Kodak 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

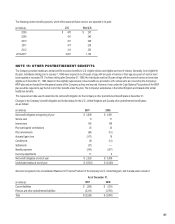

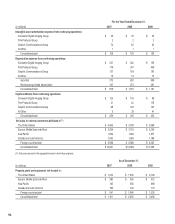

NOTE 20: ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

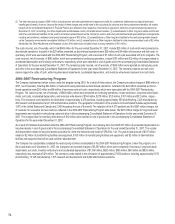

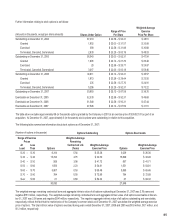

The components of accumulated other comprehensive income (loss), net of tax, were as follows:

As of December 31,

(in millions) 2007 2006 2005

Unrealized holding losses related to available-for-sale securities $ — $ (10) $ (8)

Unrealized gains related to hedging activity 10 — 4

Translation adjustments 311 197 109

Pension and other postretirement benefits liability adjustments 131 (436) (572)

Adjustment to initially apply SFAS No. 158 for pension and other

postretirement benefits

—

(386)

—

Total $ 452 $ (635) $ (467)

NOTE 21: STOCK OPTION AND COMPENSATION PLANS

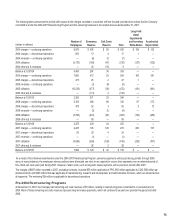

The Company accounts for stock-based compensation in accordance with SFAS No. 123R, “Share-Based Payment,” using the fair value recognition provi-

sions of SFAS No. 123, “Accounting for Stock-Based Compensation.” The Company recognized expense under SFAS No. 123R in the amount of $20 mil-

lion, $17 million and $17 million for the years ended December 31, 2007, 2006 and 2005, respectively. The related impact on basic and diluted earnings

per share for the years ended December 31, 2007, 2006 and 2005 was a reduction of $.07, $.06 and $.06, respectively. The impacts on the Company’s

cash flow for 2007, 2006 and 2005 were not material. Stock-based compensation costs for employees related to manufacturing activities are included in

the costs capitalized in inventory at period end.

The Company’s stock incentive plans consist of the 2005 Omnibus Long-Term Compensation Plan (the 2005 Plan), the 2000 Omnibus Long-Term Com-

pensation Plan (the 2000 Plan), and the 1995 Omnibus Long-Term Compensation Plan (the 1995 Plan). The Plans are administered by the Executive

Compensation and Development Committee of the Board of Directors.

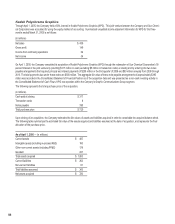

Under the 2005 Plan, 11 million shares of the Company’s common stock may be granted to employees between January 1, 2005 and December 31, 2014.

This share reserve may be increased by: shares that are forfeited pursuant to awards made under the 1995 and 2000 Plans; shares retained for payment

of tax withholding; shares issued in connection with reinvestments of dividends and dividend equivalents; shares delivered for payment or satisfaction of

tax withholding; shares reacquired on the open market using option exercise price cash proceeds; and awards that otherwise do not result in the issuance

of shares. The 2005 Plan is substantially similar to and is intended to replace the 2000 Plan, which expired on January 18, 2005. Stock options are gen-

erally non-qualified and are issued at prices not less than 100% of the per share fair market value on the date of grant. Options granted under the 2005

Plan generally expire seven years from the date of grant, but may be forfeited or canceled earlier if the optionee’s employment terminates prior to the end

of the contractual term. The 2005 Plan also provides for Stock Appreciation Rights (SARs) to be granted, either in tandem with options or freestanding.

SARs allow optionees to receive payment equal to the increase in the market price of the Company’s stock from the grant date to the exercise date. As of

December 31, 2007, 3,333 freestanding SARs were outstanding under the 2005 Plan at an option price of $24.59. Compensation expense recognized for

the year ended December 31, 2007, 2006, or 2005 on those freestanding SARs was not material.

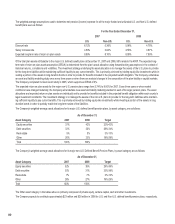

Under the 2000 Plan, 22 million shares of the Company’s common stock were eligible for grant to a variety of employees between January 1, 2000 and

December 31, 2004. The 2000 Plan is substantially similar to, and was intended to replace, the 1995 Plan, which expired on December 31, 1999. Stock

options are generally non-qualified and are at prices not less than 100% of the per share fair market value on the date of grant, and the options gener-

ally expire ten years from the date of grant, but may expire sooner if the optionee’s employment terminates. The 2000 Plan also provides for SARs to be

granted, either in tandem with options or freestanding. As of December 31, 2007, 46,638 freestanding SARs were outstanding under the 2000 Plan at op-

tion prices ranging from $23.25 to $60.50. Compensation expense recognized for the year ended December 31, 2007, 2006, or 2005 on those freestand-

ing SARs was not material.

Under the 1995 Plan, 22 million shares of the Company’s common stock were eligible for grant to a variety of employees between February 1, 1995 and

December 31, 1999. Stock options are generally non-qualified and are at prices not less than 100% of the per share fair market value on the date of

grant, and the options generally expire ten years from the date of grant, but may expire sooner if the optionee’s employment terminates. The 1995 Plan

also provides for SARs to be granted, either in tandem with options or freestanding. As of December 31, 2007, 23,671 freestanding SARs were outstand-

ing under the 1995 Plan at option prices ranging from $31.30 to $78.16. Compensation expense recognized for the year ended December 31, 2007,

2006, or 2005 on those freestanding SARs was not material.

In addition, the 2005 Plan, the 2000 Plan, and the 1995 Plan provide for, but are not limited to, grants of unvested stock and performance awards. Com-

pensation expense of $10 million, $9 million and $1 million was recognized for these grants and awards for the years ended December 31, 2007, 2006

and 2005, respectively.