Kodak 2007 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

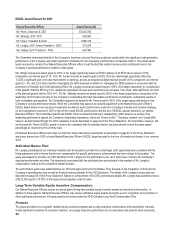

Compensation of Named Executive Officers

SUMMARY COMPENSATION TABLE

The table below summarizes the total compensation of each of our Named Executive Officers (NEO) for 2006 and 2007.

Name and

Principal

Position Year Salary (1) Bonus

Stock Awards

(2)

Option

Awards (3)

Non-Equity

Incentive

Plan

Comp. (4)

Change in

Pension

Value and

Non-

qualified

Deferred

Comp.

Earnings (5)

All Other

Comp. (6) Total

A.M. Perez

Chairman &

CEO

2007 $1,096,168 — $1,515,177 $2,444,914 $3,324,750 $ 519,560 $377,865 $9,278,434

2006 1,096,168 $690,525(7) 1,801,792(8) 1,704,007 — 3,214,598 269,020 8,776,110

F.S. Sklarsky

EVP, CFO(9)

2007 597,911 — 649,584 383,486 900,000 104,165 37,504 2,672,650

2006 91,986 75,000(10) 74,781 78,333 — 18,303 2,539 340,942

P.J. Faraci

President &

COO

2007 606,879 — 257,987 503,845 1,066,158 386,094 31,362 2,852,325

2006 518,188 130,572(7) 179,631 381,227 — 319,305 42,614 1,571,537

J.T. Langley

SVP(11)

2007 498,258 — 199,394 520,455 785,750 212,069 54,486 2,270,412

2006 498,258 150,550(12) 160,299 291,079 490,000 171,160 58,400 1,819,746

M.J. Hellyar

EVP,

President -

FPG

2007 488,293 — 234,000 616,539 637,980 4,093 2,653 1,983,558

2006 484,843 130,634(7) 211,734 279,322 — 1,102,430 10,349 2,219,312

(1) This column reports base salary earned by each of our Named Executive Officers. See page 40 of this Proxy Statement for a

discussion and analysis of base salary levels. Mr. Faraci’s base salary increased in March 2007 from $520,000 to $600,000 and in

September 2007 to $700,000 in connection with his initial promotion to co-lead the Chief Operating Office and his subsequent

promotion to President and Chief Operating Officer.

(2) This column reports the compensation cost recognized by the Company for financial statement reporting purposes in accordance with

SFAS 123R, without any reduction for risk of forfeiture, for all stock awards (including Leadership Stock, restricted stock, restricted

stock units and 2006 Executive Performance Share Program (EPSP)) during each year reported. The value disclosed represents the

annual aggregate expense for stock awards granted in 2007 and in prior years as compensation cost is recognized for financial

reporting purposes over the period in which the employee is required to provide service in exchange for the award. Compensation cost

is initially measured based on the grant date fair value of an award, determined pursuant to SFAS 123R without any reduction for risk

of forfeiture. The assumptions used to calculate the value of the awards are the same as that used for our stock-based compensation

disclosure discussed in Note 21 to our financial statements in our Annual Report on Form 10-K for the year ended December 31, 2007,

as filed with the SEC on February 27, 2008.

(3) This column reports the compensation cost recognized by the Company for financial statement reporting purposes in accordance with

SFAS 123R, without any reduction for risk of forfeiture, in each year reported related to stock options, including stock options granted

in 2007 and in prior years as compensation cost is recognized for financial reporting purposes over the period in which the employee is

required to provide service in exchange for the award. The following table includes the assumptions used to calculate the

compensation expense reported for 2006 and 2007 on a grant-date basis. Compensation cost is initially measured based on the grant

date fair value of an award, determined pursuant to SFAS 123R without any reduction for risk of forfeiture.