Kodak 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

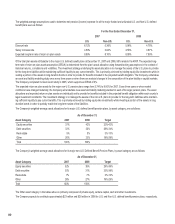

87

2005

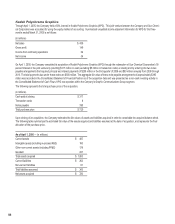

Creo Inc.

On June 15, 2005, the Company completed the acquisition of Creo Inc. (Creo), a premier supplier of prepress and workflow systems used by commercial

printers around the world. The acquisition of Creo uniquely positions the Company to be the preferred partner for its customers, helping them improve

efficiency, expand their offerings and grow their businesses. The Company paid $954 million (excluding approximately $13 million in transaction related

costs), or $16.50 per share, for all of the outstanding shares of Creo. The Company used its bank lines to initially fund the acquisition, which has been

refinanced with a term loan under the Company’s Secured Credit Agreement. Creo’s extensive solutions portfolio is now part of the Company’s Graphic

Communications Group segment.

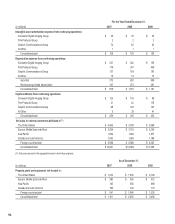

The following represents the total purchase price of the acquisition (in millions):

Cash paid at closing $ 954

Estimated transaction costs 13

Total purchase price $ 967

Upon closing of an acquisition, the Company estimates the fair values of assets and liabilities acquired in order to consolidate the acquired balance sheet.

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition and represents the final

allocation of the purchase price.

As of June 15, 2005 — (in millions):

Current assets $ 328

Intangible assets (including in-process R&D) 292

Other non-current assets (including PP&E) 166

Goodwill 483

Total assets acquired $ 1,269

Current liabilities $ 241

Non-current liabilities 61

Total liabilities assumed $ 302

Net assets acquired $ 967

Of the $292 million of acquired intangible assets, approximately $36 million was assigned to in-process research and development assets that were

written off at the date of acquisition. The remaining $256 million of intangible assets, which relate to developed technology, trademarks and customer

relationships, have useful lives ranging from six to eight years. The $483 million of goodwill was assigned to the Company’s Graphic Communications

Group segment.

As of the acquisition date, management began to assess and formulate restructuring plans at Creo. As of June 30, 2006, management completed its

assessment and approved actions on these plans. Accordingly, the Company recorded a related liability of approximately $38 million. This liability is

included in the current liabilities amount reported above and represents restructuring charges related to Creo net assets acquired.

During 2007, the Company recorded purchase accounting corrections increasing goodwill by $38 million. See Note 5, “Goodwill and Other Intangible

Assets,” for further discussion.