Kodak 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

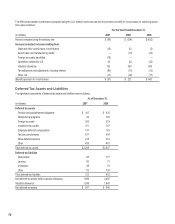

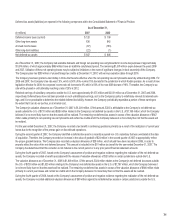

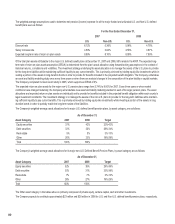

Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position:

As of December 31,

(in millions) 2007 2006

Deferred income taxes (current) $ 120 $ 108

Other long-term assets 636 642

Accrued income taxes (87) (103)

Other long-term liabilities (22) (1)

Net deferred tax assets $ 647 $ 646

As of December 31, 2007, the Company had available domestic and foreign net operating loss carryforwards for income tax purposes of approximately

$1,874 million, of which approximately $498 million have an indefinite carryforward period. The remaining $1,376 million expire between the years 2008

and 2027. Utilization of these net operating losses may be subject to limitations in the event of significant changes in stock ownership of the Company.

The Company also has $209 million of unused foreign tax credits at December 31, 2007, with various expiration dates through 2016.

The Company has been granted a tax holiday in China that became effective when the net operating loss carryforwards were fully utilized during 2004. For

2006 and 2007, the Company’s tax rate was 7.5%, which is 50% of the normal 15% tax rate for the jurisdiction in which Kodak operates. As a result of new

legislation effective for 2008, the corporate income rate will increase to 9% which is 50% of the new 2008 tax rate of 18%. Thereafter, the Company’s tax

rate will be phased in until ultimately reaching a rate of 25% in 2012.

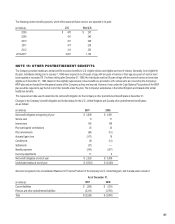

Retained earnings of subsidiary companies outside the U.S. were approximately $1,675 million and $2,031 million as of December 31, 2007 and 2006,

respectively. Deferred taxes have not been provided on such undistributed earnings, as it is the Company’s policy to indefinitely reinvest its retained earn-

ings, and it is not practicable to determine the related deferred tax liability. However, the Company periodically repatriates a portion of these earnings to

the extent that it can do so tax-free, or at minimal cost.

The Company’s valuation allowance as of December 31, 2007 is $1,249 million. Of this amount, $323 is attributable to the Company’s net deferred tax

assets outside the U.S. of $731 million and $926 million relates to the Company’s net deferred tax assets in the U.S. of $1,165 million, which the Company

believes it is not more likely than not that the assets will be realized. The remaining net deferred tax assets in excess of the valuation allowance of $647

million relate primarily to net operating loss carryforwards and certain tax credits which the Company believes it is more likely than not that the assets will

be realized.

For the year ended December 31, 2007, the Company recorded a tax benefit in continuing operations primarily as a result of the realization of current year

losses due to the recognition of the pre-tax gain on discontinued operations.

During the second quarter of 2007, the Company identified a deferred tax asset in a recently acquired non-U.S. subsidiary that was overstated at the date

of acquisition. Therefore, the Company recorded an increase in the value of goodwill of $24 million in the second quarter of 2007 to appropriately reflect

the proper goodwill balance. The Company also recorded a valuation allowance of $20 million, which should have been recorded in 2006, in order to

properly reflect the value of the net deferred tax asset. This amount is included in the $51 million tax benefit for the year ended December 31, 2007. The

Company has determined that this correction is not material to the current period or to any prior period financial statement amounts.

During the fourth quarter of 2007, based on the Company’s assessment of positive and negative evidence regarding the realization of the net deferred tax

assets, the Company recorded a benefit associated with the release of valuation allowances of $20 million in certain jurisdictions outside the U.S.

The valuation allowance as of December 31, 2006 is $1,849 million. Of this amount, $324 million relates to the Company’s net deferred tax assets outside

the U.S. of $728 million and $1,525 million relating to the Company’s net deferred tax assets in the U.S. of $1,767 million, which the Company believes it

is not more likely than not that the assets will be realized. The remaining net deferred tax assets in excess of the valuation allowance of $646 million relate

primarily to current year losses and certain tax credits which the Company believes it is more likely than not that the assets will be realized.

During the fourth quarter of 2006, based on the Company’s assessment of positive and negative evidence regarding the realization of the net deferred tax

assets, the Company recorded additional valuation allowances of $90 million against its net deferred tax assets in certain jurisdictions outside the U.S.