Kodak 2007 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

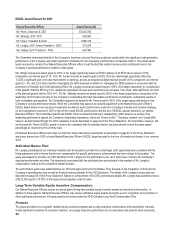

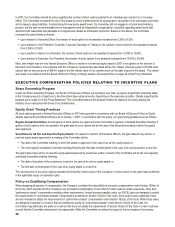

The following abbreviated corporate performance matrix shows the threshold, target and stretch goals for 2007 and the resulting

performance percentage.

Consumer Inkjet Printer Net Revenue

(in millions)

GCG Digital Revenue Growth

3.0%

(Threshold)

6.0%

(Target)

9.0%

(Stretch)

$ 53 (Threshold) 0% 50% 100%

77 (Target) 50% 100% 150%

149 (Stretch) 100% 150% 200%

Awards are earned under the plan based on an executive’s target allocation multiplied by the applicable performance percentage. If results

exceed threshold, the Committee will determine the performance percentage based on interpolation. If results fall below threshold all

awards under the program would be forfeited. The maximum number of performance stock units that may be earned by an executive is

200% of the executive’s target allocation.

The threshold, target and maximum number of shares allocated to our Named Executive Officers under the 2007 Leadership Stock

performance cycle are shown in the Grants of Plan-Based Awards Table on page 57 of this Proxy Statement.

Committee Decision and Analysis

For 2007, the Company achieved a GCG Digital Revenue Growth of 7%, which was above the target level. The Company also achieved a

Consumer Inkjet Printer Net Revenue that was slightly above the threshold level. Based on these results, the performance percentage for

the 2007 cycle was 73%. The actual number of shares earned by each Named Executive Officer for the 2007 cycle was determined by

multiplying each officer’s target award allocation by 73%. As a result, our Named Executive Officers earned the following number of

restricted share units, which are subject to a subsequent two-year time-based vesting requirement: Mr. Perez (73,475); Mr. Sklarsky

(23,360); Mr. Faraci (13,709); Mr. Langley (13,709); and Ms. Hellyar (13,709). These restricted share units will vest on December 31, 2009

if service conditions are satisfied.

Leadership Stock — 2006 - 2007 Performance Cycle Awards

In 2006, as in prior years, the 2006 - 2007 performance cycle had a two-year performance cycle and a one-year subsequent vesting

requirement. Similar to the 2007 performance cycle described above, awards are earned based on an executive’s target allocation

multiplied by the applicable performance percentage derived from the performance formula established for the particular performance

cycle. For the 2006 - 2007 performance cycle, the program’s sole performance metric was digital earnings from operations (DEFO). DEFO

is a non-GAAP performance metric that measures total earnings from the Company’s digital strategic product groups included within

earnings from continuing operations, before: 1) restructuring charges; 2) interest; 3) other (income) charges, net; and 4) income taxes. This

performance was selected by the Committee to further encourage and reinforce executive actions implementing Kodak’s transition to a

digital technology company. As determined by the Committee in March 2006, in order to achieve any payout under the 2006-2007

Leadership Stock performance cycle, the Company’s aggregate DEFO for the two-year period from January 1, 2006 to December 31, 2007

would need to be greater than $750 million. In order to achieve 100% of the target award allocation, the Company’s aggregate DEFO

would need to equal $1 billion. The maximum payout under the program, equal to 200% of target allocation, would require a DEFO equal

to $1.15 billion. If results fell between these DEFO targets, the Committee would determine a percentage payout based on interpolation.

Committee Decision and Analysis

Our Named Executive Officers did not earn any shares for the 2006-2007 Leadership Stock performance cycle. The DEFO achieved by

the Company for the 2006 - 2007 performance period was $519 million, less than the threshold DEFO target of $750 million. Given

Kodak’s sale of its Health Group on April 30, 2007, the DEFO achieved by the Company fell short of the threshold DEFO target because

the actual DEFO result did not include results from the Health Group for the entire two-year performance period. The DEFO target

established by the Committee in 2006 at the beginning of the performance period had taken into account results from the Health Group for

two years. In light of the rules regarding the deductibility of compensation under Section 162(m) of the Code, the Committee did not adjust

the performance formula under the plan for Named Executive Officers.

Initial Hire Grants and Ad Hoc Awards

In addition to annual equity awards, our Named Executive Officers may receive stock options and time-based restricted stock grants in

connection with the commencement of their employment, as a result of a promotion or for retention purposes. The objectives of these

grants are to encourage hiring, retention and stock ownership and to align an executive’s interest with those of our shareholders. On

occasion, the Committee may also grant one-time, ad hoc stock option awards to reward an executive for superior individual performance.