Kodak 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

For all awards issued after adoption of SFAS No. 123R, the Company changed from the nominal-vesting approach to the non-substantive vesting

approach for purposes of accounting for retirement eligible participants. The impact of applying the nominal-vesting approach vs. the non-substantive

approach upon adoption of SFAS No. 123R in 2005 was immaterial. The Company has a policy of issuing shares of treasury stock to satisfy share option

exercises. Based on an estimate of option exercises, the Company does not expect option exercises to result in the repurchase of stock during 2008.

In November 2005, the FASB issued Staff Position (“FSP”) No. FAS 123(R)-3, “Transition Election Related to Accounting for Tax Effects of Share-Based

Payment Awards.” During the third quarter of 2007, the Company elected to adopt the alternative transition method provided in FSP No. FAS 123(R)-3

for calculating the tax effects of stock-based compensation. The alternative transition method includes simplified methods to determine the beginning

balance of the additional paid-in capital (“APIC”) pool related to the tax effects of stock-based compensation, and to determine the subsequent impact on

the APIC pool and the statement of cash flows of the tax effects of stock-based awards that were fully vested and outstanding upon the adoption of SFAS

No. 123(R), “Share-Based Payment.” The adoption of FSP No. FAS 123(R)-3 did not have a material impact on the Company’s cash flows or results of

operations for the year ended December 31, 2007 or its financial position as of December 31, 2007.

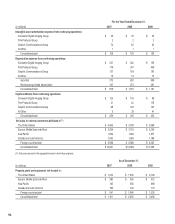

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model that uses the assumptions noted

in the following table. Expected volatilities are based on historical volatility of the Company’s stock, management’s estimate of implied volatility of the

Company’s stock, and other factors. The expected term of options granted is derived from the vesting period of the award, as well as historical exercise

behavior, and represents the period of time that options granted are expected to be outstanding. The risk-free rate is calculated using the U.S. Treasury

yield curve, and is based on the expected term of the option. The Company uses historical data to estimate forfeitures.

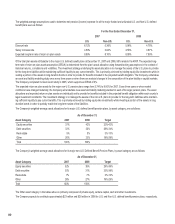

The Black-Scholes option pricing model was used with the following weighted-average assumptions for options issued in each year:

For the Year Ended

2007 2006 2005

Weighted-average risk-free interest rate 3.5% 4.6% 3.9%

Risk-free interest rates 3.2% - 5.0% 4.5% - 5.1% 3.6% - 4.5%

Weighted-average expected option lives 5 years 6 years 5 years

Expected option lives 4 - 7 years 3 - 7 years 3 - 7 years

Weighted-average volatility 32% 34% 35%

Expected volatilities 31% - 35% 29% - 36% 31% - 36%

Weighted-average expected dividend yield 2.0% 1.9% 1.8%

Expected dividend yields 1.9% - 2.1% 1.8% - 2.3% 1.5% - 1.9%

The weighted-average fair value per option granted in 2007, 2006, and 2005 was $6.19, $8.18, and $7.70, respectively.

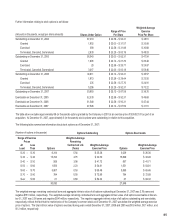

As of December 31, 2007, there was $14.0 million of total unrecognized compensation cost related to unvested options. The cost is expected to be

recognized over a weighted-average period of 2.2 years.

The total fair value of shares vested during the years ended December 31, 2007, 2006 and 2005 was $10 million, $8 million and $16 million, respectively.

Cash received for option exercises for the years ended December 31, 2007, 2006 and 2005 was $6 million, $0 million, and $12 million, respectively. The

actual tax benefit realized for the tax deductions from option exercises was not material for 2007, 2006 or 2005.

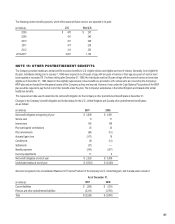

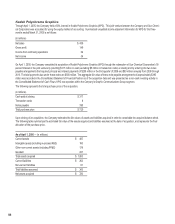

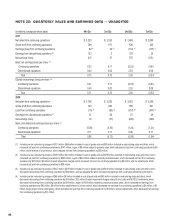

NOTE 22: ACQUISITIONS

2007

There were no significant acquisitions in 2007.

2006

There were no significant acquisitions in 2006.