Kodak 2007 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

(9) This option was granted on May 12, 2005 and will vest in substantially equal annual installments on the first three anniversaries of the

grant date.

(10) This option was granted on February 1, 2006 and will vest in substantially equal annual installments on the first three anniversaries of

the grant date.

(11) This option was granted on January 17, 2005 and will vest in substantially equal annual installments on the first three anniversaries of

the grant date.

(12) This option was granted on October 16, 2007 and will vest in substantially equal annual installments on the first three anniversaries of

the grant date.

(13) Mr. Perez's unvested stock awards include: (i) the remaining 50,000 unvested shares of a restricted stock award granted on April 2,

2003, which will vest on April 2, 2008; (ii) a restricted stock award of 60,000 shares, granted on June 1, 2005, which will vest 50% on

June 1, 2008 and 50% on June 1, 2010; (iii) a restricted stock award of 28,487 shares, granted on February 27, 2007, which will vest

in equal installments on February 27, 2008, 2009 and 2010; (iv) the remaining 25,000 unvested restricted stock units granted on

October 1, 2003, which will vest on October 1, 2008; and (v) 73,475 performance stock units resulting from the 2007 Leadership

Stock cycle which will vest on December 31, 2009 and be paid in the form of shares of common stock.

(14) Mr. Sklarksy's unvested stock awards include: (i) a restricted stock award of 50,000 shares, granted on October 30, 2006, which will

vest 50% on October 30, 2008 and 50% on October 30, 2010; and (ii) 23,360 performance stock units resulting from the 2007

Leadership Stock cycle which will vest on December 31, 2009 and be paid in the form of shares of common stock.

(15) Mr. Faraci's unvested stock awards include: (i) the remaining 5,000 unvested shares of a restricted stock award granted on December

6, 2004, which will vest on December 6, 2009; (ii) a restricted stock award of 5,387 shares, granted on February 27, 2007, which will

vest in substantially equal installments on February 27, 2008, 2009 and 2010; and (iii) 13,709 performance stock units resulting from

the 2007 Leadership Stock cycle which will vest on December 31, 2009 and be paid in the form of shares of common stock.

(16) Mr. Langley's unvested stock awards include: (i) a restricted stock award of 5,179 shares, granted on February 27, 2007, which will

vest in substantially equal installments on February 27, 2008, 2009 and 2010; and (ii) 13,709 performance stock units resulting from

the 2007 Leadership Stock cycle which will vest on December 31, 2009 and be paid in the form of shares of common stock. In

connection with Mr. Langley’s termination without cause from the Company on March 14, 2008, he received “approved reason” and

accelerated vesting with respect to the 5,179 restricted shares of the Company’s stock granted to him on February 27, 2007; and

“approved reason” and accelerated vesting with respect to the performance stock units he earned under the 2007 performance cycle

of the Leadership Stock Program, to be paid in January 2010 in the form of fully vested shares of the Company’s common stock.

(17) Ms. Hellyar’s unvested stock awards include: (i) a restricted stock award of 15,000 shares, granted on July 17, 2006, which will vest

50% on July 17, 2009 and 50% on July 17, 2011; (ii) a restricted stock award of 5,389 shares, granted on February 27, 2007, which

will vest in substantially equal installments on February 27, 2008, 2009 and 2010; and (iii) 13,709 performance stock units resulting

from the 2007 Leadership Stock cycle which will vest on December 31, 2009 and be paid in the form of shares of common stock.

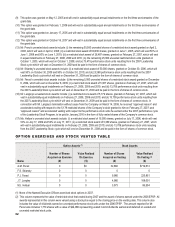

OPTION EXERCISES AND STOCK VESTED TABLE

Name

Option Awards (1) Stock Awards

Number of Shares

Acquired on Exercise

(#)

Value Realized

On Exercise

($)

Number of Shares

Acquired on Vesting

(#)

Value Realized

On Vesting (2)

($)

A.M. Perez 0 $0 32,660 $719,612

F.S. Sklarsky 0 0 0 0

P.J. Faraci 0 0 9,966 225,851

J.T. Langley 0 0 4,966 108,601

M.J. Hellyar 0 0 3,973 86,894

(1) None of the Named Executive Officers exercised stock options in 2007.

(2) This column represents the value of restricted stock that vested during 2007 and the award of shares earned under the 2006 EPSP. All

awards represented in this column were valued using a stock price equal to the closing price on the vesting date. This column also

includes the value of dividends earned on unvested performance stock units under the 2006 EPSP. The amount reported for Mr.

Perez also includes 1,770 shares with a value of $44,066 representing vested in-kind dividends earned and deferred on vested and

unvested restricted stock units.