Kodak 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Earnings Per Share

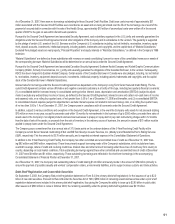

Basic earnings-per-share computations are based on the weighted-average number of shares of common stock outstanding during the year. As a result of

the net loss from continuing operations presented for the years ended December 31, 2007, 2006 and 2005, the Company calculates diluted earnings-per-

share using weighted-average basic shares outstanding for each period, as utilizing diluted shares would be anti-dilutive to loss per share. The reconcilia-

tion between the numerator and denominator of the basic and diluted earnings-per-share computations is presented as follows:

For the Year Ended December 31,

(dollars in millions) 2007 2006 2005

Numerator:

Loss from continuing operations used in basic net earnings (loss) per share $ (205) $ (804) $ (1,657)

Denominator:

Number of common shares used in basic net earnings (loss) per share 287.7 287.3 287.9

Effect of dilutive securities:

Employee stock options — — —

Convertible securities — — —

Number of common shares used in diluted net earnings (loss) per share 287.7 287.3 287.9

Outstanding options, to purchase shares of the Company’s common stock, of 30.9 million, 34.6 million and 36.0 million, as of December 31, 2007, 2006

and 2005, respectively, were not included in the computation of diluted earnings per share because the Company reported a net loss from continuing

operations; therefore, the effect would be anti-dilutive.

The Company currently has approximately $575 million in contingent convertible notes (the Convertible Securities) outstanding that were issued in

October 2003. Interest on the Convertible Securities accrues at a rate of 3.375% per annum and is payable semi-annually. The Convertible Securities are

convertible at an initial conversion rate of 32.2373 shares of the Company’s common stock for each $1,000 principal amount of the Convertible Securities.

The Company’s diluted net earnings per share exclude the effect of the Convertible Securities, as they were anti-dilutive for all periods presented.

Recently Issued Accounting Standards

FASB Statement No. 158

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans (an amend-

ment of FASB Statements No. 87, 88, 106, and 132(R))”, which is effective in fiscal years ending after December 15, 2006. This Statement requires an

employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of financial

position, and to recognize changes in that funded status in the year in which the changes occur through comprehensive income. SFAS No. 158 does

not change the amount of actuarially determined expense that is recorded in the Consolidated Statement of Operations. SFAS No. 158 also requires an

employer to measure the funded status of a plan as of the date of its year-end statement of financial position, which is consistent with the Company’s

present measurement date. The adoption of SFAS No. 158 did not have any impact on the Company’s Consolidated Statement of Operations, Statement

of Cash Flows, or compliance with its debt covenants.