Kodak 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

The Kodak Stock Option Plan, an “all employee stock option plan” which the Company formerly maintained, became effective on March 13, 1998, and terminated

on March 12, 2003. The plan was used in 1998 to grant an award of 100 non-qualified stock options or, in those countries where the grant of stock options was not

possible, 100 freestanding stock appreciation rights, to almost all full-time and part-time employees of the Company and many of its domestic and foreign subsidiar-

ies. In March of 2000, the Company made essentially an identical grant under the plan to generally the same category of employees. The Compensation Committee

administered this plan and continues to administer these plan awards that remain outstanding. A total of 16,600,000 shares were available for grant under the plan. All

awards granted under the plan generally contained the following features: 1) a grant price equal to the fair market value of the Company’s common stock on the date of

grant; 2) a two-year vesting period; and 3) a term of 10 years.

On December 31, 2007, the equity overhang, or the percentage of outstanding shares (plus shares that could be issued pursuant to plans represented by

all stock incentives granted and available for future grant under all plans) was 14.5%.

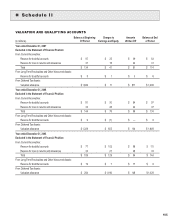

The following table sets forth information regarding awards granted and earned, the run rate for each of the last three fiscal years and the average run rate

over the last three years.

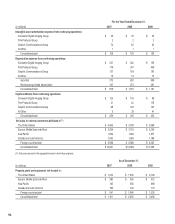

Run Rate for the Year Ended December 31,

(shares in thousands) 2007 2006 2005 3-year Average

Stock options granted 1,813 1,605 1,852 1,757

Unvested service-based stock granted 183 82 126 130

Actual performance-based stock awards earned 166 437 — 201

Basic common shares outstanding at fiscal year end 288,000 287,333 287,223 287,519

Run rate 0.75% 0.74% 0.69% 0.73%

The Company continues to manage its run rate of awards granted over time to levels it believes are reasonable in light of changes in its business and

number of outstanding shares while ensuring that our overall executive compensation program is competitive, relevant, and motivational.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

The information required by Item 13 is incorporated by reference from the information under the captions “Compensation Discussion and Analysis –

Employment Contracts and Arrangements” and “Board Structure and Corporate Governance – Board Independence” in the Proxy Statement.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The information required by Item 14 regarding principal auditor fees and services is incorporated by reference from the information under the caption

“Committee Reports – Report of the Audit Committee” in the Proxy Statement.