Kodak 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

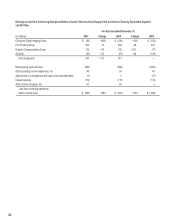

12/31/2002 12/31/2003 12/31/2004 12/31/2005 12/31/2006 12/31/2007

Eastman Kodak Company 100.00 76.23 97.50 72.24 81.33 70.23

S&P 500 100.00 128.68 142.69 149.70 173.34 182.87

Dow Jones US Industrial Average 100.00 128.28 135.09 137.42 163.60 178.13

The graph assumes that $100 was invested on December 31, 2002 in each of the Company’s common stock, the Standard & Poor’s 500 Composite Stock

Price Index and the Dow Jones Industrial Index, and that all dividends were reinvested. In addition, the graph weighs the constituent companies on the

basis of their respective market capitalizations, measured at the beginning of each relevant time period.

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 98.

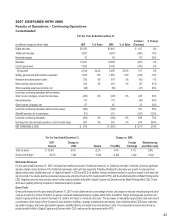

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS (MD&A) OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader under-

stand the results of operations and financial condition of Kodak for the three years ended December 31, 2007. All references to Notes relate to Notes to

the Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

Overview

Kodak is the world’s foremost imaging innovator and generates revenue and profits from the sale of products, technology, solutions and services to

consumers, businesses and creative professionals. The Company’s portfolio is broad, including image capture and output devices, consumables and

systems and solutions for consumer, business, and commercial printing applications. Kodak has three reportable business segments, which are more

fully described later in this discussion in “Kodak Operating Model and Reporting Structure.” The three business segments are: Consumer Digital Imaging

Group (“CDG”), Film Products Group (“FPG”) and Graphic Communications Group (“GCG”).

During 2007, the Company met or exceeded each of its strategic objectives established for the year:

• Net cash generation

• Earnings growth from digital products and services

• Revenue growth from digital products and services

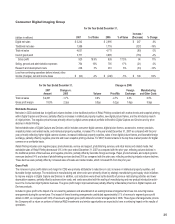

The Company’s 2007 performance was the result of a series of actions taken and business model changes deployed over the last several years to

dramatically transform the Company. Over this time period, the Company divested of businesses that were not strategic to the core value proposition

of the new Kodak, while investing in targeted acquisitions which built critical capability, scale and portfolio breadth in high value-creating segments. The

Company has also been keenly focused on reducing manufacturing capacity in the traditional imaging businesses ahead of demand reduction and ratio-

nalizing its go-to-market and administrative infrastructure through its 2004-2007 Restructuring Program, while concurrently investing in people, technology

and capabilities in the growing digital businesses. These actions have led to a more sustainable global business model for Kodak. The Company’s 2007

financial results begin to reflect this improved business model.

Critical Accounting Policies and Estimates

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is pertinent to management’s

discussion and analysis of the financial condition and results of operations. The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets,

liabilities, revenue and expenses, and the related disclosure of contingent assets and liabilities.

The Company believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to the

sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts. Specific risks associated

with these critical accounting policies are discussed throughout this MD&A, where such policies affect our reported and expected financial results. For a

detailed discussion of the application of these and other accounting policies, refer to the Notes to Financial Statements.