Kodak 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

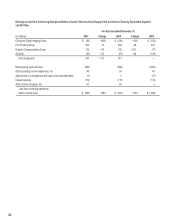

Included in gross profit for the year are a non-recurring extension and amendment of an existing license arrangement and new non-recurring license

arrangements. The impact of these licensing arrangements contributed approximately 2.3% of revenue to consolidated gross profit dollars in the current

year, as compared with 1.7% of revenue to consolidated gross profit dollars for similar arrangements in the prior year. These types of arrangements

provide the Company with a return on portions of historical R&D investments and similar opportunities are expected to have a continuing impact on the

results of operations.

Selling, General and Administrative Expenses

The year-over-year decrease in consolidated SG&A in dollars and as a percent of sales was primarily attributable to significant Company-wide cost reduc-

tion actions, partially offset by increased advertising costs related to Consumer Inkjet Systems and the impacts of foreign exchange.

Research and Development Costs

The decrease in R&D costs was primarily driven by the continuing realignment of resources, as well as the timing of development of new products.

Restructuring Costs and Other

The most significant charge within restructuring costs was a $238 million impairment charge related to the sale of the Company’s Xiamen, China facility in

the second quarter. These costs, as well as the restructuring-related costs reported in cost of goods sold, are discussed in further detail under “Restructur-

ing Costs and Other” below.

Other Operating (Income) Expenses, Net

The other operating (income) expenses, net category includes gains and losses on sales of capital assets and certain asset impairment charges. The

year-over-year increase in other operating (income) expenses, net was largely driven by gains on sales of capital assets in the current year of $158 mil-

lion, partially offset by asset impairments including the impairment of an intangible asset of $46 million in connection with the Company’s plan to dispose of

its stake in Lucky Film Co. Ltd.

Interest Expense

Lower interest expense was primarily due to lower debt levels resulting from the full payoff of the Company’s Secured Term Debt in the second quarter of

2007, partially offset by higher interest rates in the current year.

Other Income (Charges), Net

The Other income (charges), net category includes interest income, income and losses from equity investments, and foreign exchange gains and losses.

The increase in other income (charges), net as compared with the prior year period was primarily attributable to increased interest income due to higher

cash balances resulting from the proceeds on the sale of the Health Group (See Note 23, “Discontinued Operations” in the Notes to Financial Statements)

and higher interest rates. This increase was partially offset by an impairment of an equity method investment.

Income Tax (Benefit) Provision

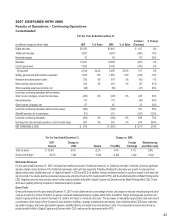

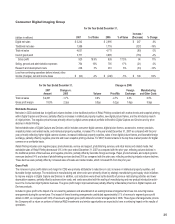

For the Year Ended December 31,

(dollars in millions) 2007 2006

Loss from continuing operations before income taxes ($256) ($583)

(Benefit) provision for income taxes ($51) $221

Effective tax rate 19.9% (37.9)%

The change in the Company’s annual effective tax rate from continuing operations is primarily attributable to the ability to recognize a tax benefit in

continuing operations associated with the realization of current year losses in certain jurisdictions where it has historically had a valuation allowance due

to the recognition of the pre-tax gain in discontinued operations and due to the favorable outcome of income tax audits in various jurisdictions around the

world.

During the fourth quarter of 2007, based on the Company’s assessment of positive and negative evidence regarding the realization of the net deferred tax

assets, the Company recorded a benefit associated with the release of valuation allowances of $20 million in certain jurisdictions outside the U.S.

During 2007, the Company reached a settlement with the Internal Revenue Service covering tax years 1999-2000. As a result, the Company recognized

a tax benefit from continuing operations in the U.S. of $17 million, including interest. Also during 2007, the Company reached a settlement with the taxing

authorities in two locations outside of the U.S. resulting in a tax benefit of $76 million.

During the second quarter of 2007, the Company identified a deferred tax asset in a recently acquired non-U.S. subsidiary that was overstated at the date

of acquisition. Therefore, the Company recorded an increase in the value of goodwill of $24 million in the second quarter of 2007 to appropriately reflect

the proper goodwill balance. The Company also recorded a valuation allowance of $20 million, which should have been recorded in 2006, in order to

properly reflect the value of the net deferred tax asset. This amount is included in the $51 million tax benefit for the year ended December 31, 2007. The

Company has determined that this correction is not material to the current period or to any prior period financial statement amounts.