Kodak 2007 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

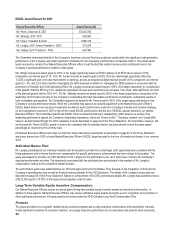

The total long-term variable equity incentive value used by the Committee in determining the number of stock options granted in 2006 and

the 2007 Leadership Stock allocation for each Named Executive Officer was: Mr. Perez ($5,032,000); Mr. Sklarsky ($1,600,000); Mr.

Faraci ($939,000); Mr. Langley ($939,000); and Ms. Hellyar ($939,000).

While the Committee determines a total value for purposes of determining the number of stock options and Leadership Stock units to be

granted, this value does not represent the actual compensation that may be realized by our Named Executive Officers. Whether or not our

executives receive any actual value will depend on the Company’s stock price and the number of shares earned under the Leadership

Stock program. The number of stock options and Leadership Stock units granted to, or earned by, our Named Executive Officers in 2007

are shown in the Grants of Plan-Based Awards Table on page 57 of this Proxy Statement.

Committee Decision and Analysis

With respect to determination of award allocations occurring in 2007, with the exception of our CEO, the size of each Named Executive

Officer’s target long-term equity incentive compensation (i.e., 2007 stock options and 2008 Leadership Stock allocations) was based on the

position of each executive’s total direct compensation relative to the market median and our CEO’s assessment of each executive’s

leadership and performance over the prior year. In the case of our CEO, his target allocation for 2007 was based on the Committee’s

review of the Company’s overall performance as measured by operating results, progress on major aspects of the Company’s digital

transformation, demonstrated leadership and the competitive median total direct compensation levels.

The Committee did not increase Mr. Sklarsky’s target allocation determining that his total direct compensation continued to be

competitively positioned. Mr. Faraci’s target allocation was increased by 102% in order to bring his target total direct compensation closer

to the market median and to a level the Committee determined to be appropriate in light of his new role as President and Chief Operating

Officer and his strong individual performance for the prior year. Ms. Hellyar’s target allocation increased by 8.4% in order to bring her total

direct compensation to the market median in recognition of her increased responsibilities in managing a $3.5 billion business. As noted

above, FPEG, the business segment Ms. Hellyar leads, was restructured effective January 1, 2008 to increase from $2.5 billion to $3.5

billion in annual revenues. Mr. Langley did not receive any long-term equity award in 2007 due to his pending departure from the

Company. The Committee determined to increase our CEO’s target allocation for 2007 by 15% because of his leadership during the final

year of our digital transformation. In making this determination, the Committee reviewed information concerning Mr. Perez’s execution and

leadership as well as a summary of the results from our 2007 CEO evaluation process, as described on page 40 of this Proxy Statement.

The Committee determined that Mr. Perez had performed well with respect to execution of the Company’s operational and strategic

imperatives, as the Company had either already completed, or was on track to achieve, each 2007 imperative. The Committee also

determined that Mr. Perez’s leadership had been outstanding based on a review of his leadership performance against the Company’s

leadership imperatives, which are “Drives to Win,” “Develops Leaders” and “Leads With Values.” Based on these factors the Committee

concluded that this award would reasonably position Mr. Perez’s total direct compensation at an appropriate level above market median

total direct compensation benchmarks.

As a result of these decisions, the total long-term variable equity incentive value used by the Committee in determining the number of stock

options granted in 2007 and the 2008 Leadership Stock allocation for each Named Executive Officer, other than Mr. Langley, was: Mr.

Perez ($5,787,000); Mr. Sklarsky ($1,600,000); Mr. Faraci ($1,900,000); and Ms. Hellyar ($1,018,000).

Leadership Stock — 2007 Performance Cycle Awards

As part of its annual review of long-term variable equity incentives, the Committee approves the performance criteria and terms of the

annual Leadership Stock cycle. The Leadership Stock performance goals are approved in compliance with the rules of Section 162(m) of

the Code, which generally require that goals be established no later than 90 days after the start of the performance period.

As discussed above, these awards provide the participant with the right to earn shares of our common stock based upon attainment of

certain performance goals. The two performance metrics selected by the Committee for the 2007 performance cycle were 2007 GCG

Digital Revenue Growth and 2007 Consumer Inkjet Printer Net Revenue. These metrics are non-GAAP financial measures. GCG Digital

Revenue Growth represents the year-over-year growth in total net revenue of GCG’s digital products. Consumer Inkjet Printer Net

Revenue means the total net revenue of the Consumer Inkjet Equipment strategic product group (SPG) within CDG, excluding revenue

from ink or other consumables. For purposes of determining total net revenue of the SPG under the plan, certain other costs such as

returns, discounts and certain marketing expenses are also deducted. The performance target for GCG Digital Revenue Growth was set

within the range our CEO reported to the investment community. The goal for Consumer Inkjet Printer Net Revenue was established above

the range reported externally to establish an internal stretch goal. The Committee approved these performance metrics, as recommended

by management, because they are leading indicators of the future growth of the Company and representative of the successful

transformation to a digital technology company. The Committee decided to use a one-year performance period followed by a two-year

subsequent time-based vesting schedule for the 2007 awards due to the difficulty in establishing multi-year performance goals during the

final stages of the Company’s digital transformation and to ensure that the awards provided strong retention impact.