Kodak 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

Revenue Recognition

The Company’s revenue transactions include sales of the following: products; equipment; software; services; equipment bundled with products and/or

services and/or software; integrated solutions, and intellectual property licensing. The Company recognizes revenue when it is realized or realizable and

earned. For the sale of multiple-element arrangements whereby equipment is combined with services, including maintenance and training, and other ele-

ments, including software and products, the Company allocates to, and recognizes revenue from, the various elements based on their fair value.

At the time revenue is recognized, the Company also records reductions to revenue for customer incentive programs in accordance with the provisions

of Emerging Issues Task Force (EITF) Issue No. 01-09, “Accounting for Consideration Given from a Vendor to a Customer (Including a Reseller of the

Vendor’s Products).” Such incentive programs include cash and volume discounts, price protection, promotional, cooperative and other advertising allow-

ances and coupons. For those incentives that require the estimation of sales volumes or redemption rates, such as for volume rebates or coupons, the

Company uses historical experience and internal and customer data to estimate the sales incentive at the time revenue is recognized. In the event that the

actual results of these items differ from the estimates, adjustments to the sales incentive accruals would be recorded.

Incremental direct costs of a customer contract in a transaction that results in the deferral of revenue are deferred and netted against revenue in proportion

to the related revenue recognized in each period if: (1) an enforceable contract for the remaining deliverable items exists; and (2) delivery of the remaining

items in the arrangement is expected to generate positive margins allowing realization of the deferred costs. Incremental direct costs are defined as costs

that vary with and are directly related to the acquisition of a contract, which would not have been incurred but for the acquisition of the contract.

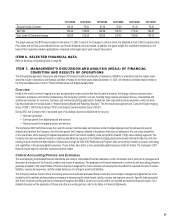

Valuation of Long-lived Assets, Including Goodwill and Purchased Intangible Assets

The Company reviews the carrying value of its long-lived assets, including goodwill and purchased intangible assets, for impairment whenever events or

changes in circumstances indicate that the carrying value may not be recoverable.

The Company’s assessments of impairment of long-lived assets, including goodwill and purchased intangible assets, and its periodic review of the

remaining useful lives of its long-lived assets are an integral part of the Company’s ongoing strategic review of the business and operations, and are also

performed in conjunction with the Company’s restructuring actions. Therefore, changes in the Company’s strategy, the Company’s digital transformation

and other changes in the operations of the Company could impact the projected future operating results that are inherent in the Company’s estimates of

fair value, resulting in impairments in the future. Additionally, other changes in the estimates and assumptions, including the discount rate and expected

long-term growth rate, which drive the valuation techniques employed to estimate the fair value of long-lived assets and goodwill could change and,

therefore, impact the assessments of impairment in the future.

Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, “Accounting for Income Taxes” and Financial Accounting Standards Board

(FASB) Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). The asset and liability approach underlying SFAS No. 109 requires

the recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and

tax basis of the Company’s assets and liabilities. FIN 48 prescribes a recognition threshold and measurement attribute for financial statement recognition

and measurement of a tax position taken or expected to be taken in a tax return, and also provides guidance on various related matters such as derecog-

nition, interest and penalties, and disclosure.

The Company records a valuation allowance to reduce its net deferred tax assets to the amount that is more likely than not to be realized. The Company

has considered forecasted earnings, future taxable income, the mix of earnings in the jurisdictions in which the Company operates and prudent and

feasible tax planning strategies in determining the need for these valuation allowances. If Kodak were to determine that it would not be able to realize a

portion of its net deferred tax assets in the future, for which there is currently no valuation allowance, an adjustment to the net deferred tax assets would

be charged to earnings in the period such determination was made. Conversely, if the Company were to make a determination that it is more likely than

not that the deferred tax assets, for which there is currently a valuation allowance, would be realized, the related valuation allowance would be reduced

and a benefit to earnings would be recorded.

The Company’s effective tax rate considers the impact of undistributed earnings of subsidiary companies outside of the U.S. Deferred taxes have not been

provided for the potential remittance of such undistributed earnings, as it is the Company’s policy to indefinitely reinvest its retained earnings. However,

from time to time and to the extent that the Company can repatriate overseas earnings on essentially a tax-free basis, the Company’s foreign subsidiaries

will pay dividends to the U.S. Material changes in the Company’s working capital and long-term investment requirements could impact the decisions made

by management with respect to the level and source of future remittances and, as a result, the Company’s effective tax rate.

The Company operates within multiple taxing jurisdictions worldwide and is subject to audit in these jurisdictions. These audits can involve complex

issues, which may require an extended period of time for resolution. Although management believes that adequate provision has been made for such is-

sues, there is the possibility that the ultimate resolution of such issues could have an adverse effect on the earnings of the Company. Conversely, if these

issues are resolved favorably in the future, the related provisions would be reduced, thus having a positive impact on earnings.