Kodak 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

n

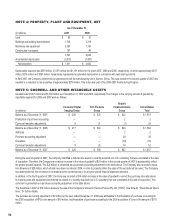

NOTE 1: SIGNIFICANT ACCOUNTING POLICIES

Accounting Principles

The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of

America. The following is a description of the significant accounting policies of Eastman Kodak Company.

Basis of Consolidation

The consolidated financial statements include the accounts of Kodak and its majority owned subsidiary companies. Intercompany transactions are

eliminated and net earnings are reduced by the portion of the net earnings of subsidiaries applicable to minority interests. The equity method of account-

ing is used for joint ventures and investments in associated companies over which Kodak has significant influence, but does not have effective control.

Significant influence is generally deemed to exist when the Company has an ownership interest in the voting stock of the investee of between 20% and

50%, although other factors, such as representation on the investee’s Board of Directors, voting rights and the impact of commercial arrangements, are

considered in determining whether the equity method of accounting is appropriate. Income and losses of investments accounted for using the equity

method are reported in other income (charges), net, in the accompanying Consolidated Statement of Operations. See Note 7, “Investments,” and Note 15

“Other Income (Charges), Net.”

Certain amounts for prior years have been reclassified to conform to the current year classification. Prior year reclassifications include the following:

• The reclassification of gains and losses on sales of capital assets and certain asset impairment charges from other income (charges), net to other

operating (income) expenses, net.

• The presentation of discontinued operations and related assets and liabilities held for sale, as a result of the divestiture of the Health Group seg-

ment.

• The presentation of discontinued operations as a result of the divestiture of Hermes Precisa Pty. Ltd. (“HPA”).

• The adoption of FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,” which required recognition and reclassification of net

liabilities related to uncertain tax positions from Accrued income and other taxes to Other long-term liabilities.

• The revision of prior year segment results to conform to the new segment reporting structure, which was effective January 1, 2007.

During the year ended December 31, 2007, the Company recorded net adjustments of $23 million of expense, for items that should have been recorded

in prior periods. The largest of these items of expense is a $20 million tax provision recorded in the second quarter of 2007 for a valuation allowance that

should have been recorded in 2006. This item is discussed further in Note 5, “Goodwill and Other Intangible Assets” and Note 16, “Income Taxes.” Each

correction recorded in the year ended December 31, 2007 is individually no greater than $6 million, other than the item noted above. The Company has

determined that these corrections, individually and in the aggregate, are not material to the current period financial statements or to any prior year financial

statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at year end,

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Foreign Currency

For most subsidiaries and branches outside the U.S., the local currency is the functional currency. In accordance with the Statement of Financial Account-

ing Standards (SFAS) No. 52, “Foreign Currency Translation,” the financial statements of these subsidiaries and branches are translated into U.S. dollars

as follows: assets and liabilities at year-end exchange rates; income, expenses and cash flows at average exchange rates; and shareholders’ equity at

historical exchange rates. For those subsidiaries for which the local currency is the functional currency, the resulting translation adjustment is recorded as

a component of accumulated other comprehensive (loss) income in the accompanying Consolidated Statement of Financial Position. Translation adjust-

ments are not tax-effected since they relate to investments, which are permanent in nature.

n

Eastman Ko dak Company

Notes to Fin ancial Statements