Kodak 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

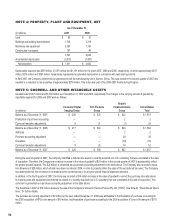

NOTE 6: OTHER LONG-TERM ASSETS

As of December 31,

(in millions) 2007 2006

Overfunded pension plans $ 2,454 $ 1,597

Deferred income taxes, net of valuation allowance 636 642

Intangible assets 362 510

Non-current receivables 405 394

Miscellaneous other long-term assets 281 366

Total $ 4,138 $ 3,509

The miscellaneous component above consists of other miscellaneous long-term assets that, individually, are less than 5% of the Company’s total assets,

and therefore, have been aggregated in accordance with Regulation S-X.

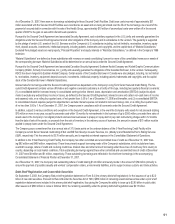

NOTE 7: INVESTMENTS

Equity Method

The Company’s significant equity method investees and the Company’s approximate ownership interest in each investee were as follows:

As of December 31,

2007 2006

Matsushita-Ultra Technologies Battery Corporation 30% 30%

Lucky Film Co. Ltd (Lucky Film) 13% 13%

As of December 31, 2007 and 2006, the carrying value of the Company’s equity investment in these significant unconsolidated affiliates was $33 million

and $36 million, respectively, and is reported within other long-term assets in the accompanying Consolidated Statement of Financial Position. The

Company records its equity in the income or losses of these investees and reports such amounts in other income (charges), net in the accompanying

Consolidated Statement of Operations. See Note 15, “Other Income (Charges), Net.”

In the fourth quarter of 2007, the shareholders of Matsushita-Ultra Tech Battery Corporation (“MUTEC”), a joint venture between the Company and

Matsushita Electric Corporation of America, voted to dissolve the joint venture agreement, which was to expire on December 17, 2007, but was extended

to March 31, 2008. Kodak expects that MUTEC will cease operations by March 31, 2008 and that the entity will be liquidated by December 31, 2008. As

a result of this decision, Kodak recorded an impairment charge of approximately $5 million in the fourth quarter of 2007. This charge is reflected in other

income (charges), net on the Consolidated Statement of Operations.

On November 8, 2007, the Company entered into an agreement with Lucky Film Co. Ltd., China Lucky Film Corp. (together, “Lucky”), and Guangzhou

Chengzin Venture Capital Co. Ltd. (“Investment Co.”) to sell Kodak’s equity interest in Lucky Film Co. Ltd. to Investment Co. In addition, Kodak and Lucky

terminated or amended certain other existing agreements and entered into other new agreements. The transaction closed in January 2008. In conjunction

with the transaction, Kodak received proceeds of $46 million, and recorded an asset impairment charge in the fourth quarter of 2007 related to certain

manufacturing exclusivity and distribution right intangible assets approximating $46 million. This charge is reflected in other operating expenses (income),

net on the Consolidated Statement of Operations.

In January 2006, Kodak terminated the SK Display joint venture arrangement with Sanyo Electric Company pursuant to terms of the original agreement.

The Company recognized a $7 million gain in other income (charges), net on this transaction. This termination did not have a material impact on the

Company’s financial position, results of operations or cash flows. Kodak will continue as exclusive licensing agent on behalf of Kodak and Sanyo for

certain OLED intellectual property.