Kodak 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

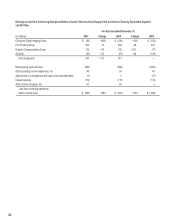

For the Year Ended December 31, Change vs. 2005

2006

Amount

Change vs.

2005

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Acquisitions

Total net sales $10,568 -7.3% -10.1% -3.3% 0.5% 0.0% 5.6%

Gross profit margin 22.8% 0.6pp 0.0pp 0.4pp 0.1pp -0.4pp 0.5pp

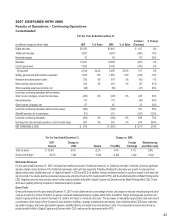

Worldwide Revenues

The decrease in net sales was primarily due to significant industry-related volume declines in the traditional businesses within all three segments, partially

offset by growth in digital revenues. The volume declines were primarily driven by Film Capture within FPG, and Digital Capture and Devices and the

traditional portion of Retail Printing within CDG. Negative price/mix was primarily driven by Prepress Solutions within GCG, Retail Printing and Digital

Capture and Devices within CDG, and Film Capture within FPG. These items were partially offset by an increase in digital revenue due to the KPG and

Creo acquisitions in the second quarter of 2005, intellectual property royalties, and favorable foreign exchange.

Gross Profit

Gross profit margin for 2006 increased as compared with 2005 due largely to the 2005 acquisitions of Kodak Polychrome Graphics (“KPG”) and Creo

Inc. (“Creo”), favorable price/mix in Digital Capture and Devices within CDG, including increased intellectual property royalties, and favorable foreign

exchange. These increases were partially offset by increased manufacturing and other costs.

Included in gross profit for the year are extensions and amendments of existing license arrangements and a new licensing arrangement. The non-recurring

portions of these licensing arrangements contributed approximately 1.7% of revenue to consolidated gross profit dollars in 2006, as compared with 0.5%

of revenue to consolidated gross profit dollars for similar arrangements in 2005.

Selling, General and Administrative Expenses

The year-over-year decrease in consolidated SG&A was primarily attributable to Company-wide cost reduction initiatives.

Research and Development Costs

The decrease in R&D costs was primarily driven by: (1) write-offs in 2005 of purchased in-process R&D of $54 million associated with acquisitions made

during 2005, (2) significant spending reductions related to traditional products and services, (3) lower R&D spending related to the display business, and

(4) integration synergies within the GCG segment.

Restructuring Costs and Other

These costs, as well as the restructuring-related costs reported in cost of goods sold, are discussed in further detail under “Restructuring Costs and Other”

below.

Other Operating (Income) Expenses, Net

The other operating (income) expenses, net category includes gains and losses on sales of capital assets and certain asset impairment charges. Other

operating income was $59 million for 2006 as compared with other operating income of $40 million for 2005, representing an improvement of $19 million.

This improvement was largely driven by lower asset impairments.

Interest Expense

Higher interest expense is primarily attributable to increased levels of debt associated with the 2005 acquisitions of KPG and Creo, and higher interest

rates.

Other Income (Charges), Net

The other income (charges), net component includes interest income, income and losses from equity investments, and foreign exchange gains and losses.

The increase in other income (charges), net was primarily attributable to: (1) a year-over-year increase in interest income of $35 million, (2) lower losses

on foreign exchange, which resulted in an increase in other income of $31 million, and (3) lower impairment charges on equity method investments, which

increased other income by $19 million. These increases were partially offset by a loss on the early extinguishment of debt in 2006 of $9 million.