Kodak 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

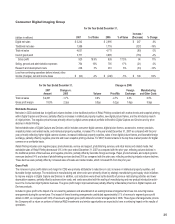

In the third quarter of 2007, the Company revised its expectations for total employment reductions to be in the range of 27,000 to 28,000 positions and

total charges in the range of $3.4 billion to $3.6 billion. These new estimates reflected greater efficiencies in manufacturing infrastructure projects as well

as the Company’s ability to outsource or sell certain operations, which reduced involuntary severance charges.

During the year ended December 31, 2007, the Company made cash payments of approximately $446 million related to restructuring. Of this amount

$424 million was paid out of restructuring reserves, while $22 million was paid out of reserves for pension and other postretirement liabilities.

The costs incurred, net of reversals, which total $685 million for the year ended December 31, 2007, include $23 million of costs which were presented

as discontinued operations. Included in the $23 million presented as discontinued operations were $20 million and $4 million of severance and exit costs,

respectively, which were associated with the 2004-2007 Restructuring Program, and a reversal of $1 million of exit costs associated with prior programs.

The costs incurred, net of reversals, of $662 million, which were presented as continuing operations include $107 million and $12 million of charges

related to accelerated depreciation and inventory write-downs, respectively, which were reported in cost of goods sold in the accompanying Consolidated

Statement of Operations for the year ended December 31, 2007. The remaining costs incurred, net of reversals, of $543 million were reported as restruc-

turing costs and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2007. The Company expects to incur

approximately $5 million of additional accelerated depreciation in 2008 as a result of the initiatives already implemented under the 2004-2007 Restructur-

ing Program.

The restructuring actions implemented during fiscal year 2007 under the 2004-2007 Restructuring Program are expected to generate future annual cost

savings of approximately $295 million, $274 million of which are expected to be future annual cash savings. These cost savings began to be realized by

the Company beginning in the first quarter of 2007, and the majority of the savings are expected to be realized by the end of 2008 as most of the actions

and severance payouts are completed. These total cost savings are expected to reduce future cost of goods sold, SG&A, and R&D expenses by approxi-

mately $154 million, $122 million, and $19 million, respectively.

Based on all of the actions taken to date under the 2004-2007 Restructuring Program, the program is expected to generate annual cost savings of ap-

proximately $1,680 million, including annual cash savings of $1,605 million, as compared with pre-program levels. The Company began realizing these

savings in the second quarter of 2004, and expects the majority of the savings to be realized by the end of 2008 as most of the actions and severance

payouts are completed. These total cost savings are expected to reduce cost of goods sold, SG&A, and R&D expenses annually by approximately $1,051

million, $473 million, and $156 million, respectively.

These estimates are based primarily on objective data related to the Company’s severance actions. Savings resulting from facility closures and other non-

severance actions that are more difficult to quantify are not included.

The Company has substantially completed the restructuring activities contemplated in the 2004-2007 Restructuring Program. Under this program, on a

life-to-date basis as of December 31, 2007, the Company has recorded charges of $3,397 million, which were composed of severance, long-lived asset

impairments, exit costs, inventory write-downs and accelerated depreciation of $1,398 million, $620 million, $385 million, $80 million and $935 million,

respectively, less reversals of $21 million. The severance costs related to the elimination of approximately 27,650 positions, including approximately 6,750

photofinishing, 13,125 manufacturing, 1,575 research and development and 6,200 administrative positions.

Modest rationalization charges are expected in 2008 and beyond as the Company will continue to explore and execute on cost efficiency opportunities

with respect to its sales, manufacturing and administrative infrastructure.

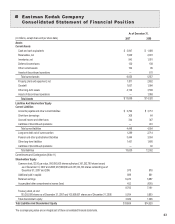

Liquidity and Capital Resources

2007

Cash Flow Activity

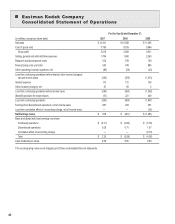

The Company’s primary sources and uses of cash for the year ended December 31, 2007 included proceeds on the sale of businesses/assets, loss from

continuing operations adjusted for non-cash items of income and expense, debt payments, restructuring payments, capital additions, working capital

sources and needs, dividend payments and employee and retiree benefit plan payments/contributions.

Net cash provided by continuing operations from operating activities was $351 million for the year ended December 31, 2007. The Company’s primary

sources of cash from operating activities for the period are earnings from continuing operations, as adjusted for non-cash items of income and expense,

which provided $652 million of operating cash. Included in cash flow from operating activities is approximately $306 million that relates to current and

prior-year non-recurring licensing arrangements. The Company’s other primary sources and uses of cash in operating activities in 2007 include:

• Decreases in receivables, driven by focused collection efforts including the reduction of past-due trade receivables;

• Decreases in inventories, driven by management of year-end inventory levels; and

• The net decrease in liabilities, excluding borrowings, including:

— The decrease in pension and other postretirement liabilities due to settlement and curtailment activities related to restructuring;

— Recognition of deferred income on intellectual property arrangements;