Kodak 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

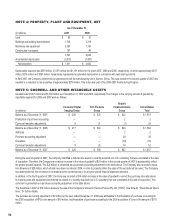

NOTE 4: PROPERTY, PLANT AND EQUIPMENT, NET

As of December 31,

(in millions) 2007 2006

Land $ 85 $ 91

Buildings and building improvements 1,748 2,319

Machinery and equipment 5,387 7,153

Construction in progress 107 86

7,327 9,649

Accumulated depreciation (5,516) (7,047)

Net properties $ 1,811 $ 2,602

Depreciation expense was $679 million, $1,075 million and $1,191 million for the years 2007, 2006 and 2005, respectively, of which approximately $107

million, $273 million and $391 million, respectively, represented accelerated depreciation in connection with restructuring actions.

In April 2007, the Company entered into an agreement to sell its manufacturing site in Xiamen, China. This sale closed in the second quarter of 2007 and

resulted in a reduction to net properties of approximately $278 million. This action was part of the 2004-2007 Restructuring Program.

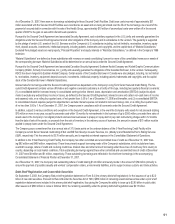

NOTE 5: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill was $1,657 million and $1,584 million as of December 31, 2007 and 2006, respectively. The changes in the carrying amount of goodwill by

reportable segment for 2006 and 2007 were as follows:

(in millions)

Consumer Digital

Imaging Group

Film Products

Group

Graphic

Communications

Group

Consolidated

Total

Balance as of December 31, 2005 $ 208 $ 523 $ 822 $ 1,553

Finalization of purchase accounting — — 2 2

Currency translation adjustments 9 21 (1) 29

Balance as of December 31, 2006 $ 217 $ 544 $ 823 $ 1,584

Additions — — 2 2

Purchase accounting adjustment — — 38 38

Divestiture — — (19) (19)

Currency translation adjustments 9 25 18 52

Balance as of December 31, 2007 $ 226 $ 569 $ 862 $ 1,657

During the second quarter of 2007, the Company identified a deferred tax asset in a recently acquired non-U.S. subsidiary that was overstated at the date

of acquisition. Therefore, the Company recorded an increase in the value of goodwill of $24 million in the second quarter of 2007 to appropriately reflect

the proper goodwill balance. This $24 million is presented as a purchase accounting adjustment in the table above. The Company also recorded a valua-

tion allowance of $20 million, which should have been recorded in 2006, in order to properly reflect the value of the net deferred tax asset. The Company

has determined that this correction is not material to the current period or to any prior period financial statement amounts.

In addition, in the fourth quarter of 2007, the Company recorded a $14 million increase in the value of goodwill to correct the purchase price allocations

to property, plant and equipment and deferred tax assets in a recently acquired non-U.S. subsidiary that was overstated at the date of acquisition. This

correction is presented as a purchase accounting adjustment in the table above.

The divestiture in 2007 of $19 million relates to the sale of the Company’s interest in Hermes Precisa Pty. Ltd. (“HPA”). See Note 23, “Discontinued Opera-

tions,” for further details.

The purchase accounting adjustment of $2 million for the year ended December 31, 2006 was attributable to the finalization of purchase accounting for

the 2005 acquisition of KPG in the amount of $19 million, and finalization of purchase accounting for the 2005 acquisition of Creo in the amount of $(17)

million.