Kodak 2007 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 59

The first two goals have qualitative metrics, which the CEO and Compensation Committee determined Mr. Langley completed as defined.

The third goal had a minimum threshold of achieving either business unit or corporate center level SG&A targets. The business unit SG&A

run rate was achieved, while the targeted SG&A for the corporate center was not achieved, although significantly improved. With respect to

the fourth goal relating to GCG financial performance, only one of the performance metrics was achieved. GCG achieved the Digital

Revenue Growth goal with a result of 7%. GCG did not achieve the Earnings from Operations metric, instead delivering a 3.2% result. The

Contribution EFO result was also below the established target range.

Based on these results and the CEO’s recommendation, the Compensation Committee determined to award Mr. Langley a bonus payment

equal to 70.75% of target, equal to $212,250, which was paid on March 6, 2008. The calculation used by the Compensation Committee in

the determination of this payout reflected the first two goals completed at 100% of target, the third goal completed at 50% of target and the

fourth goal completed at 33% of target.

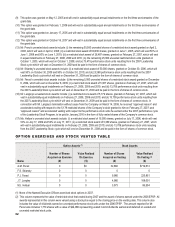

2007 Option Grants

On December 11, 2007, the Compensation Committee approved a non-qualified stock option grant for each Named Executive Officer.

Stock options granted in 2007 have a seven-year term and vest in three substantially equal annual installments beginning on the first

anniversary of the grant date. All stock options become fully vested and exercisable upon the third anniversary of the grant date. Upon

termination of employment, all unvested stock options will be forfeited, except in certain cases. If a Named Executive Officer’s employment

is terminated as a result of death, disability, transfer or divestiture (as defined in the plan), all unvested stock options will fully vest and will

expire on the third anniversary date of the Named Executive Officer’s termination of employment. If a Named Executive Officer’s

employment is terminated as a result of retirement, layoff, pursuant to a special separation program or for an approved reason, any

unvested stock options will continue to vest and will expire three years after termination of employment. The exercise price of the stock

options is $23.28, the mean between the high and low price at which the Kodak shares traded on the NYSE on the grant date. All options

are granted under the Company’s 2005 Omnibus Long-Term Compensation Plan.

2007 Promotion Grant

In accordance with the Company’s policy, Ms. Hellyar received a promotion grant of 20,000 shares of non-qualified stock options under the

Company’s 2005 Omnibus Long-Term Compensation Plan on October 16, 2007, in recognition of her election to Executive Vice President.

The stock options will vest in substantially equal installments on each of the first three anniversaries of the date of grant and expire seven

years from the grant date. The exercise price of the stock options is $28.44, the mean between the high and low price at which the Kodak

shares traded on the NYSE on the grant date.