Kodak 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Of the $160 million of acquired intangible assets, approximately $16 million was assigned to research and development assets that were written off at the

date of acquisition.

The remaining $144 million of intangible assets, which relate to developed technology, trademarks and customer relationships, have useful lives ranging

from three to sixteen years. The $237 million of goodwill was assigned to the Company’s Graphic Communications Group segment.

As of the acquisition date, management began to assess and formulate restructuring plans at KPG. As of March 31, 2006, management completed its

assessment and approved actions on these plans. Accordingly, the Company recorded a related liability of approximately $8 million on these approved

actions. This liability is included in the current liabilities amount reported above and represents restructuring charges related to the net assets acquired. To

the extent such actions related to the Company’s historical ownership in the KPG joint venture, the restructuring charges were reflected in the Consoli-

dated Statement of Operations.

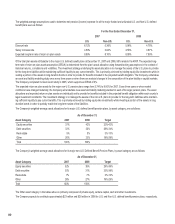

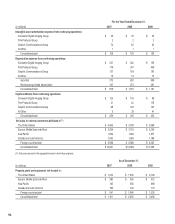

The unaudited pro forma combined historical results, as if KPG had been acquired at the beginning of 2005, are estimated to be:

(in millions, except per share data) 2005

Net sales $ 11,834

Loss from continuing operations $ (1,639)

Basic net loss per share from continuing operations $ (5.69)

Diluted net loss per share from continuing operations $ (5.69)

Number of common shares used in:

Basic net loss per share 287.9

Diluted net loss per share 287.9

The pro forma results include amortization of the intangible assets presented above, depreciation related to the fixed asset step-up, and the interest

expense related to acquisition-related debt, and exclude the write-off of research and development assets that were acquired.

Pro-forma Financial Information

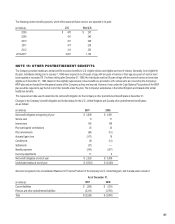

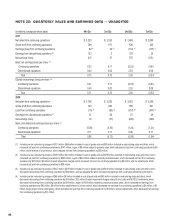

The following unaudited pro forma financial information presents the combined results of operations of the Company and the Company’s significant acqui-

sitions since January 1, 2005, KPG and Creo, as if the acquisitions had occurred as of the beginning of the periods presented. The unaudited pro forma

financial information is not intended to represent or be indicative of the consolidated results of operations or financial condition of the Company that would

have been reported had the acquisitions been completed as of the beginning of the periods presented, and should not be taken as representative of the

future consolidated results of operations or financial condition of the Company. Pro forma results were as follows for year ended December 31, 2005:

(in millions, except per share data) 2005

Net sales $ 12,119

Loss from continuing operations $ (1,694)

Basic net loss per share from continuing operations $ (5.88)

Diluted net loss per share from continuing operations $ (5.88)

Number of common shares used in:

Basic net loss per share 287.9

Diluted net loss per share 287.9

The pro forma results include amortization of the intangible assets, depreciation related to the fixed asset step-up, and the interest expense related to

acquisition-related debt, and exclude the write-off of research and development assets that were acquired.