Kodak 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Although management believes that adequate provision has been made for such issues, there is the possibility that the ultimate resolution of such issues

could have an adverse effect on the earnings of the Company. Conversely, if these issues are resolved favorably in the future, the related provisions would

be reduced, thus having a positive impact on earnings. It is anticipated that audit settlements will be reached during 2008 in the United States and in

certain foreign jurisdictions that could have a significant earnings impact. Due to the uncertainty of amounts and in accordance with its accounting policies,

the Company has not recorded any potential impact of these settlements.

During 2005, the Company reached a settlement with the IRS covering tax years 1993-1998. As a result, the Company recognized a tax benefit from

continuing operations of $44 million, including interest, and a tax benefit of $203 million from discontinued operations.

NOTE 17: RESTRUCTURING COSTS AND OTHER

The Company has undertaken a cost reduction program that was initially announced in January 2004. This program has been referred to as the

“2004–2007 Restructuring Program.” This program was initially expected to result in total charges of $1.3 billion to $1.7 billion over a three-year period.

Overall, Kodak’s worldwide facility square footage was expected to be reduced by approximately one-third, and approximately 12,000 to 15,000 positions

worldwide were expected to be eliminated, primarily in global manufacturing, selected traditional businesses, and corporate administration.

As the 2004-2007 Restructuring Program underpinned a dramatic transformation of the Company, the underlying business model necessarily evolved.

This required broader and more costly manufacturing infrastructure reductions (primarily non-cash charges) than originally anticipated, as well as similarly

broader rationalization of selling, administrative and other business resources (primarily severance charges). In addition, the divestiture of the Health

Group further increased the amount of reductions necessary to appropriately scale the corporate infrastructure. As a result, the Company expanded the

program to extend into 2007 and increased the expected employment reductions to 28,000 to 30,000 positions and total charges to $3.6 billion to $3.8

billion.

In the third quarter of 2007, the Company revised its expectations for total employment reductions to be in the range of 27,000 to 28,000 positions and

total charges in the range of $3.4 billion to $3.6 billion. These new estimates reflect greater efficiencies in manufacturing infrastructure projects as well as

the Company’s ability to outsource or sell certain operations, which reduces involuntary severance charges.

The actual charges for initiatives under this program are recorded in the period in which the Company commits to formalized restructuring plans or

executes the specific actions contemplated by the program and all criteria for restructuring charge recognition under the applicable accounting guidance

have been met.

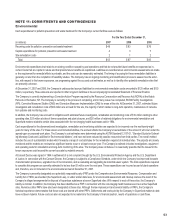

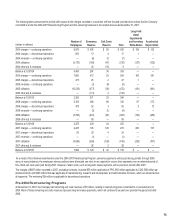

Restructuring Programs Summary

The activity in the accrued restructuring balances and the non-cash charges incurred in relation to all of the Company’s restructuring programs were as

follows for the year ended December 31, 2007:

(in millions)

Balance

December 31,

2006

Cost

Incurred (1)

Reversals (1)

Cash

Payments (2)

Non-cash

Settlements

Other

Adjustments

and Reclasses (3)

Balance

December 31,

2007

2004-2007 Restructuring

Program:

Severance reserve $ 228 $ 165 $ (1) $ (289) $ — $ 26 $ 129

Exit costs reserve 24 133 — (129) $ — 2 30

Total reserve $ 252 $ 298 $ (1) $ (418) $ — $ 28 $ 159

Long-lived asset impairments and

inventory write-downs

$ —

$ 282

$ —

$ —

$ (282)

$ —

$ —

Accelerated depreciation $ — $ 107 $ — $ — $ (107) $ — $ —

Pre-2004 Restructuring Programs:

Severance reserve $ — $ — $ — $ — $ — $ — $ —

Exit costs reserve 11 — (1) (6) — 1 5

Total reserve $ 11 $ — $ (1) $ (6) $ — $ 1 $ 5

Total of all restructuring programs $ 263 $ 687 $ (2) $ (424) $ (389) $ 29 $ 164

(1) The costs incurred, net of reversals, of $685 million include both continuing operations of $662 million and discontinued operations of $23 million.

(2) During the year ended December 31, 2007, the Company made cash payments of approximately $446 million related to restructuring. Of this amount, $424 million was

paid out of restructuring liabilities, while $22 million was paid out of pension and other postretirement liabilities.