Kodak 2007 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 45

The Committee reviews our long-term variable equity incentive program annually to ensure that it is in line with these principles.

Over the last several years in connection with our digital transformation, the Committee has implemented a compensation strategy

designed to increase the proportion of our Named Executive Officers’ total direct compensation delivered in the form of long-term variable

equity incentive awards.

Mix of Long-Term Variable Equity Incentive Compensation

The Committee has no set policy for determining the mix of the form of long-term variable equity incentives granted to our Named

Executive Officers. However, in 2007, as in recent years, our long-term equity incentive compensation program was designed to provide

one-half of the value of our Named Executive Officers’ long-term variable equity incentive compensation in the form of stock options that

vest over a three-year period and one-half of the value in the form of Leadership Stock. Awards under the Leadership Stock program are

granted in the form of performance stock units which, if earned, are paid in the form of shares of common stock upon fulfilling the specified

vesting period. The performance goals for the Leadership Stock program are established each year, providing flexibility to the Committee

to design a pay-for-performance plan that rewards achievement of key financial and/or operational metrics. The Committee believes that

this mix balances a focus on stock price appreciation and the achievement of strategic business goals. In determining the mix of stock

options and Leadership Stock, the Committee considered a variety of factors, including most importantly:

• Retention and alignment with shareholders’ interests. Due to multi-year vesting, both awards promote the Company’s retention

objectives. Also, because the value of both awards are wholly or partially dependent on changes in share price, they each support the

shareholder alignment objective as well.

• Pay for performance. While stock options foster the strongest linkage between changes in shareholder value and gains realized by

our executives, the Committee also recognizes that they can create windfalls in a rising market and may lead to gains even when

operating performance is weak. Conversely, in a declining market it is possible for stock options to deliver little or no value to

executives even when operating performance is strong. By awarding Leadership Stock, the Committee ensures that a portion of the

long-term incentive opportunity is tied directly to the achievement of key operating goals, thus mitigating but not eliminating the impact

of uncontrollable market volatility on payouts and strengthening the linkage between controllable performance and realized

compensation.

• Financial efficiency. Stock options create a fixed expense regardless of whether they actually deliver value to executives (assuming

the vesting requirements are met) and therefore create the possibility of incurring earnings charges for awards that may deliver little or

no value, particularly over short periods. Conversely, the costs associated with Leadership Stock are incurred only if the underlying

operating performance goals are achieved, meaning that accrued expense is avoided (or reversed) in the event that operating

performance is poor. In addition, because Leadership Stock opportunity is structured as whole shares (rather than just appreciation in

the underlying shares), it requires less shares to deliver a given level of value and thereby protects against unwarranted growth in

potential share dilution (i.e., overhang).

The Committee will continue to evaluate these and other related factors periodically as part of its ongoing planning activities. Changes in

the mix may be made if the facts and circumstances under which the Company operates change.

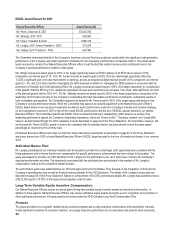

Determining Annual Target Allocations of Long-Term Variable Equity Incentive Compensation

The number of stock options and Leadership Stock units granted to the Named Executive Officers is based on a dollar value determined

for each executive, which is established to generally bring target total direct compensation to approximately the market median and then

adjusted to reflect individual performance factors.

At its regularly scheduled meeting in December of each year, the Committee grants stock options and determines the subsequent year’s

Leadership Stock allocation for the performance cycle that begins January 1. These equity grants are made in accordance with the Board

of Directors Policy on Equity Awards, discussed further on page 48 of this Proxy Statement. As a result of this process, the Committee

determined the size of the 2006 stock option grants and the 2007 Leadership Stock allocations in December 2006. Similarly, the size of our

executives’ 2007 stock option grants and the 2008 Leadership Stock allocations were determined in December 2007. The actual number of

Leadership Stock units earned by an executive will be based on company performance against established metrics for the performance

year.

The Committee’s annual review of total direct compensation conducted in 2006 indicated that our Named Executive Officer’s total direct

compensation was below market median, principally as a result of below-market long-term variable equity awards. To better align

executive compensation with market rates and support important retention and shareholder alignment objectives, the Committee increased

the prior year guidelines for each Named Executive Officer in 2006 to “close the gap” in target total direct compensation relative to market.

The 2006 stock option awards and 2007 Leadership Stock allocations were set at levels that brought each Named Executive Officer to the

market median and were not adjusted for individual performance factors. The material factors considered by the Committee in 2006 when

determining these award allocations are discussed in our 2006 proxy statement. The 2007 stock option awards and 2008 Leadership Stock

allocations were based on the new competitive levels approved by the Committee in 2006.