Kodak 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

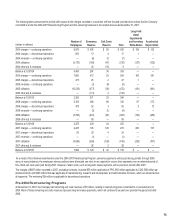

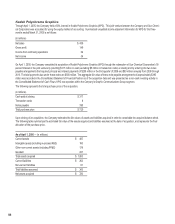

Further information relating to stock options is as follows:

(Amounts in thousands, except per share amounts)

Shares Under Option

Range of Price

Per Share

Weighted-Average

Exercise

Price Per Share

Outstanding on December 31, 2004 37,210 $ 22.58 – $ 92.31 $ 48.51

Granted 1,852 $ 22.03 – $ 31.57 $ 25.89

Exercised 389 $ 22.58 – $ 31.88 $ 30.68

Terminated, Canceled, Surrendered 2,630 $ 23.25 – $ 83.19 $ 48.53

Outstanding on December 31, 2005 36,043 $ 22.03 – $ 92.31 $ 47.54

Granted 1,605 $ 20.12 – $ 27.70 $ 25.48

Exercised 20 $ 22.58 – $ 26.71 $ 24.97

Terminated, Canceled, Surrendered 3,017 $ 22.03 – $ 83.19 $ 58.46

Outstanding on December 31, 2006 34,611 $ 20.12 – $ 92.31 $ 45.57

Granted 1,813 $ 23.28 – $ 28.44 $ 23.50

Exercised 235 $ 22.58 – $ 27.70 $ 24.91

Terminated, Canceled, Surrendered 5,296 $ 23.25 – $ 92.31 $ 73.22

Outstanding on December 31, 2007 30,893 $ 20.12 – $ 87.59 $ 39.70

Exercisable on December 31, 2005 32,330 $ 22.58 – $ 92.31 $ 49.69

Exercisable on December 31, 2006 31,548 $ 22.58 – $ 92.31 $ 47.44

Exercisable on December 31, 2007 27,546 $ 20.12 – $ 87.59 $ 41.51

The table above excludes approximately 68 (in thousands) options granted by the Company in 2001 at an exercise price of $.05-$21.91 as part of an

acquisition. At December 31, 2007, approximately 3 (in thousands) stock options were outstanding in relation to this acquisition.

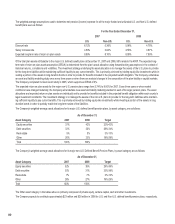

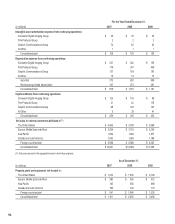

The following table summarizes information about stock options as of December 31, 2007:

(Number of options in thousands) Options Outstanding Options Exercisable

Range of Exercise

Prices

At Less

Least Than

Options

Weighted-Average

Remaining

Contractual Life

(Years)

Weighted-Average

Exercise Price

Options

Weighted-Average

Exercise Price

$ 20 – $ 30 6,314 5.54 $ 25.38 3,029 $ 26.36

$ 30 – $ 40 15,742 4.75 $ 32.50 15,699 $ 32.49

$ 40 – $ 50 569 3.08 $ 41.72 567 $ 41.71

$ 50 – $ 60 1,556 2.23 $ 54.81 1,551 $ 54.81

$ 60 – $ 70 5,907 0.53 $ 65.46 5,895 $ 65.46

$ 70 – $ 80 784 0.50 $ 72.89 784 $ 72.89

Over $ 80 21 0.60 $ 84.32 21 $ 84.32

30,893 27,546

The weighted-average remaining contractual term and aggregate intrinsic value of all options outstanding at December 31, 2007 was 2.76 years and

negative $551 million, respectively. The weighted-average remaining contractual term and aggregate intrinsic value of all options exercisable at Decem-

ber 31, 2007 was 2.38 years and negative $541 million, respectively. The negative aggregate intrinsic value of all options outstanding and exercisable,

respectively, reflects the fact that the market price of the Company’s common stock as of December 31, 2007 was below the weighted-average exercise

price of options. The total intrinsic value of options exercised during years ended December 31, 2007, 2006 and 2005 was $0.8 million, $0.1 million, and

$1.2 million, respectively.