Kodak 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

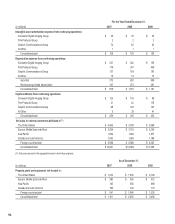

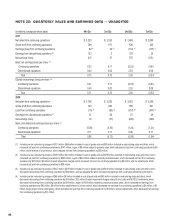

NOTE 23: DISCONTINUED OPER ATIONS

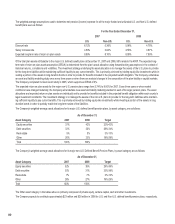

The significant components of earnings from discontinued operations, net of income taxes, are as follows:

For the Year Ended December 31,

(in millions) 2007 2006 2005

Revenues from Health Group operations $ 754 $ 2,551 $ 2,708

Revenues from HPA operations 148 155 165

Total revenues from discontinued operations $ 902 $ 2,706 $ 2,873

Pre-tax income from Health Group operations $ 27 $ 225 $ 397

Pre-tax gain on sale of Health Group segment 986 — —

Pre-tax income from HPA operations 8 12 12

Pre-tax gain on sale of HPA 123 — —

Provision for income taxes related to Health Group and HPA (262) (33) (106)

Loss from cumulative effect of accounting change related to Health Group, net of tax — — (2)

Loss on sale of Remote Sensing Systems (RSS), net of tax — — (55)

Tax reserve reversals related to audit settlement for tax years 1993 - 1998 — — 203

All other items, net (1) (1) 2

Earnings from discontinued operations, net of income taxes $ 881 $ 203 $ 451

2007

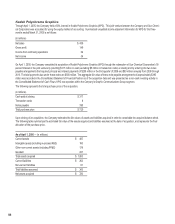

Health Group Segment

On April 30, 2007, the Company sold all of the assets and business operations of its Health Group segment to Onex Healthcare Holdings, Inc. (“Onex”)

(now known as Carestream Health, Inc.), a subsidiary of Onex Corporation, for up to $2.55 billion. The price was composed of $2.35 billion in cash at

closing and $200 million in additional future payments if Onex achieves certain returns with respect to its investment. If Onex investors realize an internal

rate of return in excess of 25% on their investment, the Company will receive payment equal to 25% of the excess return, up to $200 million.

About 8,100 employees of the Company associated with the Health Group transitioned to Carestream Health, Inc. as part of the transaction. Also included

in the sale were manufacturing operations focused on the production of health imaging products, as well as an office building in Rochester, NY.

The Company recognized a pre-tax gain of $986 million on the sale of the Health Group segment during 2007. This pre-tax gain excludes the following:

up to $200 million of potential future payments related to Onex’s return on its investment as noted above; potential charges related to settling pension

obligations with Onex in future periods; and any adjustments that may be made in the future that are currently under review.

Upon authorization of the Company’s Board of Directors on January 8, 2007, the Company met all the requirements of SFAS No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets,” for accounting for the Health Group segment as a discontinued operation. As such, the Health Group

business ceased depreciation and amortization of long-lived assets on that date.

The Company was required to use a portion of the initial $2.35 billion cash proceeds to fully repay its approximately $1.15 billion of Secured Term Debt.

In accordance with EITF No 87-24, “Allocation of Interest to Discontinued Operations,” the Company allocated to discontinued operations the interest

expense related to the Secured Term Debt because it was required to be repaid as a result of the sale. Interest expense allocated to discontinued opera-

tions totaled $30 million for the year ended December 31, 2007.

In accordance with SFAS No. 109, “Accounting for Income Taxes,” due to the recognition of the pre-tax gain in discontinued operations, the Company

recorded a tax benefit in continuing operations associated with the realization of current year losses in certain jurisdictions where it has historically had a

valuation allowance.