Kodak 2007 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

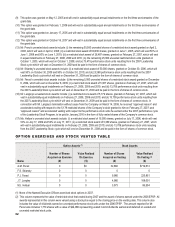

(1) The amounts shown for the “Threshold,” “Target” and “Maximum” levels represent the possible payouts for 2007 under the EXCEL

plan as well as Mr. Langley’s individual bonus plan. There is no amount in the “threshold” level for either the EXCEL plan or the

individual bonus plan as the potential payouts can range from zero to the maximum amount allowable under the respective plan based

on performance. Actual payouts for 2007 are disclosed in the Summary Compensation Table in the column “Non-Equity Incentive Plan

Compensation.”

(2) The amounts shown represent the “threshold,” “target” and “maximum” number of shares of common stock that Named Executive

Officers can earn under the 2007 Leadership Stock (LS) performance cycle. There is no amount in the “threshold” level as participants

can earn any amount between zero and the maximum award payable, depending on performance.

(3) The maximum amounts for the EXCEL plan represent the maximum payout permitted under the plan in accordance with the formula

established under the plan. The maximum bonus payout for the EXCEL plan is the lesser of: 1) 10% of the corporate funding pool

determined in accordance with performance against the pre-established performance targets; 2) 500% of a Named Executive Officer’s

annual base salary as of December 31, 2006; or 3) $5 million. The maximum amount shown for the EXCEL plan is the lesser of 500%

of annual base salary or $5 million since the amount representing 10% of the corporate funding pool is not determinable as of the

beginning of the year. The maximum payout shown for Mr. Langley’s individual bonus plan is the maximum payout under his plan.

(4) The amounts shown represent full grant date fair value, as calculated in accordance with SFAS 123R.

(5) Due to two promotions throughout the year, Mr. Faraci had three target bonus percentages during fiscal 2007; in accordance with

Company policy, the target bonus shown in the table above represents Mr. Faraci's end-of-year salary multiplied by the weighted

average target bonus percentage during fiscal 2007.

EXCEL Plan

EXCEL (Executive Compensation for Excellence and Leadership) is our short-term variable incentive plan for executives. For a discussion

of the EXCEL plan, target allocations for our Named Executive Officers and the award earned under the plan for 2007 performance, see

the discussion in the “Compensation Discussion and Analysis” under the heading “Annual Variable Pay.”

2007 Leadership Stock

On December 12, 2006, the Compensation Committee approved a performance stock allocation to each Named Executive Officer

pursuant to the 2007 performance cycle of the Leadership Stock Program. The allocations became effective on January 1, 2007.

Leadership Stock may be earned by our executives at the end of a performance cycle if the Company achieves the aggregate performance

target established for the performance cycle. The actual number of stock units earned by an executive is based on the executive’s target

allocation multiplied by the applicable performance percentage based on the Company’s performance. Any unearned units are forfeited at

the end of the performance period. The performance metrics established for the 2007 performance cycle are discussed in the

“Compensation Discussion and Analysis” under the heading “Leadership Stock – 2007 Performance Cycle Awards.”

For the 2007 Leadership Stock performance cycle, the payment of any stock units earned under the program for the 2007 performance

cycle is delayed for two years contingent on the executive’s continued employment with the Company. During this two-year vesting period,

dividend equivalents accrue on the stock units, but payment of the dividends is also subject to this two-year vesting period. At the end of

the two-year period, the stock units and the dividend equivalents earned on these stock units are paid to the executive in the form of

shares of Company common stock. All shares earned under the Leadership Stock program are granted under the Company’s 2005

Omnibus Long-Term Compensation Plan.

2006 Performance Bonus

One-half of the discretionary bonus awarded to Named Executive Officers for performance in 2006 was awarded in the form of restricted

shares of Company common stock. These awards were granted on February 27, 2007 and assuming continued employment will vest in

equal installments on each of the first three anniversaries of the grant date, subject to acceleration upon the occurrence of certain events

as described in “Potential Payments upon Termination of Employment or Change-in-Control” later.

Individual Bonus Plan

Mr. Langley is eligible to earn a cash bonus under an individual bonus plan established to incent achievement of certain pre-established

goals in the GCG for the 2007 performance year. The target and maximum payout under the plan was $300,000. At the beginning of the

year, our CEO established the following four equally weighted performance goals, which were approved by the Compensation Committee:

1) solidify and operationalize the GCG operating structure; 2) deliver an accepted, cohesive and comprehensive graphic communications

strategy; 3) reduce SG&A targets at the business unit and corporate center level; and 4) drive GCG financial performance, specifically

GCG Digital Revenue Growth, GCG Earnings from Operation and GCG Contribution Earnings from Operations. The first three goals

focused on the integration of GCG into Kodak’s operating structure. The fourth goal relating to GCG financial performance had a minimum

threshold of achieving one of three specified financial metrics: Digital Revenue Growth, Earnings from Operations and Contribution

Earnings from Operations. The minimum goal for Digital Revenue Growth was 6% with a target of 7%. The Earnings from Operations

minimum goal was 4% with a target of 6%. The Contribution EFO minimum goal was $275 million with a target of $296 million.