Kodak 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

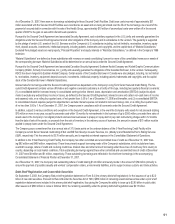

FASB Statement No. 141R

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations,” a revision to SFAS No. 141, “Business Combinations.” SFAS No. 141R

provides revised guidance for recognition and measurement of identifiable assets and goodwill acquired, liabilities assumed, and any noncontrolling

interest in the acquiree at fair value. The Statement also establishes disclosure requirements to enable the evaluation of the nature and financial effects

of a business combination. SFAS No. 141R is required to be applied prospectively to business combinations for which the acquisition date is on or after

the beginning of the first annual reporting period beginning on or after December 15, 2008 (January 1, 2009 for the Company). The Company is currently

evaluating the potential impact, if any, of the adoption of SFAS No. 141R on its Consolidated Financial Statements.

FASB Statement No. 160

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51.” This

Statement establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent. Specifically, SFAS

No. 160 requires the presentation of noncontrolling interests as equity in the Consolidated Statement of Financial Position, and separate identification

and presentation in the Consolidated Statement of Operations of net income attributable to the entity and the noncontrolling interest. It also establishes

accounting and reporting standards regarding deconsolidation and changes in a parent’s ownership interest. SFAS No. 160 is effective for fiscal years,

and interim periods within those fiscal years, beginning on or after December 15, 2008 (January 1, 2009 for the Company). The provisions of SFAS No.

160 are generally required to be applied prospectively, except for the presentation and disclosure requirements, which must be applied retrospectively.

The Company is currently evaluating the potential impact, if any, of the adoption of SFAS No. 160 on its Consolidated Financial Statements.

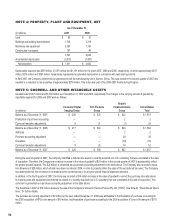

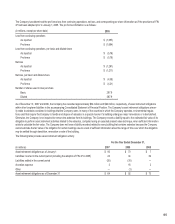

NOTE 2: RECEIVABLES, NET

As of December 31,

(in millions) 2007 2006

Trade receivables $ 1,697 $ 1,737

Miscellaneous receivables 242 335

Total (net of allowances of $114 and $134 as of December 31, 2007 and 2006, respectively) $ 1,939 $ 2,072

Of the total trade receivable amounts of $1,697 million and $1,737 million as of December 31, 2007 and 2006, respectively, approximately $266 million

and $272 million, respectively, are expected to be settled through customer deductions in lieu of cash payments. Such deductions represent rebates owed

to the customer and are included in accounts payable and other current liabilities in the accompanying Consolidated Statement of Financial Position at

each respective balance sheet date.

NOTE 3: INVENTORIES, NET

As of December 31,

(in millions) 2007 2006

Finished goods $ 537 $ 606

Work in process 235 192

Raw materials 171 203

Total $ 943 $ 1,001