Kodak 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

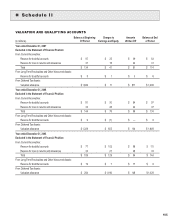

n

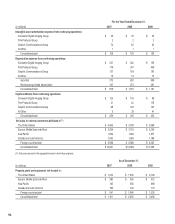

(in millions, except per share data, shareholders, and employees) 2007 2006 2005 2004 2003

Supplemental Information

Net sales from continuing operations

— CDG $ 4,631 $ 4,711 $ 5,646 $ 5,748 $ 5,453

— FPG 1,968 2,312 2,841 3,624 3,963

— GCG 3,590 3,477 2,825 1,223 862

— All Other 112 68 83 70 54

Research and development costs 535 578 739 667 612

Depreciation 679 1,075 1,191 850 734

Taxes (excludes payroll, sales and excise taxes) (7) 5 327 798 (100) 4

Wages, salaries and employee benefits (8) 2,846 3,480 3,941 4,188 3,960

Employees as of year end

— in the U.S (7) 14,200 20,600 25,500 29,200 33,800

— worldwide (7) 26,900 40,900 51,100 54,800 62,300

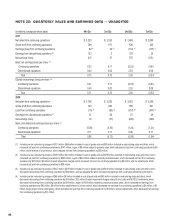

(1) Includes pre-tax restructuring charges of $662 million, net of reversals; $157 million of income related to property and asset sales; $57 million of charges related to as-

set impairments; $6 million of charges for the establishment of a loan reserve; $9 million of charges for a foreign export contingency; and tax adjustments of $14 million.

These items increased net loss from continuing operations by $464 million.

(2) Includes pre-tax restructuring charges of $698 million, net of reversals; $2 million of income related to legal settlements; $46 million of income related to property and

asset sales; and $11 million of charges related to asset impairments. These items increased net loss by $691 million. Also included is a valuation allowance of $89 mil-

lion recorded against the Company’s net deferred assets in certain jurisdictions outside the U.S., portions of which are reflected in the aforementioned net loss impact.

(3) Includes pre-tax restructuring charges of $1,092 million; $52 million of purchased R&D; $44 million for charges related to asset impairments; $41 million of income

related to the gain on the sale of properties in connection with restructuring actions; $21 million for unfavorable legal settlements and a $6 million tax charge related to

a change in estimate with respect to a tax benefit recorded in connection with a land donation in a prior period. These items increased net loss by $1,080 million. Also

included is a valuation allowance of $961 million recorded against the Company’s net deferred tax assets in the U.S., portions of which are reflected in the aforemen-

tioned net loss impact.

(4) Includes pre-tax restructuring charges of $873 million; $16 million of purchased R&D; $12 million for a charge related to asset impairments and other asset write-offs;

and the benefit of legal settlements, net of charges, of $95 million. These items reduced net earnings by $595 million.

(5) Includes pre-tax restructuring charges of $532 million; $31 million of purchased R&D; $7 million for a charge related to asset impairments and other asset write-offs; a

$12 million charge related to an intellectual property settlement; $14 million for a charge connected with the settlement of a patent infringement claim; $9 million for a

charge to write down certain assets held for sale following the acquisition of the Burrell Companies; $8 million for a donation to a technology enterprise; an $8 million

charge for legal settlements; and a $9 million reversal for an environmental reserve. These items reduced net earnings by $430 million.

(6) Refer to Note 23, “Discontinued Operations” in the Notes to Financial Statements for a discussion regarding the earnings from discontinued operations.

(7) Amounts for 2006 and prior years have not been adjusted to remove amounts associated with the Health Group.

(8) Amounts for 2007 and prior years have not been adjusted to remove wages, salaries and employee benefits associated with the Health Group.

n

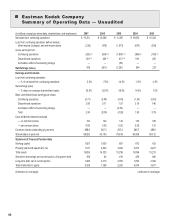

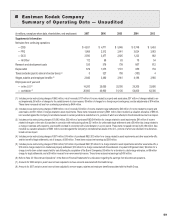

Eastman Ko dak Company

Sum mar y o f O perati ng Data — Unaudite d