Kodak 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

For certain other subsidiaries and branches, operations are conducted primarily in U.S. dollars, which is therefore the functional currency. Monetary assets

and liabilities of these foreign subsidiaries and branches, which are recorded in local currency, are remeasured at year-end exchange rates, while the

related revenue, expense, and gain and loss accounts, which are recorded in local currency, are remeasured at average exchange rates. Non-monetary

assets and liabilities, and the related revenue, expense, and gain and loss accounts, are remeasured at historical rates. Adjustments that result from

the remeasurement of the assets and liabilities of these subsidiaries are included in net earnings (loss) in the accompanying Consolidated Statement of

Operations.

Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the entity involved are

included in net earnings (loss) in the accompanying Consolidated Statement of Operations. The effects of foreign currency transactions, including related

hedging activities, are included in other income (charges), net, in the accompanying Consolidated Statement of Operations.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents,

receivables, and derivative instruments. The Company places its cash and cash equivalents with high-quality financial institutions and limits the amount

of credit exposure to any one institution. With respect to receivables, such receivables arise from sales to numerous customers in a variety of industries,

markets, and geographies around the world. Receivables arising from these sales are generally not collateralized. The Company performs ongoing credit

evaluations of its customers’ financial conditions and no single customer accounts for greater than 10% of the sales of the Company. The Company

maintains reserves for potential credit losses and such losses, in the aggregate, have not exceeded management’s expectations. With respect to the

derivative instruments, the counterparties to these contracts are major financial institutions. The Company has not experienced non-performance by any of

its derivative instruments counterparties.

Cash Equivalents

All highly liquid investments with a remaining maturity of three months or less at date of purchase are considered to be cash equivalents.

Inventories

Inventories are stated at the lower of cost or market. The cost of all of the Company’s inventories is determined by either the “first in, first out” (FIFO) or

average cost method, which approximates current cost. The Company provides inventory reserves for excess, obsolete or slow-moving inventory based

on changes in customer demand, technology developments or other economic factors.

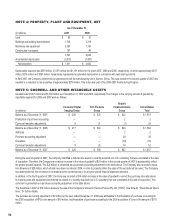

Properties

Properties are recorded at cost, net of accumulated depreciation. The Company principally calculates depreciation expense using the straight-line method

over the assets’ estimated useful lives, which are as follows:

Years

Buildings and building improvements 5-40

Land improvements 10-20

Leasehold improvements 3-10

Equipment 3-10

Tooling 1-3

Furniture and fixtures 3-15

Maintenance and repairs are charged to expense as incurred. Upon sale or other disposition, the applicable amounts of asset cost and accumulated

depreciation are removed from the accounts and the net amount, less proceeds from disposal, is charged or credited to net earnings (loss).

Goodwill

Goodwill represents the excess of purchase price of an acquisition over the fair value of net assets acquired. The Company applies the provisions of

SFAS No. 142, “Goodwill and Other Intangible Assets.” In accordance with SFAS No. 142, goodwill is not amortized, but is required to be assessed for

impairment at least annually. The Company has elected to make September 30 the annual impairment assessment date for all of its reporting units,

and will perform additional impairment tests when events or changes in circumstances occur that would more likely than not reduce the fair value of the

reporting unit below its carrying amount. SFAS No. 142 defines a reporting unit as an operating segment or one level below an operating segment. The

Company estimates the fair value of its reporting units utilizing income and market approaches through the application of discounted cash flow and market

comparable methods. The assessment is required to be performed in two steps, step one to test for a potential impairment of goodwill and, if potential

losses are identified, step two to measure the impairment loss. The Company completed step one in its fourth quarter and determined that there were no

such impairments. Accordingly, the performance of step two was not required.