Kodak 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

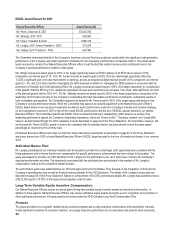

40

The 2007 market review indicated that: 1) base salaries of our Named Executive Officers are generally competitive; 2) target cash

compensation for our Named Executive Officers is aligned with or slightly above the approximate median value; and 3) total direct

compensation approximates the median for all Named Executive Officers. As noted above, the Committee does not target each element

of total direct compensation to the market median. However, in 2007 the Committee considered the results of the 2007 market review

when determining the appropriate level of each component of total direct compensation for the Named Executive Officers. The

compensation decisions specific to each component of total direct compensation for the Named Executive Officers are discussed under

“Elements of Total Direct Compensation,” beginning on page 40 of this Proxy Statement.

Use of Tally Sheets

In addition to the competitive benchmarking analysis, the Committee annually reviews all components of our Named Executive Officers’

compensation as presented in a comprehensive set of Tally Sheets prepared by the Committee’s independent compensation consultant.

The Tally Sheets provide a comprehensive view of each Named Executive Officer’s compensation, broken down into three components:

1)

An estimate of projected annual compensation, including total target cash compensation, the total estimated value of annual long-

term equity incentive awards and the value of benefits and perquisites received by each Named Executive Officer;

2) A comprehensive summary of the vested and unvested values of all outstanding equity awards held by each Named Executive

Officer at current and assumed future stock prices; and

3) A summary of the severance benefits potentially payable to each Named Executive Officer as of year end under various leaving

scenarios.

The Tally Sheets provide the Committee with context for the decisions they make in relation to total direct compensation. Although they do

not necessarily drive decision making with regard to specific components of the total compensation program, the Tally Sheets enable the

Committee to holistically assess total direct compensation and the relationship of various components of the total compensation program

to each other. The Tally Sheets also enable the Committee to determine how much wealth creation opportunity exists through equity-

based compensation and how strong the retention power is as a result of unvested value. The Tally Sheets may also influence the

Committee’s views on a variety of issues, such as changes to severance plans and employment agreements, special equity grants to

promote retention, or changes in long-term variable equity incentives.

Use of the CEO Evaluation Process

The Presiding Director, the Chair of the Compensation Committee and the Chief Human Resources Officer lead the annual CEO

evaluation process to assess the performance of our CEO. In February each year, a written self-assessment of performance versus the

business plan of record is completed by our CEO. The written assessment is sent to the full Board for review. Later in the same month, the

Chief Human Resources Officer interviews each member of the Board to collect feedback against an established set of criteria, including

reaction to our CEO self-assessment and the Company’s leadership imperatives, which are “Drives to Win,” “Develops Leaders” and

“Leads With Values.” All input is summarized and reviewed by the Presiding Director and the Chair of the Compensation Committee, who

are responsible for delivering feedback to our CEO.

For 2007, the Committee determined that Mr. Perez had performed well with respect to execution as the Company had either already

completed, or was on track to achieve, each 2007 operational and strategic imperative of the Company. The Committee also determined

that Mr. Perez’s leadership had been outstanding based on a review of his leadership performance against each of the Company’s

leadership imperatives.

The Committee considered the evaluation results when determining our CEO’s annual variable cash incentive award for 2007 under

EXCEL, as further described on page 44 of this Proxy Statement. The results of the 2006 CEO evaluation were considered by the

Committee when determining our CEO’s long-term variable equity target allocation as described on page 46 of this Proxy Statement.

ELEMENTS OF TOTAL DIRECT COMPENSATION

Total direct compensation consists of the following elements: base salary, annual variable pay and long-term variable equity incentives.

Base Salaries

Base salaries are intended to provide a regular source of income to our Named Executive Officers. Consistent with our philosophy of tying

pay to performance, our Named Executive Officers receive a relatively small proportion of overall total direct compensation in the form of

base salary. The base salaries of our Named Executive Officers in 2007 ranged from approximately 14% to 28% of their total target direct

compensation, with a positive correlation between the degree of compensation at risk and the level of an executive’s responsibility.

Base salaries are reviewed annually by the Committee at the beginning of the year, but are not automatically increased annually. Rather,

base salaries are adjusted as the Committee deems appropriate to recognize expanded responsibilities, experience, the importance of the