Kodak 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

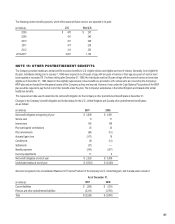

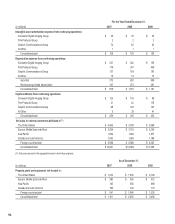

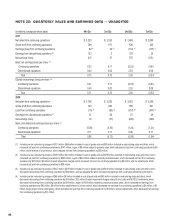

The following assets and liabilities, related to the Health Group business, were segregated and included in current and non-current Assets of discontinued

operations and Liabilities of discontinued operations, as appropriate, in the Consolidated Statement of Financial Position at December 31, 2006.

As of December 31,

(in millions) 2006

Receivables, net $ 597

Inventories, net 201

Other current assets 13

Current assets of discontinued operations $ 811

Property, plant and equipment, net 240

Goodwill 612

Other long-term assets 216

Noncurrent assets of discontinued operations $ 1,068

Current liabilities of discontinued operations $ 431

Pension and other postretirement liabilities 30

Other long-term liabilities 10

Noncurrent liabilities of discontinued operations $ 40

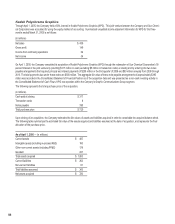

HPA

On October 17, 2007, the shareholders of Hermes Precisa Pty. Ltd. (“HPA”), a majority owned subsidiary of Kodak (Australasia) Pty. Ltd., a wholly owned

subsidiary of the Company, approved an agreement to sell all of the shares of HPA to Salmat Limited. HPA, a publicly traded Australian company, is a

provider of outsourced services in business communication and data processes and was formerly reported within the Company’s Graphic Communica-

tions Group segment.

The sale was approved by the Federal Court of Australia on October 18, 2007, and closed on November 2, 2007. Kodak received $139 million in cash at

closing for its shares of HPA, and recognized a pre-tax gain on the sale of $123 million. The assets and liabilities held-for-sale were not material in any

period presented.

2006

Earnings from discontinued operations for the year ended December 31, 2006 were primarily related to the operations of the Health Group segment.

Interest expense allocated to discontinued operations totaled $90 million for the year.

2005

Earnings from discontinued operations for the year ended December 31, 2005 were primarily related to the operations of the Health Group segment.

Interest expense allocated to Health Group discontinued operations totaled $72 million for the year.

During the fourth quarter of 2005, the Company was informed that the United States Congress Joint Committee on Taxation had approved, and the Inter-

nal Revenue Service had signed, a settlement between the Company and the Internal Revenue Service concerning the audit of the tax years 1993-1998.

As a result of the settlement, the Company was able to reverse certain tax accruals of approximately $203 million, which were established in 1994 in con-

nection with the sale of Sterling Winthrop Inc., the Company’s pharmaceutical, consumer health, and household products businesses at that time. These

tax accrual reversals were recognized in earnings from discontinued operations for the year ended December 31, 2005.

On August 13, 2004 the Company completed the sale of the assets and business of the Remote Sensing Systems operation, including the stock of

Kodak’s wholly owned subsidiary, Research Systems, Inc. (collectively known as RSS), to ITT Industries for $725 million in cash. As a result of the sale

of RSS, the Company transferred the related employees’ plan assets from the Company’s pension plan. This transfer was subject to a true-up provision,

which was completed in the fourth quarter of 2005 and resulted in a settlement loss of $54 million being recognized in earnings from discontinued opera-

tions for the year ended December 31, 2005.