Kodak 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

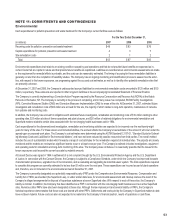

Other Commitments and Contingencies

The Company has entered into agreements with several companies, which provide Kodak with products and services to be used in its normal operations.

These agreements are related to supplies, production and administrative services, as well as marketing and advertising. The terms of these agreements

cover the next two to sixteen years. The minimum payments for these agreements are approximately $563 million in 2008, $178 million in 2009, $121

million in 2010, $87 million in 2011, $87 million in 2012 and $94 million in 2013 and thereafter.

Rental expense, net of minor sublease income, amounted to $130 million in 2007, $160 million in 2006 and $149 million in 2005. The approximate

amounts of noncancelable lease commitments with terms of more than one year, principally for the rental of real property, reduced by minor sublease

income, are $99 million in 2008, $81 million in 2009, $68 million in 2010, $45 million in 2011, $36 million in 2012 and $83 million in 2013 and thereafter.

In December 2003, the Company sold a property in France for approximately $65 million, net of direct selling costs, and then leased back a portion of

this property for a nine-year term. In accordance with SFAS No. 98, “Accounting for Leases,” the entire gain on the property sale of approximately $57

million was deferred and no gain was recognizable upon the closing of the sale as the Company’s continuing involvement in the property is deemed to

be significant. As a result, the Company is accounting for the transaction as a financing. Future minimum lease payments under this noncancelable lease

commitment are approximately $5 million per year for 2008 through 2012.

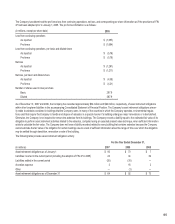

The Company’s Brazilian operations are involved in governmental assessments in various stages of litigation related to indirect and other taxes. The Com-

pany is disputing these tax matters and intends to vigorously defend the Company’s position. Based on the opinion of legal counsel, management does

not believe that the ultimate resolution of these matters will materially impact the Company’s results of operations, financial position or cash flows. The

Company routinely assesses all these matters as to the probability of ultimately incurring a liability in its Brazilian operations and records its best estimate

of the ultimate loss in situations where it assesses the likelihood of loss as probable.

The Company and its subsidiaries are involved in various lawsuits, claims, investigations and proceedings, including commercial, customs, employment,

environmental, and health and safety matters, which are being handled and defended in the ordinary course of business. In addition, the Company is

subject to various assertions, claims, proceedings and requests for indemnification concerning intellectual property, including patent infringement suits

involving technologies that are incorporated in a broad spectrum of the Company’s products. These matters are in various stages of investigation and

litigation and are being vigorously defended. Although the Company does not expect that the outcome in any of these matters, individually or collectively,

will have a material adverse effect on its financial condition or results of operations, litigation is inherently unpredictable. Therefore, judgments could be

rendered or settlements entered, that could adversely affect the Company’s operating results or cash flow in a particular period.

NOTE 12: GUARANTEES

The Company guarantees debt and other obligations of certain customers. The debt and other obligations are primarily due to banks and leasing compa-

nies in connection with financing of customers’ purchases of product and equipment from the Company. The following customer guarantees were in place:

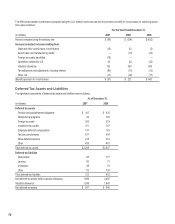

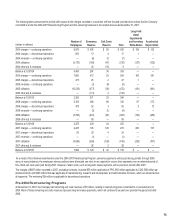

(in millions)

As of December 31, 2007

Maximum Amount Amount Outstanding

Customer amounts due to banks and leasing companies $ 150 $ 117

Other third-parties 2 —

Total guarantees of customer debt and other obligations $ 152 $ 117

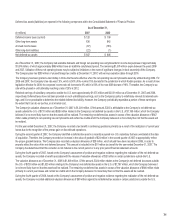

The guarantees for the third party debt mature between 2008 and 2011. The customer financing agreements and related guarantees typically have a term

of 90 days for product and short-term equipment financing arrangements, and up to five years for long-term equipment financing arrangements. These

guarantees would require payment from the Company only in the event of default on payment by the respective debtor. In some cases, particularly for

guarantees related to equipment financing, the Company has collateral or recourse provisions to recover and sell the equipment to reduce any losses that

might be incurred in connection with the guarantees.

The Company also guarantees debt and other obligations owed to banks for some of its consolidated subsidiaries. The maximum amount guaranteed

is $637 million, and the outstanding debt under those guarantees, which is recorded within the short-term borrowings and long-term debt, net of current

portion components in the accompanying Consolidated Statement of Financial Position, is $229 million. These guarantees expire between 2008 and 2013.

Pursuant to the terms of the Company’s $2.7 billion Senior Secured Credit Agreement dated October 18, 2005, obligations under the $2.7 billion Secured

Credit Facilities and other obligations of the Company and its subsidiaries to the $2.7 billion Secured Credit Facilities lenders are guaranteed.

During the fourth quarter of 2007, Eastman Kodak Company (the “Parent”) issued a guarantee to Kodak Limited (the “Subsidiary”) and the Trustees of the

Kodak Pension Plan of the United Kingdom (the “Trustees”). Under this arrangement, the Parent guarantees to the Subsidiary and the Trustees the ability