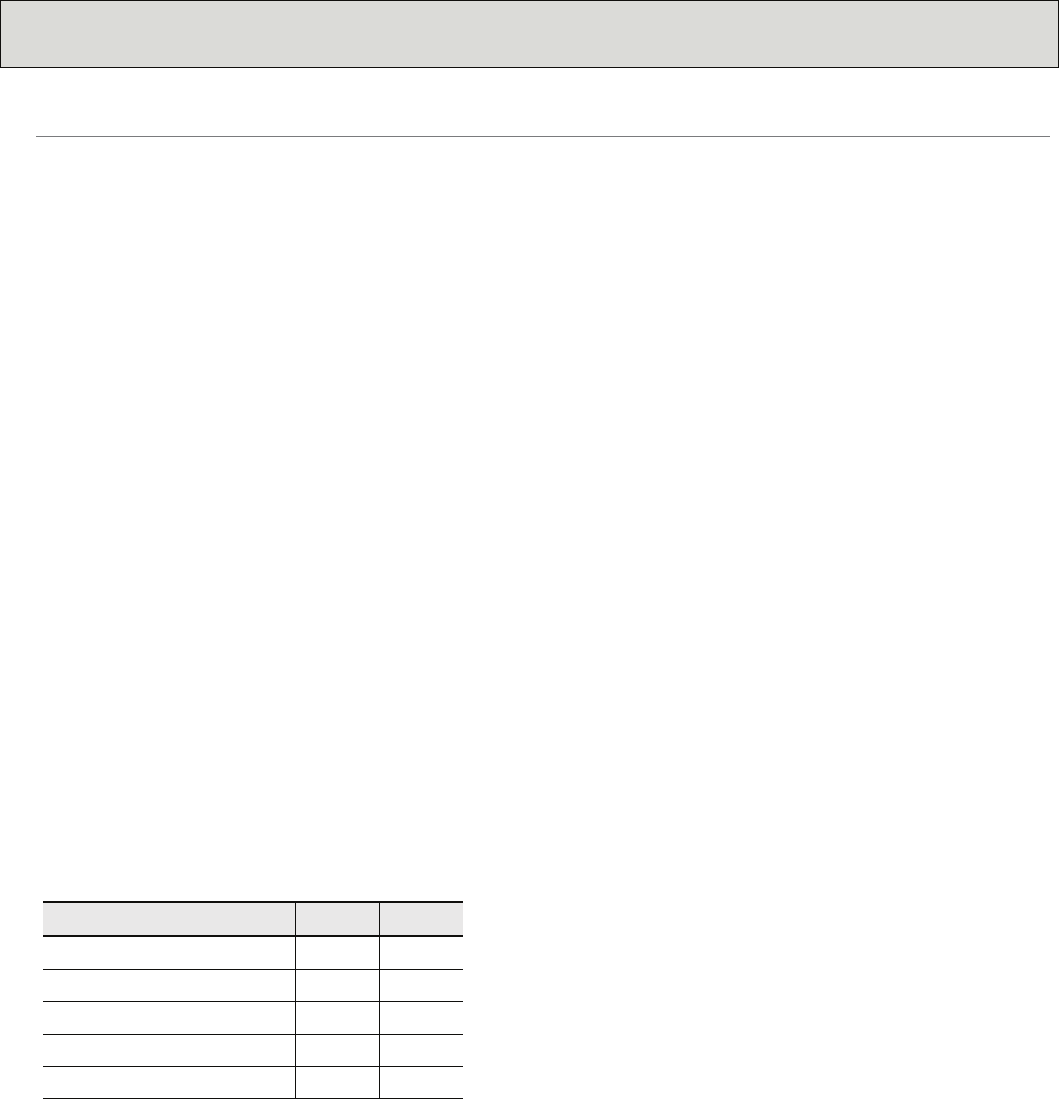

the Audit Committee’s recommendations. The following fees were paid to PwC for services rendered in 2007 and 2006:

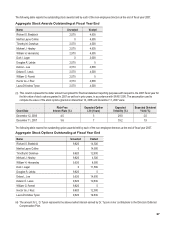

(in millions) 2007 2006

Audit Fees $14.4 $17.2

Audit-Related Fees 3.2 4.4

Tax Fees 2.1 2.2

All Other Fees 0 0

Total 19.7 23.8

The Audit Fees related primarily to the annual audit of the Company’s consolidated financial statements (including Section 404 internal

control assessment under the Sarbanes-Oxley Act of 2002) included in the Company’s Annual Report on Form 10-K, quarterly reviews of

interim financial statements included in the Company’s Quarterly Reports on Forms 10-Q, statutory audits of certain of the Company’s

subsidiaries, and services relating to filings under the Securities Act of 1933 and the Securities Exchange Act of 1934.

The Audit-Related Fees for 2006 and 2007 are related primarily to separate financial statement audits for the Company’s Health Group

Segment.

Tax Fees in 2007 consisted of $1.9 million for tax compliance services and $.2 million for tax planning and advice. Tax Fees in 2006

consisted of $1.9 million for tax compliance services and $.3 million for tax planning and advice.