Kodak 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

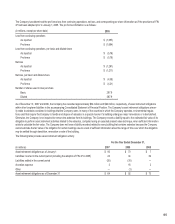

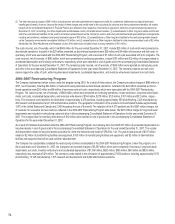

(3) The total restructuring charges of $687 million include pension and other postretirement charges and credits for curtailments, settlements and special termination

benefits gains (losses). However, because the impact of these charges and credits relate to the accounting for pensions and other postretirement benefits, the related

impacts on the Consolidated Statement of Financial Position are reflected in their respective components as opposed to within the accrued restructuring balances at

December 31, 2007. Accordingly, the Other Adjustments and Reclasses column of the table above includes: (1) reclassifications to Other long-term assets and Pension

and other postretirement liabilities for the position elimination-related impacts on the Company’s pension and other postretirement employee benefit plan arrangements,

including net curtailment, settlement and special termination gains of $13 million, (2) reclassifications to Other long-term liabilities for the restructuring-related impacts

on the Company’s environmental remediation liabilities of $1 million, and (3) reclassifications to Other long-term liabilities for other severance-related costs of $2 million.

Additionally, the Other Adjustments and Reclasses column of the table above includes foreign currency translation of $13 million.

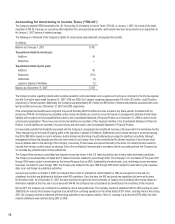

The costs incurred, net of reversals, which total $685 million for the year ended December 31, 2007, include $23 million of costs which were presented as

discontinued operations. Included in the $23 million presented as discontinued operations were $20 million and $4 million of severance and exit costs, re-

spectively, which were associated with the 2004-2007 Restructuring Program, and a reversal of $1 million of exit costs associated with prior programs. The

costs incurred, net of reversals, of $662 million, which were presented as continuing operations, include $107 million and $12 million of charges related to

accelerated depreciation and inventory write-downs, respectively, which were reported in cost of goods sold in the accompanying Consolidated Statement

of Operations for the year ended December 31, 2007. The remaining costs incurred, net of reversals, of $543 million were reported as restructuring costs

and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2007. The severance reserve and exit costs

reserve require the outlay of cash, while long-lived asset impairments, accelerated depreciation, and inventory write-downs represent non-cash items.

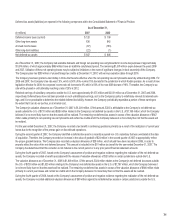

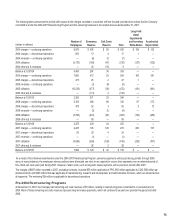

2004-2007 Restructuring Program

The Company implemented certain actions under this program during 2007. As a result of these actions, the Company recorded charges of $686 million in

2007, net of reversals, including $24 million of costs which were presented as discontinued operations. Included in the $24 million presented as discon-

tinued operations were $20 million and $4 million of severance and exit costs, respectively, which were associated with the 2004-2007 Restructuring

Program. The costs incurred, net of reversals, of $662 million, which were presented as continuing operations, include severance, long-lived asset impair-

ments, exit costs, accelerated depreciation, and inventory write-downs of $144 million, $270 million, $129 million, $107 million and $12 million, respec-

tively. The severance costs related to the elimination of approximately 4,275 positions, including approximately 550 photofinishing, 2,225 manufacturing,

200 research and development and 1,300 administrative positions. The geographic composition of the positions to be eliminated includes approximately

1,975 in the United States and Canada and 2,300 throughout the rest of the world. The reduction of the 4,275 positions and the $297 million charges, net

of reversals, for severance and exit costs are reflected in the 2004-2007 Restructuring Program table below. The $270 million charge for long-lived asset

impairments was included in restructuring costs and other in the accompanying Consolidated Statement of Operations for the year ended December 31,

2007. The charges taken for inventory write-downs of $12 million were reported in cost of goods sold in the accompanying Consolidated Statement of

Operations for the year ended December 31, 2007.

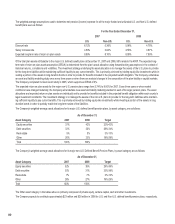

As a result of initiatives implemented under the 2004-2007 Restructuring Program, the Company also recorded $107 million of accelerated depreciation on

long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Operations for the year ended December 31, 2007. The acceler-

ated depreciation relates to long-lived assets accounted for under the held-and-used model of SFAS No. 144. The year-to-date amount of $107 million

relates to $2 million of photofinishing facilities and equipment, $103 million of manufacturing facilities and equipment, and $2 million of administrative

facilities and equipment that will be used until their abandonment.

The Company has substantially completed the restructuring activities contemplated in the 2004-2007 Restructuring Program. Under this program, on a

life-to-date basis as of December 31, 2007, the Company has recorded charges of $3,397 million, which were composed of severance, long-lived asset

impairments, exit costs, inventory write-downs and accelerated depreciation of $1,398 million, $620 million, $385 million, $80 million and $935 million,

respectively, less reversals of $21 million. The severance costs related to the elimination of approximately 27,650 positions, including approximately 6,750

photofinishing, 13,125 manufacturing, 1,575 research and development and 6,200 administrative positions.