Kodak 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

88

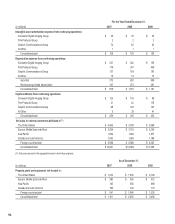

Kodak Polychrome Graphics

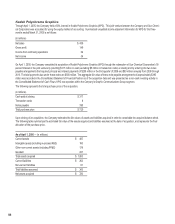

Through April 1, 2005, the Company held a 50% interest in Kodak Polychrome Graphics (KPG). This joint venture between the Company and Sun Chemi-

cal Corporation was accounted for using the equity method of accounting. Summarized unaudited income statement information for KPG for the three

months ended March 31, 2005 is as follows:

(in millions)

Net sales $ 439

Gross profit 149

Income from continuing operations 34

Net income 34

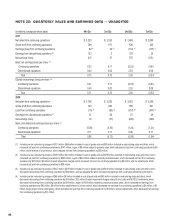

On April 1, 2005, the Company completed its acquisition of Kodak Polychrome Graphics (KPG) through the redemption of Sun Chemical Corporation’s 50

percent interest in the joint venture by providing $317 million in cash (excluding $8 million in transaction costs) at closing and by entering into two notes

payable arrangements that required principal and interest payments of $200 million in the third quarter of 2006 and $50 million annually from 2008 through

2013. The total payments due under these notes are $500 million. The aggregate fair value of these note payable arrangements of approximately $395

million was recorded in the Consolidated Statement of Financial Position as of the acquisition date and was presented as a non-cash investing activity in

the Consolidated Statement of Cash Flows. KPG now operates within the Company’s Graphic Communications Group segment.

The following represents the total purchase price of the acquisition:

(in millions)

Cash paid at closing $ 317

Transaction costs 8

Notes payable 395

Total purchase price $ 720

Upon closing of an acquisition, the Company estimates the fair values of assets and liabilities acquired in order to consolidate the acquired balance sheet.

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition, and represents the final

allocation of the purchase price.

As of April 1, 2005 — (in millions):

Current assets $ 487

Intangible assets (including in-process R&D) 160

Other non-current assets (including PP&E) 179

Goodwill 237

Total assets acquired $ 1,063

Current liabilities $ 262

Non-current liabilities 81

Total liabilities assumed $ 343

Net assets acquired $ 720