Kodak 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

On October 10, 2003, the Company completed the offering and sale of $500 million aggregate principal amount of Senior Notes due 2013 (the Notes),

which was made pursuant to the Company’s new debt shelf registration. The remaining unused balance under the Company’s new debt shelf is $2.15

billion. Concurrent with the sale of the Notes, on October 10, 2003, the Company completed the private placement of $575 million aggregate principal

amount of Convertible Senior Notes due 2033 (the Convertible Securities) to qualified institutional buyers pursuant to Rule 144A under the Securities Act

of 1933. Interest on the Convertible Securities will accrue at the rate of 3.375% per annum and is payable semiannually. The Convertible Securities are

unsecured and rank equally with all of the Company’s other unsecured and unsubordinated indebtedness. As a condition of the private placement, on

January 6, 2004 the Company filed a shelf registration statement under the Securities Act of 1933 relating to the resale of the Convertible Securities and

the common stock to be issued upon conversion of the Convertible Securities pursuant to a registration rights agreement, and made this shelf registration

statement effective on February 6, 2004.

The Convertible Securities contain a number of conversion features that include substantive contingencies. The Convertible Securities are convertible by

the holders at an initial conversion rate of 32.2373 shares of the Company’s common stock for each $1,000 principal amount of the Convertible Securities,

which is equal to an initial conversion price of $31.02 per share. The initial conversion rate of 32.2373 is subject to adjustment for: (1) stock dividends, (2)

subdivisions or combinations of the Company’s common stock, (3) issuance to all holders of the Company’s common stock of certain rights or warrants to

purchase shares of the Company’s common stock at less than the market price, (4) distributions to all holders of the Company’s common stock of shares

of the Company’s capital stock or the Company’s assets or evidences of indebtedness, (5) cash dividends in excess of the Company’s current cash

dividends, or (6) certain payments made by the Company in connection with tender offers and exchange offers.

The holders may convert their Convertible Securities, in whole or in part, into shares of the Company’s common stock under any of the following circum-

stances: (1) during any calendar quarter, if the price of the Company’s common stock is greater than or equal to 120% of the applicable conversion price

for at least 20 trading days during a 30 consecutive trading day period ending on the last trading day of the previous calendar quarter; (2) during any five

consecutive trading day period following any 10 consecutive trading day period in which the trading price of the Convertible Securities for each day of such

period is less than 105% of the conversion value, and the conversion value for each day of such period was less than 95% of the principal amount of the

Convertible Securities (the Parity Clause); (3) if the Company has called the Convertible Securities for redemption; (4) upon the occurrence of specified

corporate transactions such as a consolidation, merger or binding share exchange pursuant to which the Company’s common stock would be converted

into cash, property or securities; and (5) if the Senior Unsecured credit rating assigned to the Convertible Securities by either Moody’s or S&P is lower

than Ba2 or BB, respectively, or if the Convertible Securities are no longer rated by at least one of these services or their successors (the Credit Rating

Clause). At the Company’s current credit rating, the Convertible Securities may be converted by their holders.

The Company may redeem some or all of the Convertible Securities at any time on or after October 15, 2010 at a purchase price equal to 100% of the

principal amount of the Convertible Securities plus any accrued and unpaid interest. Upon a call for redemption by the Company, a conversion trigger is

met whereby the holder of each $1,000 Convertible Senior Note may convert such note to shares of the Company’s common stock.

The holders have the right to require the Company to purchase their Convertible Securities for cash at a purchase price equal to 100% of the principal

amount of the Convertible Securities plus any accrued and unpaid interest on October 15, 2010, October 15, 2013, October 15, 2018, October 15, 2023

and October 15, 2028, or upon a fundamental change as described in the offering memorandum filed under Rule 144A in conjunction with the private

placement of the Convertible Securities. As of December 31, 2007, the Company has sufficient treasury stock to cover potential future conversions of

these Convertible Securities into 18,536,447 shares of common stock.

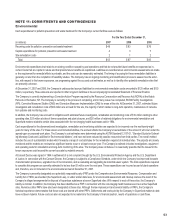

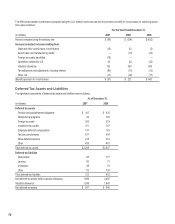

NOTE 10: OTHER LONG-TERM LIABILITIES

As of December 31,

(in millions) 2007 2006

Deferred royalty revenue from licensees $ 350 $ 545

Non-current tax-related liabilities 445 418

Environmental liabilities 125 153

Deferred compensation 102 134

Asset retirement obligations 64 92

Other 365 348

Total $ 1,451 $ 1,690

The other component above consists of other miscellaneous long-term liabilities that, individually, are less than 5% of the total liabilities component in the

accompanying Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with Regulation S-X.