Kodak 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

P A R T I I I

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information required by Item 10 regarding directors is incorporated by reference from the information under the caption “Board Structure and

Corporate Governance - Board of Directors” in the Company’s Notice of 2008 Annual Meeting and Proxy Statement (the Proxy Statement), which will be

filed within 120 days after December 31, 2007. The information required by Item 10 regarding audit committee financial expert disclosure is incorporated

by reference from the information under the caption “Board Structure and Corporate Governance - Audit Committee Financial Qualifications” in the Proxy

Statement. The information required by Item 10 regarding executive officers is contained in Part I under the caption “Executive Officers of the Registrant”

on page 13. The information required by Item 10 regarding the Company’s written code of ethics is incorporated by reference from the information under

the captions “Board Structure and Corporate Governance - Corporate Governance Guidelines” and “Board Structure and Corporate Governance - Busi-

ness Conduct Guide and Directors’ Code of Conduct” in the Proxy Statement. The information required by Item 10 regarding compliance with Section

16(a) of the Securities Exchange Act of 1934 is incorporated by reference from the information under the caption “Reporting Compliance - Section 16(a)

Beneficial Ownership Reporting Compliance” in the Proxy Statement.

ITEM 11. EXECUTIVE COMPENSATION

The information required by Item 11 is incorporated by reference from the information under the following captions in the Proxy Statement: “Board Struc-

ture and Corporate Governance” and “Compensation Discussion and Analysis.”

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Most of the information required by Item 12 is incorporated by reference from the information under the captions “Beneficial Ownership” in the Proxy State-

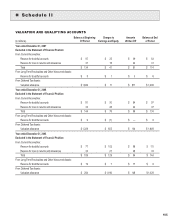

ment. “Stock Options and SARs Outstanding under Shareholder and Non-Shareholder Approved Plans” is shown below:

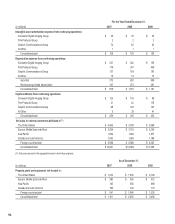

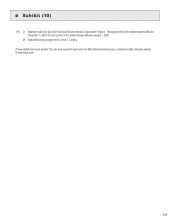

Stock Options and SARs Outstanding Under Shareholder and Non-shareholder Approved Plans

As required by Item 201(d) of Regulation S-K, the Company’s total options outstanding of 31,186,424, including total SARs outstanding of 293,090, have

been granted under equity compensation plans that have been approved by security holders and that have not been approved by security holders as

follows:

Plan Category

Number of Securities

to be issued

Upon Exercise of

Outstanding Options,

Warrants and Rights

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (a))

(a) (b) (c)

Equity compensation plans approved

by security holders (1)

23,652,835

$ 37.26

14,858,054

Equity compensation plans not approved by

security holders (2)

7,533,589

47.30

0

Total 31,186,424 $ 39.69 14,858,054

(1) The Company’s equity compensation plans approved by security holders include the 2005 Omnibus Long-Term Compensation Plan, the 2000 Omnibus Long-Term

Compensation Plan, the Eastman Kodak Company 1995 Omnibus Long-Term Compensation Plan, and the Wage Dividend Plan.

(2) The Company’s equity compensation plans not approved by security holders include the Eastman Kodak Company 1997 Stock Option Plan and the Kodak Stock

Option Plan.

The 1997 Stock Option Plan, a plan formerly maintained by the Company for the purpose of attracting and retaining senior executive officers, became effective on Feb-

ruary 13, 1997, and expired on December 31, 2003. The Compensation Committee administered this plan and continues to administer these plan awards that remain

outstanding. The plan permitted awards to be granted in the form of stock options, shares of common stock and restricted shares of common stock. The maximum

number of shares that were available for grant under the plan was 3,380,000. The plan required all stock option awards to be non-qualified, have an exercise price not

less than 100% of fair market value of the Company’s stock on the date of the option’s grant and expire on the tenth anniversary of the date of grant. Awards issued

in the form of shares of common stock or restricted shares of common stock were subject to such terms, conditions and restrictions as the Compensation Committee

deemed appropriate.